iGenius has just lately expanded its unregistered buying and selling providing via CoinRule.

iGenius has just lately expanded its unregistered buying and selling providing via CoinRule.

iGenius is an US MLM firm owned by SEC registered father or mother firm Investview.

Curiously, you received’t discover any details about CoinRule or iGenius’ new automated buying and selling passive returns funding alternative on its web site.

For extra data we flip to a latest advertising presentation given by Investview and iGenius President, Chad Garner.

[8:23] CoinRule, these guys they primarily create software program that connects to your crypto trade account.

And the software program may also execute trades. You give it mainly authorization to execute trades in your behalf, and so you possibly can have automated buying and selling happen in your trade account.

That is the “lulz can’t contact our cash!” mannequin. It’s the identical mannequin used with EndoTech, one other passive returns funding scheme iGenius fees for entry to.

Underneath the “lulz can’t contact our cash!” mannequin, an MLM firm’s clients place their funds beneath management of a central entity. On this case its “Cforce”, a purported “unique” buying and selling bot CoinRule supplies to iGenius.

As additional defined by prime iGenius promoter and Florida resident Anthony Napolitano;

[11:57] This can be a software program firm known as CoinRule. They really created this third-party product suite for us. And it gave us mainly entry to an unique technique known as Cforce.

Cforce … mainly seeks tendencies out there, within the crypto market, and it fully automates the buying and selling expertise.

[12:15] You have got full custody of your cash always. You by no means give your cash to anybody.

However as an iGenius member you might have the power to hyperlink your trade account, no matter trade you favor to make use of, to this know-how.

And this know-how has the power to automate trades 100%, 24/7, seven days of the week.

“Lulz can’t contact our cash!” buying and selling schemes sometimes implode via unhealthy or rigged trades. I can’t converse particularly to CoinRule however bot house owners sometimes steal consumer funds via rigged trades and blame it on hackers, or disappear and many others.

Right here’s how CoinRule handles investor losses;

Limitation of Legal responsibility

11.1 Coinrule shall not be answerable for any direct, oblique, incidental, particular, or consequential damages arising out of or in reference to the use or incapability to make use of the Software program, even when Coinrule has been suggested of the opportunity of such damages.

11.2 In no occasion shall Coinrule’s complete legal responsibility to you for all damages, losses, and causes of motion (whether or not in contract, tort, together with, however not restricted to, negligence, or in any other case) exceed the quantity paid by you, if any, for accessing the Software program.

Entry to Cforce requires an “Elite” iGenius membership.

An Elite iGenius membership will set you again $1499.99 after which $174.99 a month. Entry to Cforce is an further $315 yearly on prime of that.

CoinRule launched its passive returns automated buying and selling scheme in 2021. CoinRule seems to be UK primarily based and is headed up by CEO Gabriele Musella.

CoinRule sells memberships on its web site beginning for free of charge and topping out at $449.99 a month.

On its web site, CoinRule additionally advertises a $200 referral program. Presumably this implies iGenius will get an undisclosed kickback per Elite member they enroll.

I consider the FCA’s banning of “refer a good friend” schemes by “cryptoasset” corporations doesn’t apply to CoinRule. CoinRule doesn’t seem to supply any cryptoassets to shoppers.

That stated CoinRule’s passive returns funding alternative via automated buying and selling ought to be registered with the FCA.

A search of the Monetary Companies Register reveals CoinRule is just not registered with the FCA. This makes CoinRule an “unauthorised agency” within the UK.

As per CoinRule’s web site Phrases and Circumstances;

These Phrases of Use shall be ruled by and construed in accordance with the legal guidelines of England and Wales, with out regard to its battle of legislation rules.

By failing to register its passive returns funding alternative with the FCA, CoinRule is committing verifiable securities fraud in its residence jurisdiction.

As tracked by SimilarWeb, as of Could 2024 the biggest supply of visitors to CoinRule’s web site is US residents (39% of visitors).

CoinRule brazenly disclose they aren’t registered with the SEC both:

Why there’s no point out of CoinRule or Cforth on iGenius’ web site is unclear. There’s additionally no point out of EndoTech, one other firm iGenius supplies comparable passive returns via.

With out offering any verifiable proof (audited monetary studies), Napolitano pitches potential traders on CoinRule’s purported historic outcomes.

[13:34] I can inform you this tech has performed terribly effectively. Our members do really find it irresistible.

Investview is presently beneath SEC investigation for suspected iGenius associated fraud. Investview’s former CEO has additionally been incarcerated following a number of convictions on unrelated fraud fees.

Underneath US legislation (the Howey Check), the passive returns iGenius markets via CoinRule’s automated buying and selling bot represent a securities providing.

iGenius consumer traders place their cash beneath management of Cforce, which is owned and operated by a standard enterprise (CoinRule).

That is performed on the “cheap expectation of earnings to be derived from the efforts of others” (returns generated by way of automated buying and selling via CoinRule’s bot).

With all prongs of the Howey Check happy, iGenius’ passive returns supplied via CoinRule represent a securities providing.

There isn’t a point out of CoinRule in its final two SEC filings; an annual 10-Ok filed final December and a quarterly 10-Q filed on Could 14th, 2024.

Each of iGenius’ CoinRule and Endotech securities choices are merely decreased to;

iGenius members additionally achieve entry to quite a lot of advantages supplied via third celebration partnerships and affinity preparations, together with entry to a crypto buying and selling software program and a digital pockets platform.

