![]() Jas Mathur has sued Travis Bott and Richard Jason Bott over reported Merchants Area Ponzi losses.

Jas Mathur has sued Travis Bott and Richard Jason Bott over reported Merchants Area Ponzi losses.

Mathur is a Canadian nationwide from India dwelling in California.

Travis Bott is behind a sequence of fraudulent MLM funding schemes focusing on customers world wide. These embody Ryze AI, Westmyn, Onyx Way of life, Digital Revenue, Meta Bounty Hunters and Meta Lab Company

Richard Jason Bott is believed to a relative of Travis Bott (proper). Each Botts are Utah residents.

Richard Jason Bott is believed to a relative of Travis Bott (proper). Each Botts are Utah residents.

As per a lawsuit filed by Mathur’s Wyoming shell firm EM1 Capital LLC in California final October;

Since round mid-December 2022, T. Bott had been selling a SIngapore-based funding fund to mutual associates of Jas Mathur, president of EM1.

Bott defined that the funds can be buying and selling in Merchants-Area platform, which is managed/managed by Fredirick “Ted” Safranko, an in depth buddy and enterprise companion of T. Bott for the previous a number of years.

It is a little bit of an odd timeline, seeing as Merchants Area collapsed in or round October 2022.

Thus far US regulators have solely gone after a part of Merchants Area, the SAEG Ponzi facet of the enterprise (~$145 million).

Safranko, a Canadian nationwide has gone into hiding. In September 2023 the CFTC secured a $3.8 million judgment in opposition to Safranko.

Leaked monetary information reveal the total extent of Safranko’s Merchants Area associated fraud exceeds $370 million.

Based on Mathur, Travis Bott had been recruiting individuals into DWHTD Expertise PTE LTD (aka “Drive Fund”), a Singapore shell firm.

Recruitment was finished by way of Alliance Administration Companies LLP, a Utah shell firm Travis Bott allegedly owns.

Following an introduction by a mutual buddy, on January 5, 2023, T. Bott offered Mathur with a possibility to speculate $1 million in a “proprietary buying and selling enterprise” whose returns, as established by historic efficiency, would generate an 18% month-to-month return on the funding over the course of 1 (1) 12 months.

T. Bott elaborated to Mathur that he owned an organization referred to as SAVVY Pockets which was licensed by Evolve Financial institution & Belief, N.A.

Based on T. Bott, all members and customers of SAVVT Pockets would obtain a debit card which might facilitate withdrawal of funds.

