Nelo Life has launched their securities and commodities fraud providing as LifeElevate (additionally known as Nelo Commerce).

Nelo Life has launched their securities and commodities fraud providing as LifeElevate (additionally known as Nelo Commerce).

BehindMLM first reported on Nelo Life including securities and commodities fraud to its MLM providing again in March.

As we speak we dive deeper, following a rabbit gap that leads us to serial fraudster and needed fugitive Ed Zimbardi.

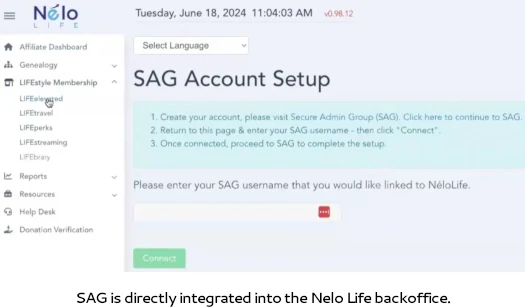

As a substitute of internet hosting LifeElevated themselves, Nelo Life requires associates to join a Safe Admin Group account.

As soon as signed up with a Safe Admin Group account, Nelo Life associates “hyperlink” their MLM account to their SAG account within the Nelo Life backoffice.

On its web site Safe Admin Group, or “SAG” for brief, pitches itself as

the primary Decentralized Auditable Useful resource Tracker which serves as an autonomous and nameless bridge to attach exchanges, actual world tasks, liquidity swimming pools, builders and members in a singular, extremely subtle ecosystem.

Basically, Safe Admin Group features because the TPA or third-party-administrator utilizing its proprietary know-how to trace efficiency of Commerce Scripts in Foreign exchange, Commodities, Cryptocurrency and different markets.

Safe Admin Group is constructed solely across the USDC stablecoin ecosystem, which is essentially the most steady and trusted stablecoin that undergoes month-to-month third-party audits to make sure it has enough liquidity in reserves.

No audits are offered to shoppers on SAG’s web site. SAG’s web site correct doesn’t even disclose who owns or runs the corporate.

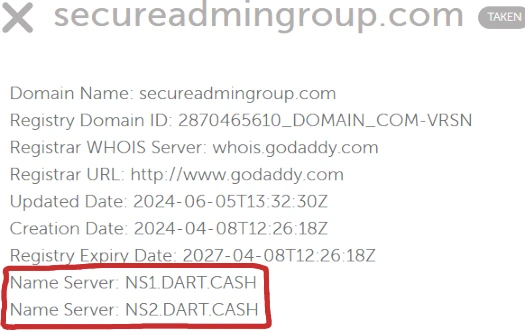

SAG operates from the area “secureadmingroup.com”. The area was solely lately registered on April eighth, 2024.

Apparently, Safe Admin Group’s area makes use of name-servers belonging to Dart Money:

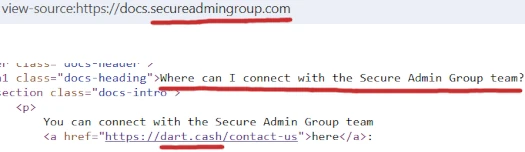

This coincides with Safe Admin Group directing anybody who needs to contact them to Dart’s web site:

On its web site, Dart pitches itself as

the primary Decentralized Auditable Useful resource Tracker which serves as an autonomous and nameless bridge to attach exchanges, actual world tasks, liquidity swimming pools, builders and members in a singular, extremely subtle ecosystem.

Basically, DART features because the TPA or third-party-administrator utilizing its proprietary know-how to trace efficiency of Commerce Scripts in Foreign exchange, Commodities, Cryptocurrency and different markets.

DART is constructed solely across the USDC stablecoin ecosystem, which is essentially the most steady and trusted stablecoin that undergoes month-to-month third-party audits to make sure it has enough liquidity in reserves.

Primarily, SAG and Dart are clones of one another. I’m undecided how each SAG and Dart might be “the primary decentralized auditable useful resource tracker”, however I digress.

From a “chaos” whitepaper hosted on Dart’s web site, we be taught each firms have been set as much as

enable direct Peer-to-Peer transactions that don’t require a fancy (and corrupt) banking system in between.

