Following the collapse of its unique TAS Vault scheme, Auratus has rebooted with Zai Playing cards.

Following the collapse of its unique TAS Vault scheme, Auratus has rebooted with Zai Playing cards.

Particulars of Auratus’ new Zai Card funding scheme had been revealed on a secret August fifth webinar hosted by Annie Starky.

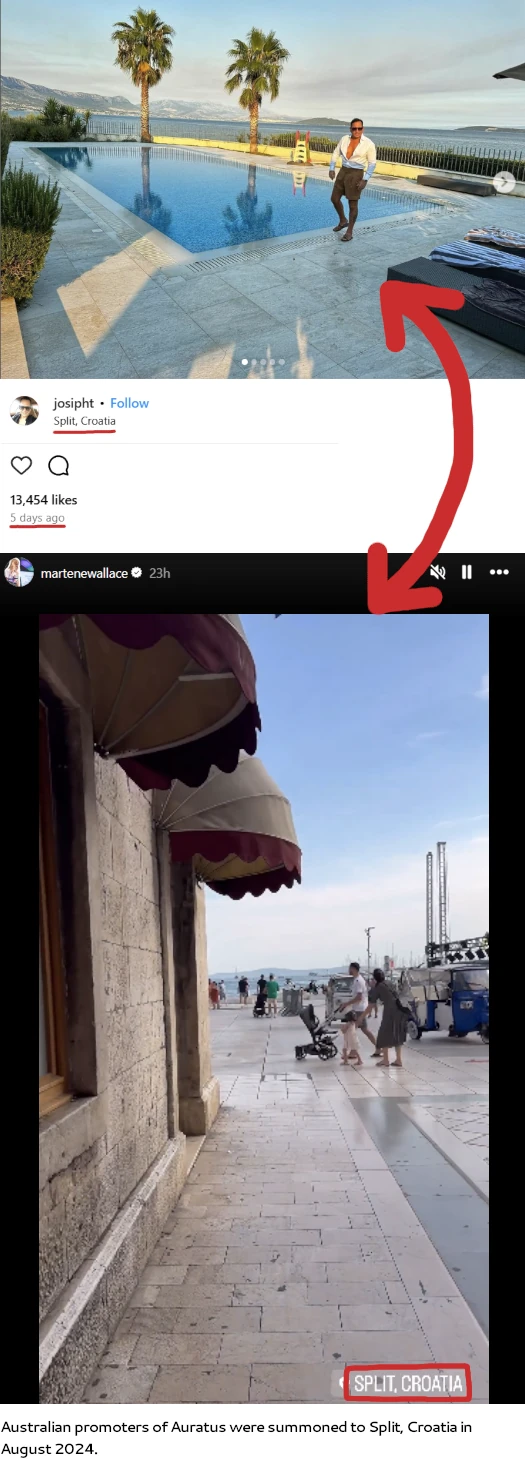

Starky, an Australian Auratus promoter, is a part of Martene Wallace’s “management” group.

Starky was really filling in for Wallace and utilizing her Zoom account, owing to Wallace and different Auratus promoters being summoned to a secret assembly with Josip Heit in Croatia.

Josip Heit owns GSB Gold Commonplace Company, by which he instantly and not directly has run and runs a number of fraudulent funding schemes. These embrace GSPartners, Swiss Valorem Financial institution, GSPro, Billionico and Auratus.

Heit is initially from Croatia and is believed to carry a Croatian passport. Like many nations, Croatia doesn’t extradite passport holders.

After blabbing on about world economies and gold for twenty minutes (observe Auratus doesn’t have something to do with precise gold), Annie Starky will get into Auratus’ new Zai Card funding scheme.

Be aware that from right here on out something in a inexperienced field is quoted from Starky instantly.

The underlying premise of Auratus’ Zai Card funding scheme is identical as its collapsed TAS Vault scheme.

This firm takes the gold and places it right into a decentralized area. It’s really bodily gold held on a digital platform.

Auratus traders are led to consider they’re investing in gold, which in fact they by no means see and no verifiable proof it exists is supplied.

What Auratus traders are actually investing in are “gold factors”, created out of skinny air and fully nugatory exterior of Auratus itself.

This occurs by Auratus’ comparatively new Zai Playing cards.

[You] purchase one thing known as a Zai Card, which is a smart-contract.

Purchase a Zai Card after which retailer [and] earn extra gold, on account of storing it on that Zai Card.