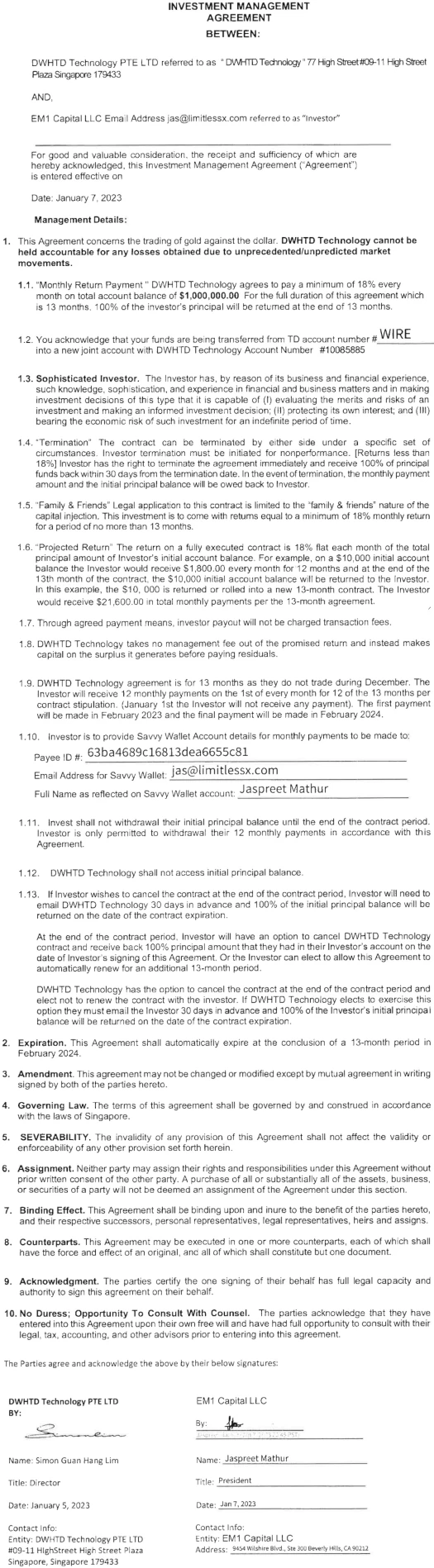

To that finish T. Bott offered Mathur with a doc entitled Funding Administration Settlement, which Mathur signed on behalf of his firm, Plaintiff EM1, on January 7, 2023.

Savvy Pockets is owned by Frank DiCrisi (proper) and Gregory “Tuffy” Baum. The cost processor was used to launder tens of millions from The Merchants Area buyers.

Savvy Pockets is owned by Frank DiCrisi (proper) and Gregory “Tuffy” Baum. The cost processor was used to launder tens of millions from The Merchants Area buyers.

If Travis Bott had an possession stake in Savvy Pockets, that is the primary I’m listening to of it.

Pursuant to the phrases of the IMA, EM1 agreed to speculate $1 million in DWHTD and DWHTD agreed to pay a minimal of 18% each month on the overall account stability of $1 million for 13 (13) months.

FWHTD additional agreed that on the finish of the 13 (13) month interval, DWHTD would return 100% of EM1’s principal funding ($1 million).

The IMA additional offers for termination upon non-performance of the settlement.

Particularly, non-performance is outlined as month-to-month returns lower than 18%.

Thus, within the occasion that DWHTD did not make a month-to-month cost of 18% to EM1, EM1 had the correct to terminate that settlement instantly and obtain 100% of the principal funds again inside thirty (30) days of termination.

DWHTD is represented by Lim Hold Guan Simon, a purported Singaporean citizen. A replica of the IMA between EM1 and DWHTD is hooked up to EM1’s Grievance as an exhibit:

After execution of the IMA, per T. Bott’s directions, EM1 wired the principal funding of $1 million to AMS, a Utah firm owned by T. Bott and R. Bott.

Per T. Bott, the 18% month-to-month curiosity funds from the $1 million funding can be disbursed month-to-month into Mathur’s SAVVY Pockets.

You possibly can in all probability guess what occurred subsequent…

On February 3, 2023, Mathur contacted T. Bott, requesting that he be paid the return he was promised.

T. Bott replied that the funds solely get disbursed after a full thirty (30) days, so a cost can be forthcoming in the midst of February 2023.

On February 16, 2023, T. Bott referred to as Mathur and acknowledged that the operators of the funds had a problem, this time trying to differentiate his function on the fund as a mere investor, slightly than an proprietor.

Regardless of his new declare that he was simply an investor, T. Bott proceeded to advise Mathur that the account had taken round a 50% loss, and Mathur might both get again $650,000 at this time … or wait till the top of March and obtain the past-due 18% returns from January, February and March.

T. Bott elaborated that different mutual associates who invested by way of him all opted to attend till the top of March.

Mathur would later notice Bott had satisfied his mutual associates that it was he who had opted to attend until the top of March “and that they need to observe his lead”.

On March 14, 2023, Mathur met with T. Bott in Los Angeles, California to debate his funding.

Previous to the assembly, Mathur carried out an web search of the Buying and selling Platform, solely uncover that Ted Safranko was charged by the CFTC in a $144,043,883 fraud.

Upon informing Bott of his findings, Bott is alleged to have grown “irate and started insulting Mathur”.

The dialog deteriorated when T. Bott threatened Mathur is entrance of two mutual associates, stating that he had a gun on him and would apply it to Mathur.

As these current endeavored to de-escalate the scenario, Mathur queried T. Bott as why, as such a purported large shot, he couldn’t simply wire Mathur the $1 million again instantly with none earnings.