In different phrases, SAG and Dart have been created to assist criminals keep away from banking and monetary regulation.

Hooked up to Dart is an compulsory crypto Ponzi scheme, run by their inhouse CHAOS shit token.

Since token holders can obtain rewards in CHAOS equal, they’ll compound their holdings quickly.

The ‘new’ CHAOS launched as rewards has a better worth than the earlier CHAOS holdings that have been launched at a decrease

valuation. This mechanism ends in vital rewards for early adopters.

As to why the necessity for SAG, if I needed to guess it’s as a result of Dart and its CHAOS Ponzi scheme have collapsed. As of Could 2024, SimilarWeb tracked simply ~2400 month-to-month visits to Dart’s web site.

One other risk is eager to arrange new cash laundering channels by SAG. Dart has been round since 2022 and will already be on monetary blacklists.

SAG’s and Dart’s hiding behind decentralization is a ruse, as clearly neither firm set itself up. SAG and Dart have been created and are owned and operated by somebody.

To that finish SAG and Dart share widespread possession, nevertheless solely three executives are disclosed.

Our crew is comprised to 10+ members from the DeFi Group. The undertaking is structured like a DAO (Decentralized Autonomous Group) however extra importantly, is created to operate unbiased of a central crew.

The bridge and liquidity within the platform are made up of a number of exchanges to offset dangers and the necessity of a single crew.

Notable crew members embody Mr. Akis Kourouzides who has over 20 years of expertise in Main Worldwide Banking, AML laws and Inner Procedures; Demetris Papadopoulos who’s an completed media marketing consultant and a thought chief in digital advertising and marketing and entrepreneurship; Vasileous P who has 15+ years expertise in navy, ecommerce, and blockchain tasks.

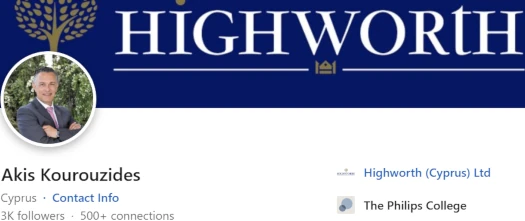

Akis Kourouzides is a resident of Cyprus (crimson flag) and claims to be a “skilled banker”. There isn’t a point out of both SAG or Dart on Kourouzides’ LinkedIn profile.

Demetris Papadopoulos calls himself “DPapa” and, though he’s from Cyprus, has been a resident of Greece since 2002. On his advertising and marketing web site Papadopoulos claims to be residing a “flip flop life”.

SAG’s and Dart’s “core crew”, as they’re referred to, make “most choices” inside each firms.

I’m not 100% positive however I imagine “Vasileous P” refers to Vasileios Pasparas, a middle-aged crypto bro with a advertising and marketing background from Greece.

The beforehand cited CHAOS whitepaper offers some extra names, and in addition suggests the tech aspect of SAG and Dart is dealt with by Indians.

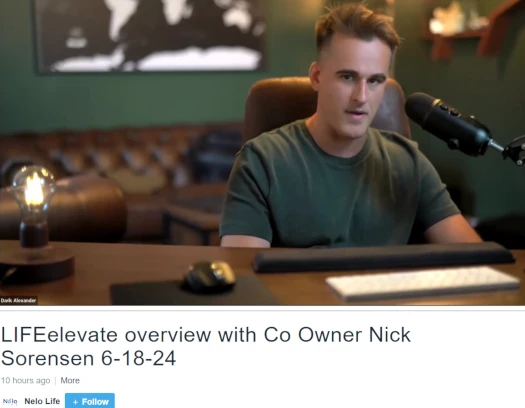

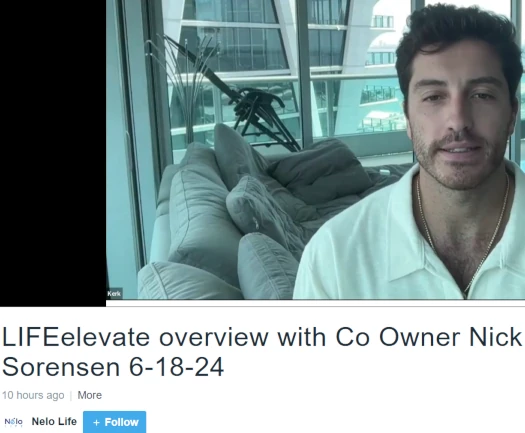

No matter monetary agreements exist between Nelo Life and SAG aren’t disclosed to potential traders. As a substitute, Nelo Life has Darik Alexander and Cameron Kerkar entrance LifeElevated.