Be aware that though they’re depicted as bodily playing cards, Auratus’ Zai Playing cards don’t really exist. They’re nothing greater than a marker to trace how a lot an Auratus investor can make investments.

Earlier than we get additional into Auratus’ new Zai Card funding scheme, there’s just a few issues happening right here I need to tie to collectively.

The entire put money into faux gold ruse is basically a reboot of Karatbars Worldwide, a collapsed pyramid turned crypto Ponzi that Josip Heit was intently concerned in.

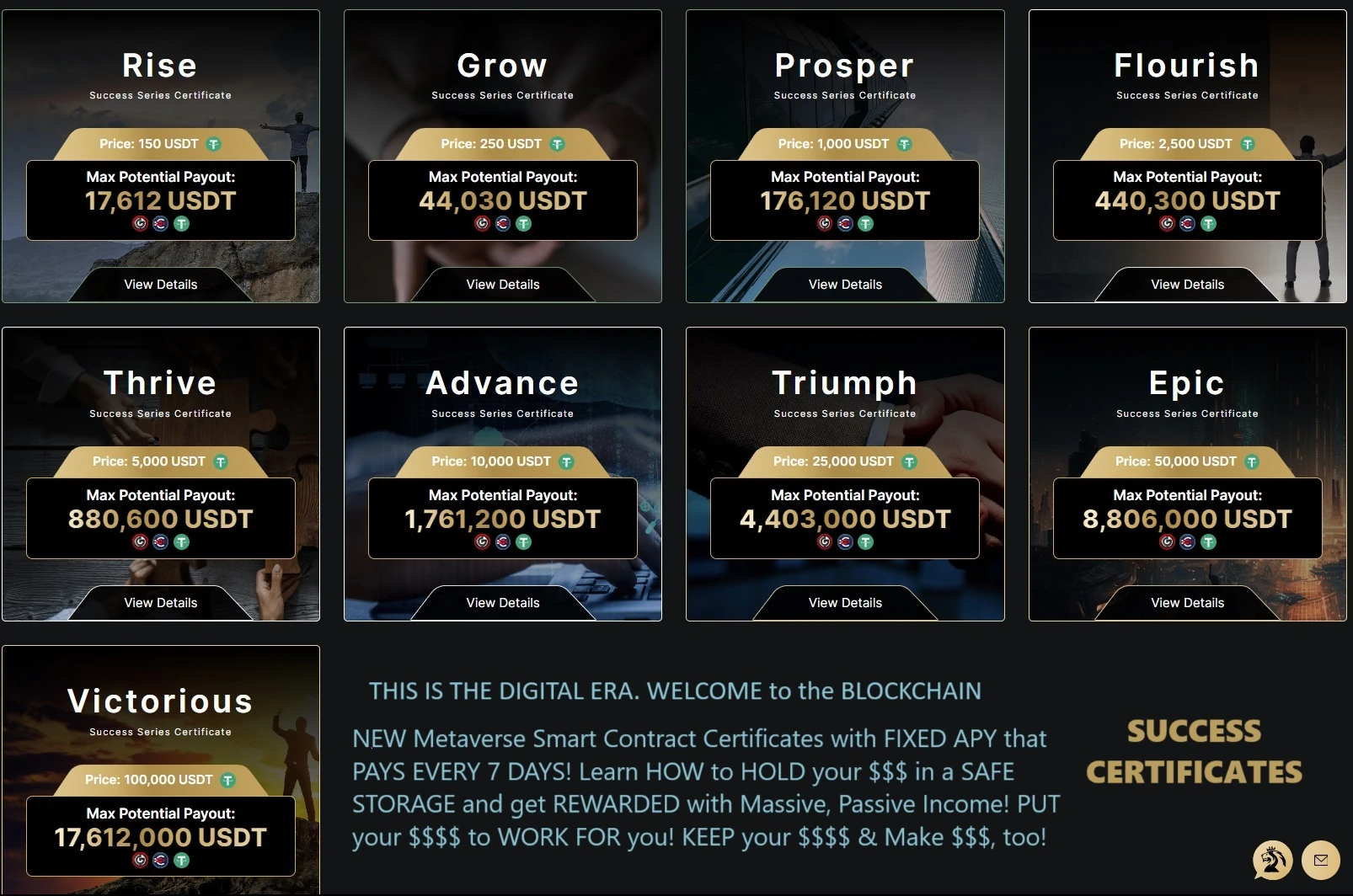

Zai Playing cards and the good contracts purportedly hooked up to them are a rebranding of GSPartners’ fraudulent metacertificates (aka metaportfolios) funding scheme.