T. Bott responded that he would do it the next day however modified his thoughts minutes later, and instructed Mathur to attend till the top of this month, and if there was no progress, T. Bott mentioned he would “vouch for it”.

Subsequently, T. Bott suggested Mathur that, as a result of involvement of mutual associates between the 2, T. Bott would offer a mortgage in opposition to the funds within the Meta Dealer account till a supposed “withdrawal concern” may very well be navigated.

As on the time of submitting his lawsuit, Mathur claims “no mortgage or different funds have been made”.

Reasonably, following involvement of counsel and a preliminary investigation, it has grow to be proof that your complete funding alternative is and all the time was a sham.

Consistent with The Merchants Area having already collapsed by the point Bott made the DWHTD funding provide to Mathur, Mathur additional discovered

DWHTD was included on December 28, 2022, which is after T. Bott floated the funding alternative to Mathur’s acquaintances in mid-December 2023 with representations that the corporate traditionally might return the promised 18% month-to-month returns on funding.

[Furthermore] DWHTD has no precise bodily presence in Singapore and its tackle is a company agent, providing incorporation companies and a “digital” tackle.

Mathur additionally famous DWHTD’s acknowledged enterprise nature was “buying and selling of gold in opposition to the greenback” within the IMA. DWHTD’s shell firm registration nevertheless acknowledged it was concerned in “growth of software program and functions (besides video games and cybersecurity)”.

Subsequent, for a cause that continues to be unanswered, T. Bott directed Mathur to wire the funds to a Utah firm T. Bott owns along with his brother, R. Bott.

This firm is just not listed within the IMA and has no seen connection to something topic to the IMA.

Mathur concludes;

In sum, this transaction is, on its face, a rip-off perpetrated in a blunt vogue, by way of plain fraud.

There are not any returns, there isn’t a stay viable firm, and there’s no buying and selling.

Reasonably, T. Bott and his brother R. Bott, merely defrauded EM1 out of $1 million.

Causes of motion in opposition to DWHTD and the Botts embody:

- fraud;

- conversion;

- violation of Penal Code part 496; and

- breach of contract

On or round February seventh, 2024, Bott had Mathur’s Grievance moved from the Los Angeles Superior Court docket to the Central District of California.

On March twenty seventh, Bott filed his reply to Mathur’s criticism – principally denying Mathur’s allegations. Bott additionally filed a counterclaim in opposition to Mathur, alleging “intentional infliction of emotional misery”.

Versus pitching Mathur himself on The Merchants Area, Bott claims “third events” did his soiled work.

What precisely was represented represented to Mathur concerning the Drive Fund is unknow [sic].

Nevertheless, after discussing the chance with the third events, Mathur turned immersed with the Drive Fund, and due to this fact needed to speculate $1,000,000, hoping that he would obtain a big return on his funding.

Once more, pursuant to The Merchants Area collapsing in or round October 2022, Bott claims

the Drive Fund was now not accepting additional investments.

So, the one technique to get hold of a holding within the Drive Fund can be to buy all or a part of an present holding from somebody who had already invested within the alternative.

As soon as bought, the already-invested holder would switch a part of his holding to the purchaser, thereby granting the purchaser a place within the Drive Fund in an quantity equal to his buy.

Bott claims undisclosed “third events … every had a $1,000,000 within the Drive Fund” [sic].

As a result of Mathur needed a $1,000,000 holding himself, he was unable to take the holding by the third events since they didn’t have sufficient to switch.

In consequence, the third events knowledgeable Mathur they’d an acquittance [sic] who had a number of tens of millions of {dollars} within the Drive Fund, and who could also be keen to switch 1,000,000 {dollars} of that holding to Mathur. That acquittance [sic] was Bott.

Bott claims it was solely then that he met Mathur.

Per Mathur’s request, the third events reached out to Bott and inquired whether or not he can be keen to promote 1,000,000 {dollars} of his holding within the Drive Fund to Mathur.

At first, Bott was reluctant to promote any portion of his holding to Mathur as a result of he was not aware of Mathur and had no prior relationship by any means.