Alexander and Kerkar, who declare to be enterprise companions for twelve years, appeared on a June 18th Nelo Life webinar to pitch potential LifeElevated traders.

Alexander describes LifeElevated as a “recreation of investing, a recreation of compound curiosity”.

[13:58] Little bit of recommendation … one, completely no query get began as quickly as you probably can with this.

[14:30] Two, if you need to have the ability to make more cash, if you need to have the ability to create extra residual earnings, then I might extremely suggest constructing an enormous group in Nelo (Life).

The rationale why is as a result of if you happen to can construct a big group on this enterprise and get lots of people concerned, you’re examine’s going to be greater than if you happen to had solely ten individuals concerned. In the event you had ten thousand individuals it’s an even bigger examine.

Why is that essential?

It’s essential as a result of when you have a ten thousand particular person crew and you’ve got that greater examine, effectively how rapidly may you reinvest your cash into programs like ours, for instance, that can provide you that compound curiosity? The place you cannot solely be incomes from Nelo however you may also be incomes out of your investments?

Now what’s the good thing about that?

If you earn out of your investments, that’s simply purely passive proper? That’s a really lovely passive earnings.

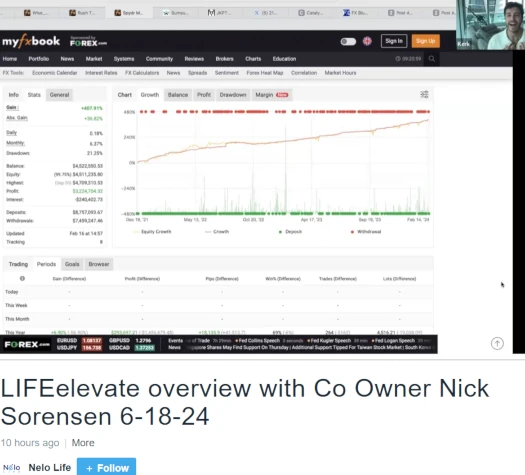

Cameron Kerkar pitches Nelo Life traders on the premise of a claimed returns over the previous 12 months.

[18:31] Nick am I in a position to share, would you want me to share my display screen and kinda give slightly little bit of an expectation… mainly returns from final 12 months?

So we’ve been operating this account I’m pulling up, we’ve been operating this for developing on thirty months now.

Kerkar brings up a MyFxBook report. I wish to stress that MyFxBook experiences are each simply faked and never an alternative choice to audited monetary experiences filed with regulators (authorized requirement).

[20:14] The very first month that we began buying and selling was again in December of 2021.

In the event you guys had the posh of us being in your community on the time … you’ll be up over 400% return in your capital since day one.

[21:43] Darik and I, if we have been doing this name a few years in the past with you guys, the backdrop would have been a lot totally different, y’know Darik wouldn’t be talking in regards to the compounding and talking about what he’s achieved for his household, the best way we’ve got, as a result of we haven’t been in a position to faucet into the compounding impact of what all these returns [generate].

No they’re not large returns each month. That is the place it will get scary is if you discuss 5 years down the highway. And proper now we’re simply over two and a half years in.

In order we proceed to do these numbers, whether or not it’s 2%, whether or not it’s 3%, whether or not it’s 5% in a month, that is constantly compounding over time.

[24:58] The most important hedge funds, the largest funds on the earth, they’re doing 30% in a 12 months, 40% a 12 months, 50% a 12 months and what are they giving their purchasers? 12%. 15%, proper?

So right here, you’re wanting on the returns proper there. Final 12 months we did over 50% and gave our purchasers over 40% return.