In a nutshell, traders make investments cryptocurrency on the promise of returns paid out over a set time frame.

As GSPartners’ ROI liabilities spiralled additional and additional uncontrolled, a “Victorious” certificates noticed GSPartners promise 17.6 million USDT off a 100,000 USDT funding.

This was a part of GSPartners’ remaining “success sequence” certificates, particulars of which you’ll see beneath (click on to enlarge):

GSPartners’ certificates scheme has obtained over a dozen regulatory fraud warnings from a number of nations. A GSPartners promoter has additionally been arrested in South Africa as a part of an ongoing legal investigation.

These warnings and arrest are the explanation Auratus is promoted in secret. You received’t discover Heit or any promoters publicly acknowledging Auratus even exists.

As to the specifics of Auratus’ Zai Card funding scheme, funding is solicited underneath the ruse of buying gold.

That is framed as buying a Zai Card after which “loading” it with bought gold (invested cryptocurrency). In GSPartners traders “loaded” bought “metacerticates” in the identical method.

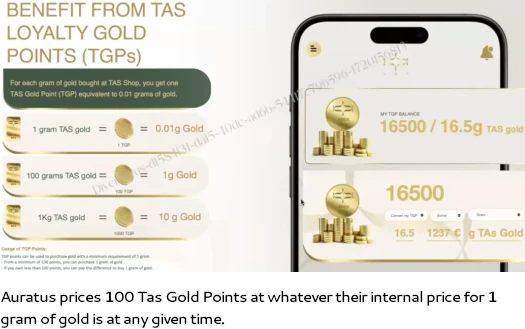

Whereas cryptocurrency enters Auratus through funding, Zai Card returns are paid in “TAS Gold Factors” (TGP).

One of many issues we’ve obtained to be conscious of is, y’know we will’t say it’s an funding as a result of that’s giving monetary recommendation. We are able to’t say it’s revenue, as a result of what they pay you… and it’s a bit like saying, um they pay you in loyalty factors.

It’s known as Tas Gold Factors. So that you receives a commission in loyalty factors.

With Auratus, you earn gold factors each time you purchase your gold and also you gold goes by a circuit system.

In Auratus’ first fraudulent funding scheme, the “circuit system” was known as a “vault cycle”. It’s the identical factor, they’ve simply modified the title.

Each two weeks you can be incomes gold factors in your Zai Card, which you’ll then become no matter you need.

To recap: cryptocurrency funding right into a Zai Card –> a passive “gold factors” ROI each two weeks –> money out gold factors on a “TAS Card” so long as Auratus enables you to.

That’s Auratus’ “new” funding scheme. An entire lot of name-changing however the underlying securities fraud stays the identical.

The secret’s to get in now and that’s why I say don’t procrastinate.

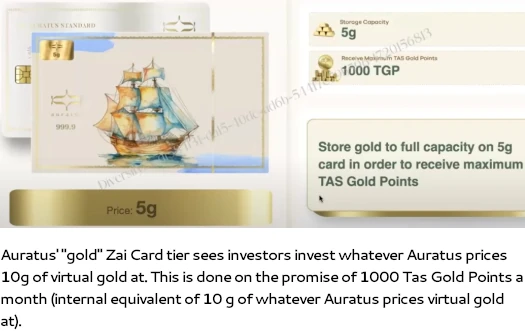

It’s $606 Australian {Dollars} to buy the Gold Zai Card. And it takes, it’s 5 grams to load. And so that you even have to take a look at 5 grams to buy, 5 grams to load.

So that you try this twice, it’s about twelve hundred and 13 {dollars} to buy proper now.

Now it tells you there, that you simply’re gonna get a month-to-month most reward of a thousand TAS Gold Factors.

Nicely really you’re not. You’re gonna get extra, as a result of we’re in a particular promotion interval proper now and that is what I’m actually enthusiastic about.

And that’s why I’m saying don’t procrastinate. Don’t take into consideration this, simply assume “What have I obtained? What can I liquidate quick?” Y’know, promote fitness center gear, promote stuff that you simply’re not utilizing. Yeah promote the TV, it’s ineffective.