Nevertheless, due to Bott’s shut relationship with the third events, he ultimately acquiesced to their request and agreed to satisfy with Mathur.

Thereafter, Mathur and Bott spoke on the cellphone. Bott was very clear to Mathur that he was not making any representations or ensures concerning the Drive Fund, and that Mathur wanted to conduct his personal due diligence to find out whether or not he

needed to proceed with the transaction.

Bott agrees the exhibited IMA was executed in early January 2023. Bott doesn’t clarify why himself or his Utah shell firm didn’t seem on any signed agreements.

On January 9, 2023, Mathur transferred $1,000,000 to Bott’s firm.

That very same day, Bott transferred $1,000,000 of the Drive Fund holding to Mathur’s firm’s, EM1 Capital, LLC.

Once more, remembering that The Merchants Area collapsed in or round October 2022, Bott alleges;

As time went one, the Drive Fund ultimately defaulted, and the chance went nowhere. Luckily for all of the buyers, the Drive Fund refunded everybody their preliminary funding plus any extra return that was gained whereas the Drive Fund was

energetic.The funds had been transferred to every investor’s Dealer Area account.

Nevertheless, on the identical time the Drive Fund defaulted, Dealer’s Area started having liquidity points, and all accounts had been positioned on maintain.

So far, all Dealer Area accounts are positioned on maintain. In consequence, no investor of the Drive Fund has been in a position to withdraw their funds from the Dealer Area platform. This contains each Bott and Mathur.

Bott’s allegations require shifting locking of investor accounts to round February or March 2023 – six months or so after The Dealer Area collapsed.

The remainder of Bott’s counterclaim presents him as an harmless bystander;

Though Mathur made his resolution to spend money on the Drive Fund previous to assembly Bott, Mathur for some cause blamed Bott for having invested his $1,000,000.

Curiously, the funds that had been returned by the Drive Fund had been sitting in a Dealer Area account that Mathur already had previous to talking with Bott.

Bott had nothing to do with the activation of the Dealer Area account. Regardless of this, Mathur blamed Bott for his incapacity to withdraw the funds.

Subsequently, Mathur went on a rampage with threats in opposition to Bott.

For instance, on or about March 12, 2023, Mathur was at a gathering at a non-public home with Bott and a number of other different people.

Throughout the assembly, Mathur approached Bott and started blaming him for not having the ability to withdraw the $1,000,000 talked about above.

He then proceeded to make threats in opposition to Bott’s life except the cash was paid again.

After the threats had been made, the third-party people current on the residence bought in between Mathur and Bott and broke up the confrontation.

As well as, Mathur has instructed sure people to contact Bott through textual content message to make dying threats except the $1,000,000 was paid again to Mathur.

Additionally, it has just lately been found that Mathur was current at a celebration in California. A number of attendees had been associates of Bott.

Throughout that occasion, Mathur started inquiring about Bott’s bodily location, claiming that Mathur wanted to get him served

with the criticism at concern.Nevertheless, Bott had already been served with the criticism and Mathur was absolutely conscious of this reality. Thus, it was clear that Mathur was looking for Bott to additional perform his dying threats, and even perhaps to harm Bott.

Bott asserts allegedly stealing $1 million from Mathur has left him “emotionally harmed”.

Bott is in worry for his life and continues to endure emotional harm.

On April twelfth, the courtroom granted a movement by Richard Jason Bott to dismiss Mathur’s case in opposition to him. The dismissal was granted on private jurisdiction grounds, not the deserves of Mathur’s allegations.

Mathur was additionally denied from serving DWHTD Expertise PTE LTD through e-mail.

On April tenth, Mathur filed his First Amended Grievance. CTB Rise Worldwide Inc. was added as a defendant.

On Could twenty third, Bott’s lawyer knowledgeable the courtroom {that a} personal settlement had been reached. In consequence, the courtroom dismissed the case on Could twenty fourth.

From a regulatory and regulation enforcement perspective, the underlying alleged securities, commodities and wire fraud, in addition to suspected cash laundering, stays unaddressed.

Such is the case with the broader The Merchants Area Ponzi scheme, with complete investor losses pegged at round $3.3 billion.