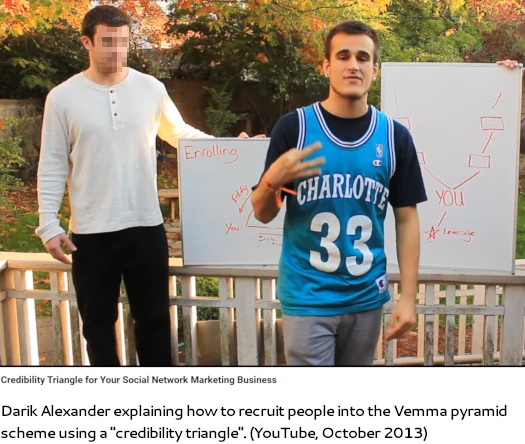

Alexander and Kerkar obtained concerned in MLM by Vemma’s “Younger Individuals Revolution” advertising and marketing arm.

YPR, because it was identified, particularly focused school college students and susceptible younger individuals.

The FTC shut Vemma down in 2015, revealing it to be a $200 million pyramid scheme.

After Vemma the pair seem to have gotten into MLM buying and selling schemes. In 2020 Alexander and Kerkar have been named defendants in a authorized dispute between Eaconomy and Auvoria Prime.

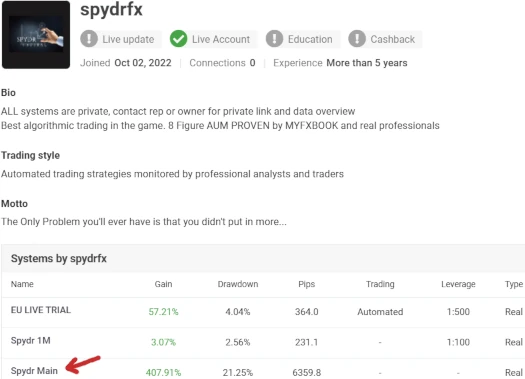

If we zoom in to Kerkar’s desktop as he presents the MyFXBook stats on the Nelo Life webinar, we will see the tab title is truncated to “Spydr M…”

This corresponds to “Spydr Principal”, an account connected to the MyFXBook account “spydrfx”.

On social media we discover Kerkar spruiking Spydr Capital, so it appears SpydrFX goes by at the very least two names.

If we open up the Spydr Principal account ourselves we discover, as of February 2024, there’s $4.5 million in claimed fairness funding.

We additionally discover the account is connected to the dealer Mugan Markets.

As already researched by Brandon Williams of Ponzi Patrol, Mugan Markets is the successor to IMGFX – each owned by Edward Anthony Zimbardi (aka Ed Zimbardi).

Mugan Markets is an offshore brokerage operated by Ed Zimbardi and his companions.

IMGFX was closed down and arrange once more underneath the Mugan Markets model. The reason being that Ed Zimbardi used IMGFX to orchestrate a number of PAMM account scams.

Individuals deposited cash into IMGFX underneath the encouragement of Ed and his associates.

They have been paid a share each month for a while, and once they needed to withdraw all of their cash, impulsively the “chief merchants” misplaced the entire cash. The cash all disappeared.

The cash didn’t disappear due to unhealthy trades, nevertheless. It disappeared as a result of there have been no merchants, Ed faked the entire trades, and the cash was merely cashed out by a backdoor of IMGFX.

The SAME THING WILL HAPPEN WITH MUGAN MARKETS.

This performs into Cameron Kerkar referring to LifeElevated (NeloTrade, SAG, SpydrFX, Spydr Capital or no matter you wish to name it), as a “marathon and never a dash”.

[26:56] Whether or not we’ve got a sluggish month or a break even month, you’ve actually obtained to zoom out and try this over a multi-year interval. And construct your technique, construct your plan of the way you wish to use this over a multi-year interval.

I additionally wish to level out that Kerkar was nonetheless selling Auvoria Prime as of October 2022.

