The SEC has filed fees towards the collapsed QZ Asset Administration Ponzi scheme.

The SEC has filed fees towards the collapsed QZ Asset Administration Ponzi scheme.

The SEC’s Criticism, filed in South Dakota on August twenty sixth, names QZ World Restricted, QZ Asset Administration Restricted and Blake Yeung Pu Lei as defendants.

- QZ World Restricted is a South Dakota shell firm

- QZ Asset Administration Restricted is a Chinese language firm that represented it had a head workplace in Shanghai

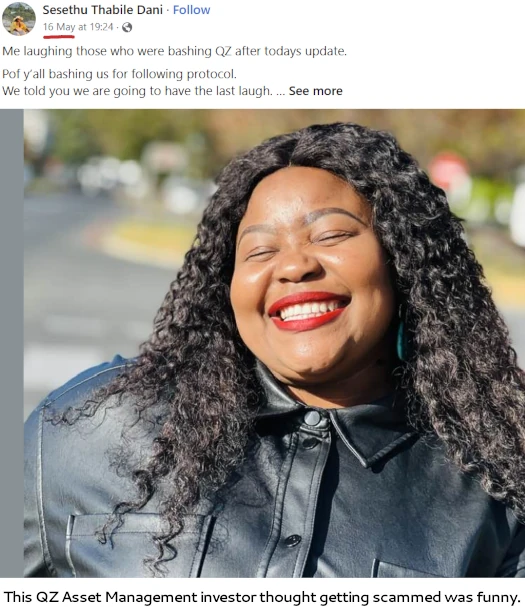

- Blake Yeung Pu Lei (under) was the face of QZ Asset Administration, though it’s unclear whether or not he was performed by an actor

The SEC characterizes QZ Asset Administration as

a China-based funding adviser … [that] engaged in a concerted scheme involving a number of false statements to defraud lots of of people out of tens of millions of {dollars}.

This tracks with BehindMLM’s QZ Asset Administration evaluate, printed in November 2022. In a nutshell, QZ Asset Administration illegally solicited funding on the promise of as much as 3.5% per week.

As we’ve seen just lately with different scams tied to Asia, like Tragetech, a part of QZ Asset Administration’s Ponzi ruse was misrepresenting SEC filings made by means of its shell firm.

Defendants deceived QZ Asset’s shoppers and potential shoppers by falsely claiming that QZ World had taken steps to go public, together with submitting an software to have its frequent inventory listed on the Nasdaq World Choose Market and having constructive interactions with SEC workers.

Additional, to offer an air of legitimacy to their fraudulent enterprise, Defendants pointed shoppers and potential shoppers to QZ World’s SEC filings, which have been accessible to view on the SEC’s EDGAR system, however which have been materially poor and incomplete.

BehindMLM documented and debunked QZ Asset Managements NASDAQ shenanigans in March 2023. We additionally famous QZ Asset Administration’s “SEC audit” exit-scam when QZ Asset Administration collapsed in Might 2023.

QZ Asset Administration filed an S-1 Registration Assertion with the SEC on February twenty seventh, 2023.

The SEC claims it despatched QZ Asset Administration a letter to Yeung, who had signed the S-1 type, on March seventeenth, 2023.

SEC workers despatched a letter addressed to Yeung, as CEO of QZ World, notifying him that the Types 1-A weren’t compliant with Regulation A as they failed to call an underwriter and failed to incorporate the required monetary statements.

Neither Yeung nor anybody from QZ World responded to the letter or submitted extra or amended filings to the SEC.

As a substitute of responding to the SEC, on March seventeenth QZ Asset Administration put out a press-release falsely claiming it had bought 100,000,000 shares.

On October 23, 2023, SEC workers despatched Yeung, as CEO of QZ World, one other letter reiterating that QZ World’s submitting didn’t adjust to Regulation A.

As soon as once more, neither Yeung nor anybody from QZ World responded to the letter or submitted extra or amended filings to the SEC.

QZ Asset Administration would go on full its exit-scam by disabling its web site on Might twenty fifth, 2023.

Documented QZ Asset losses by the SEC embody “at the least 285 shoppers globally” and “at the least $6 million”.

The SEC’s Criticism accuses QZ Asset Administration and Lei of a number of violations of the Securities and Alternate Act.

An injunction prohibiting additional violations is being sought, in addition to disgorgement and fee of a civil penalty.

I’ve added the SEC’s QZ Asset Administration case to BehindMLM calendar. Keep tuned for updates as we proceed to trace the case.