Between hiding data on its web site and in its SEC filings, shoppers are left unable to make an knowledgeable resolution about investing in iGenius’ supplied passive returns buying and selling schemes.

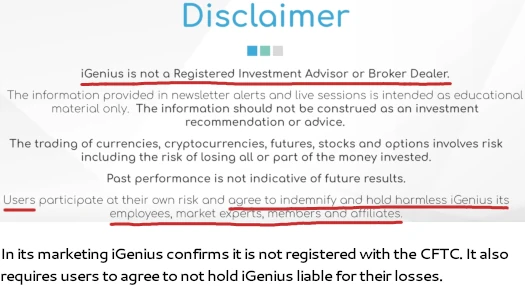

That iGenius affords passive returns via buying and selling additionally requires it to be registered with the CFTC. A search of the NFA’s BASIC database confirms neither iGenius, Investview or CoinRule are registered.

The CFTC fined Wealth Turbines $150,000 for commodities fraud in 2018. See if this sounds acquainted;

Wealth Turbines additionally supplied an algorithmic buying and selling system to its clients via its Multiplier, Multiplier 2.0, and RYZE merchandise.

These merchandise allowed clients to hyperlink to a third-party buying and selling platform operated by an off-shore retail foreign exchange trade, the place clients funded accounts that have been traded routinely by an algorithmic buying and selling system.

Clients had no discretion to direct trades utilizing these merchandise.

After the CFTC effective Investview renamed Wealth Turbines to Kuvera. Following widespread investor losses via buying and selling bots, Investview renamed Kuvera to iGenius in early 2021.

Maybe conscious that neither Investview hasn’t registered its newest passive returns funding scheme with the SEC, and that neither Investview, iGenius or CoinRule are registered with the CFTC, Napolitano trots out this pseudo-compliance;

[12:47] To make this very clear as effectively, I’m gonna reiterate it this; CoinRule is a third-party firm.

iGenius is just not the one offering this software program, CoinRule is.

Which is after all baloney…

[13:50] There’s no approach you will get entry to this tech with out being part of iGenius.

iGenius associates join and take part with CoinRule’s unregistered funding scheme via their iGenius backoffice.

Internally the supply has been named “COINpro”, and it’s unique to iGenius;

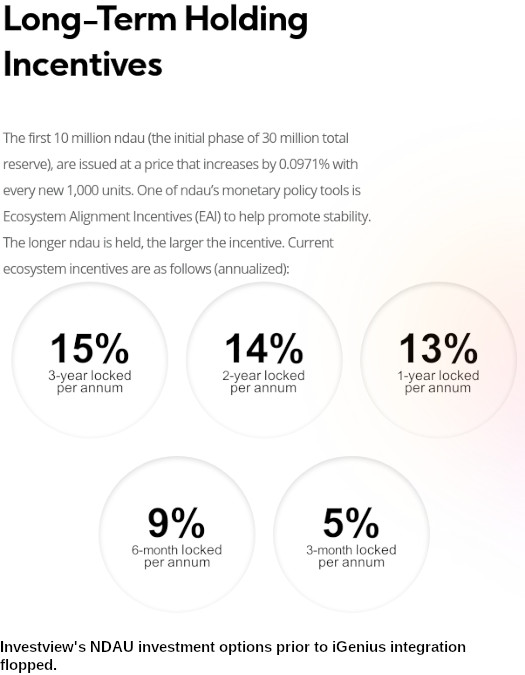

One other element of Kuver and iGenius price mentioning is Investview’s fraudulent NDAU token funding scheme.

Investview’s SEC filings clarify its NDAU funding scheme was dropped as a result of Whole Safety Plus (TPP) regulatory considerations.

Via August 2023, we generated income from the sale of cryptocurrency packages to our clients via an association with a third-party provider, sure of which, till January 2022, included a product safety choice supplied by a third-party supplier.

In keeping with advertising and authorized paperwork supplied by such third-party supplier, the product safety would enable the purchaser to guard its preliminary buy worth by acquiring 50% of its buy worth at 5 years or 100% of its buy worth at ten years.

In January 2022, we suspended any additional providing of the product safety choice within the cryptocurrency packages after the third-party supplier was unable to adjust to our normal vendor compliance protocols, citing sure offshore confidentiality entitlements.

That suspension will stay in place till we’re capable of additional validate the continued integrity of the product safety and the seller’s potential to honor its commitments to our members.

We can’t be sure that such third-party supplier will adjust to its contractual necessities, which may trigger our members to not obtain the extent of return on their investments anticipated.

Whereas we don’t consider that we’ve got any obligation to the shoppers who participated within the TPP Program supplied and administered by TPP, there’s a danger that any failure of TPP to carry out its obligations to our clients, may expose us to claims of our clients that might have an opposed impact on our enterprise, monetary situation, and working outcomes.

iGenius operates from two web site domains; “igeniusglobal.com” and “igenius.biz”.

As of Could 2024, SimilarWeb tracked prime sources of visitors to iGenius’ web sites as:

- “igeniusglobal.com” (~46,200 month-to-month visits) – Germany (16%), Poland (13%), Albania (8%), Jordan (8%) and France (7%)

- “igenius.biz” (~541,600 month-to-month visits) – Poland (56%), Germany (14%), Jordan (5%), the US (4%) and Saudi Arabia (4%)

Authorities in Poland introduced an iGenius pyramid fraud investigation final September.

iGenius failing to retain a sizeable buyer base within the US since 2021 is a significant due-diligence pink flag.