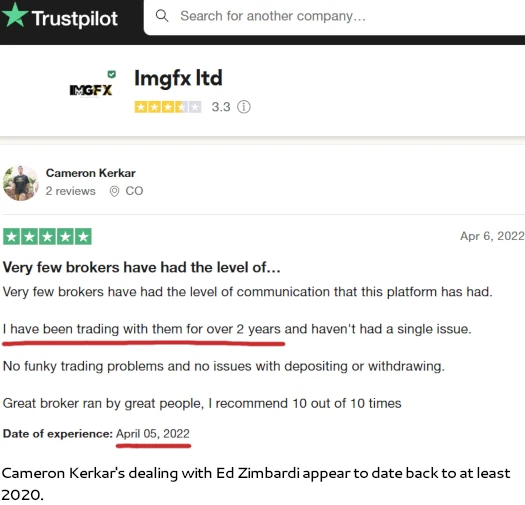

In April 2022 nevertheless, Kerkar left a TrustPilot evaluation praising IMGFX.

From this we will see Kerkar’s enterprise relationship with Zimbardi goes again to at the very least early 2022. This coincides with the Spydr Principal account on MyFXBook showing in December 2021.

Ed Zimbardi, a convicted felon, launched CryptoProgram in late 2022. The fraudulent funding scheme pitched shoppers on a perpetual 25% month-to-month ROI.

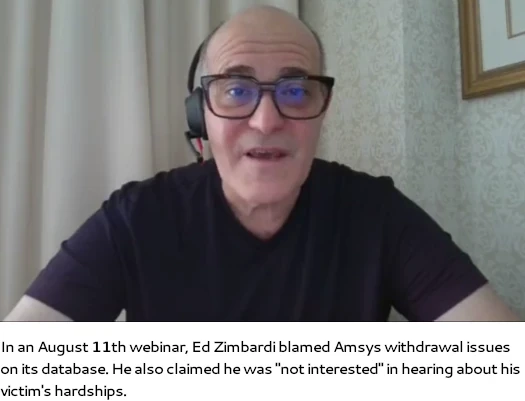

Following regulatory fraud warnings from British Columbia and California, Zimbardi collapsed CryptoProgram and rebooted it as Amsys in July 2023.

Amsys was short-lived and collapsed a couple of months later in August.

Whereas Amsys was floundering, two extra regulatory fraud warnings have been issued by Alberta and Georgia (the US state).

In some unspecified time in the future throughout all of this Zimbardi, a Georgia resident, fled the US for Europe.

In March 2024, Zimbardi was arrested within the Netherlands on suspected cash laundering costs.

Dutch authorities suspect Zimbardi assisted Corina de Jong with defrauding over 1400 shoppers. Particularly, Zimbardi is alleged to have helped De Jong launder over €56 million EUR.

De Jong funnelled investor funds into Mugan Markets, a sham dealer Zimbardi managed.

US authorities have been reported to concentrate on the arrest and dealing carefully with Dutch authorities as a part of a number of ongoing US prison and civil fraud investigations.

Regardless of being an apparent flight threat, Dutch authorities launched Zimbardi just for him to flee once more.

As of June 2024 Zimbardi’s whereabouts and standing stay unknown. The tens of thousands and thousands in stolen funds laundered by IMGFX and Mugan Markets stay unaccounted for.

What we will affirm is Zimbardi continues to defraud shoppers, the newest scheme of which is now being supplied to unsuspecting Nelo Life associates.

Along with a possible open Dutch arrest warrant, Zimbardi is believed to even be needed by US authorities.

Placing all of this collectively, we’ve got:

- Nelo Life – Nick Sorensen (Texas), Eric Allen (Indiana), Larry Lane (California) & Orkan Arat (Louisiana) –>

- Safe Admin Group – Akis Kourouzides (Cyprus), Demetris Papadopoulos (Greece), Vasileios Pasparas (Greece) & Yusuf Ouda (?) –>

- Spydr Capital/SpydrFX – Darik Alexander (Florida) & Cameron Kerkar (Florida) –>

- Mugan Markets – Ed Zimbardi (US nationwide, convicted felon and needed fugitive)

Regardless of direct ties to the US and thousands and thousands of fairness funding claimed, not one of the above entities and people are registered with the SEC or CFTC.