Um, in order that’s fascinating as a result of what you get now’s you really obtain um… properly you’re really gonna obtain about 18.34 grams out of your loyalty factors. So 1834 versus 1000 [grams].

So that you’re gonna get 1834 Tas Gold Factors for this, and in order that works out to be round about $2203 AUD.

Now bear in mind after I mentioned you get these factors delivered to you twice a month? They arrive in two funds. So in the middle of a month they receives a commission to you … twice a month.

So if we liquidate that into Australian {Dollars} it’s about $95 [that] will come into your dashboard as gold, and also you select what you need to do with that.

And on the finish of the 2 years, this works out to be 2.33x what you initially put in.

To summarize; Auratus’ Gold Zai Card tier prices round $1213 to put money into. That is on the promise of a $2203 passive return, paid out at roughly $95 each two weeks for 2 years.

There are cheaper/costlier Zai Card funding tiers. A “horse” tier Zai Card multiplies the gold tier Zai Card funding and ROI quantities by ~525%.

Starky claims “horse” tier Zai Card traders obtain $7542 AUD over a 12 month interval.

You’re going to get about $390 AUD again per thirty days once you promote or change. And on the finish of the twelve months you’re roughly going to get um, instances two extra. You’re going to get twice as a lot as you place again in.

Above the “horse” tier Zai Card tier there’s the “panda” tier, which Starky claims pays “2.36x again”.

What’s the value of 75 grams in euro? Then what’s the value of 75 grams to retailer the gold?

You’re really going to get again 2796 grams there, for the “panda” [tier]. Which works out to be 2.36x the sum of money you initially put in.

Above the “panda” Zai Card tier is the “combating fish” tier.

The “combating fish” [tier] in the meanwhile is returning about 2.5x what you place in over twenty-four months. So in 24 months you get your a refund.

Above the “bull Zai Card tier is the “bull” tier.

The “bull” [tier], the subsequent one, is uh over thirty-six months. The final 4 playing cards goes over three years and also you get 3.4x your return. After which the others are even larger.

Starky runs by the remainder of Auratus’ Zai Card funding tiers, wrapping up at “dragon”.

That’s about $1.5 million to buy the Zai Card, about $1.5 million to load and to get a rare quantity again, which I’ve right here someplace.

You get, on that one, you get uh the dragon? Yep, 2.2x what you initially put in.

Owing to the fraudulent nature of its Zai Card funding scheme, Auratus doesn’t disclose any of this on its web site.

GSPartners’ promised “metacertificates” returns had been in fact by no means paid out. As prior certificates reached expiry, GSPartners launched new certificates and promotions to masks beforehand invested funds had been stolen.

GSPartners collapsed in December 2023 and commenced terminating investor accounts shortly after. A whole lot of hundreds of thousands is believed to have been misplaced and stays unaccounted for.

If Auratus even lasts that lengthy, count on new Zai Card tiers to be trotted out as earlier tiers expire.

On the promotion aspect of issues I consider Auratus’ Zai Card funding scheme makes use of the identical MLM compensation plan as its collapsed TAS Vault scheme.

Neither Auratus’ preliminary TAS Vault or its Zai Card reboot funding scheme are registered with monetary regulators in any jurisdiction.

Owing to US authorities already issuing an Auratus Gold securities fraud warning in relation to its collapsed TAS Vault scheme, Auratus blocks its web site in Texas.

Auratus’ web site stays accessible elsewhere within the nation.

Owing to large US investor losses incurred by GSPartners’ collapse nevertheless, Auratus has no identified promotion within the US. As an alternative the scheme, together with sister pyramid scheme Billionico, is primarily being promoted in Australia.

Billionico and Auratus was being promoted in South Africa however that got here to a halt following Neil de Waal’s arrest in June. South African GSPartners and Billionico/Auratus promoters have since deleted their social media and scattered.

Australian authorities issued a GSPartners fraud warning in November 2023. ASIC has but to difficulty a comply with up Billionico/Auratus fraud warning.

Footnote: Martene Wallace and her Auratus downline often host advertising and marketing webinars however they’re routinely deleted shortly after going reside.

It is because of this that I haven’t instantly linked to Annie Starky’s August fifth Auratus webinar.

Replace seventh August 2024 – Annie Starky’s incriminating Auratus advertising and marketing webinar was certainly marked personal just a few hours after this text was revealed.