Following a movement from the SEC, its $49 million securities fraud case in opposition to iX International and Debt Field has been voluntarily dismissed.

Following a movement from the SEC, its $49 million securities fraud case in opposition to iX International and Debt Field has been voluntarily dismissed.

The court docket ordered the dismissal on Might twenty eighth, additionally ordering the SEC to pay prices.

The SEC’s bungling of the iX International case is rooted in attorneys dealing with the case getting cited dates incorrect, after which failing to rectify the error with the court docket.

Concerned attorneys have since resigned from the company.

In a bid to get away with an alleged $49 million in securities fraud, Debt Field and iX International argued the SEC’s case needs to be dismissed “with prejudice”. This would depart the SEC unable to refile a brand new case.

Reasoning that the underlying alleged securities fraud was sanctionable, the court docket sided with the SEC and dismissed the case with out prejudice.

Defendants successfully urge the court docket, based mostly on conduct already addressed, to additional sanction the Fee by dismissing with prejudice. The court docket declines the invitation.

Owing to the SEC bungling the case, the court docket dominated the regulator foot the invoice for related authorized prices. This quantities to:

- $8239 to aid defendants Calmes & Co In.c and Calmfritz Holdings LLC

- $19,015 to defendant Matthew D. Fritzsche

- $252,315 to iX International

- $153,365 to FAIR Mission

- $34,259 to Debt Field’s native attorneys

- $565,259 to Debt Field’s lead legal professional

- $42,190 to defendant Brendan Stangis and

- $746,941 to the Debt Field Receiver

Noting that the SEC “will seemingly have the ability to repurpose the analysis, discovery, and authorized arguments ready within the preliminary levels of this

litigation to be used in a subsequent case”, the court docket additional suggested;

The Fee argues dismissal with out prejudice is acceptable as a result of it would defend buyers and the general public curiosity, and won’t trigger Defendants authorized prejudice.

The Fee seeks to dismiss this case to permit a brand new crew of attorneys to “analyze and assess the present document, take further investigative steps as acceptable to make sure the document is correct and full, have interaction with Defendants and Aid Defendants, and decide whether or not it’s acceptable to suggest the Fee proceed with a brand new criticism, and, if that’s the case, the scope of any new criticism.”

In abstract, the SEC’s case in opposition to Debt Field and iX International has successfully been reset. The underlying $49 million in alleged securities fraud, which is the premise of the SEC’s case, stays intact.

We don’t have a timeline however, pending an inner evaluate of the case, it’s anticipated the SEC will refile. The court docket has ordered any refiling of the SEC’s case happen in Utah.

As for Debt Field and iX International, the scheme connected to the alleged underlying securities fraud has collapsed.

The cash laundering facet of the enterprise was dismantled by Indian authorities. The Indian prison investigation into iX International resulted in an impressive warrant in opposition to iX International CEO Joseph Martinez (proper).

The cash laundering facet of the enterprise was dismantled by Indian authorities. The Indian prison investigation into iX International resulted in an impressive warrant in opposition to iX International CEO Joseph Martinez (proper).

Confederate Viraj Patil, an Indian nationwide who relocated to Dubai however nonetheless visited India, was arrested by Indian authorities in December 2023.

Patil stays in custody and is believed to be helping Indian authorities.

Within the wake of the SEC’s lawsuit, Debt Field and iX International tried to double down on securities fraud with IN8 NFTs.

IN8 NFTs launched in January 2024 and collapsed in March.

Right this moment iX International markets itself as a “self betterment platform”.

As of April 2024, SimilarWeb tracked month-to-month visits to iX International’s web site at lower than 8000.

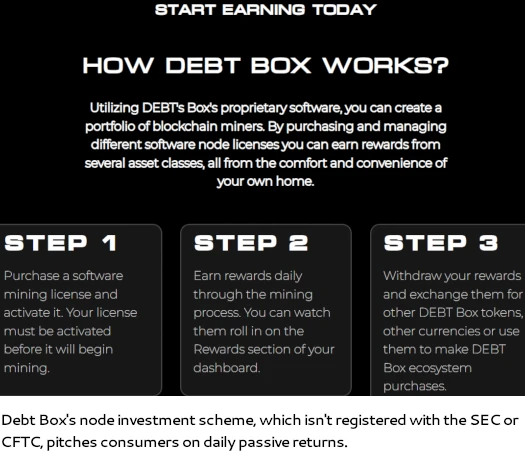

Debt Field is pitching a “crypto meets commodities” funding scheme on on its web site.

The scheme, which isn’t registered with the SEC or CFTC, is constructed round “node” funding positions.

Using DEBT’s Field’s proprietary software program, you possibly can create a portfolio of blockchain miners.

By buying and managing completely different software program node licenses you possibly can earn rewards from a number of asset lessons.

Earn rewards each day by way of the mining course of. You possibly can watch them roll in on the Rewards part of your dashboard.

Debt Field month-to-month web site visits, once more tracked by SimilarWeb for April 2024, sits at ~39,200 visits.

The vast majority of site visitors to Debt Field’s web site originates from Peru (20%), the US (14%, down 71% month on month) and India (10%).

As famous in SEC filings, Debt Field’s US founders have fled to Dubai. Their present standing is unknown.