![]() MproLab fails to offer possession or government data on its web site.

MproLab fails to offer possession or government data on its web site.

MproLab’s web site area (“mprolab.io”), was first registered in September 2022. The non-public registration was final up to date on June twelfth, 2023.

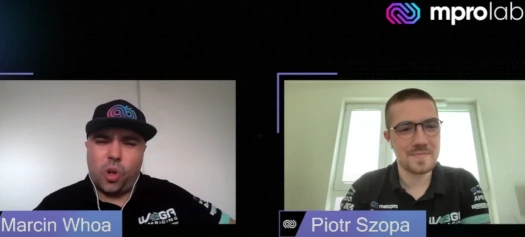

Whereas there are not any legally required disclosures on MproLab’s web site, its YouTube channel gives names we are able to connect to the corporate.

Marcin Whoa, Michal Bartczak and Piotr Szopa seem on MproLab “neighborhood lab” movies.

MproLab’s “neighborhood lab” movies started a month in the past on March eleventh.

On his LinkedIn profile Marcin Whoa, aka Marcin Wojcieszkiewicz, cites himself as a resident of Poland.

Whoa additionally cites himself as co-founder and COO of MetaPro, which seems to be connected to MproLab. So far as I can inform, Whoa is a random crypto bro with no prior MLM expertise.

Michal Bartczak and Piotr Szopa are additionally from Poland and connected to MetaPro as executives.

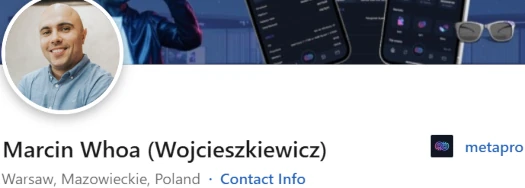

In researching the trio I additionally got here throughout a fourth title, serial Ponzi fraudster Martin Karus.

Karus has been selling MproLab and MetaPro on Twitter. He refers to each corporations within the possessive, suggesting an possession stake.

Karus (proper), additionally initially from Poland, has since fled to Dubai.

Karus (proper), additionally initially from Poland, has since fled to Dubai.

From Dubai Karus continues to defraud shoppers via varied MLM crypto Ponzi schemes.

The most recent MLM crypto Ponzi Karus has been selling is Xera, a mixture of three collapsed Dubai MLM crypto Ponzi schemes.

Collapsed MLM crypto Ponzi schemes Karus himself launched previously embrace TronCase and Monarch.

Because of the proliferation of scams and failure to implement securities fraud regulation, BehindMLM ranks Dubai because the MLM crime capital of the world.

BehindMLM’s tips for Dubai are:

- If somebody lives in Dubai and approaches you about an MLM alternative, they’re attempting to rip-off you.

- If an MLM firm relies out of or represents it has ties to Dubai, it’s a rip-off.

If you wish to know particularly how this is applicable to MproLab, learn on for a full evaluation.

MproLab’s Merchandise

MproLab has no retailable services or products.

Associates are solely capable of market MproLab affiliate membership itself.

MproLab’s Compensation Plan

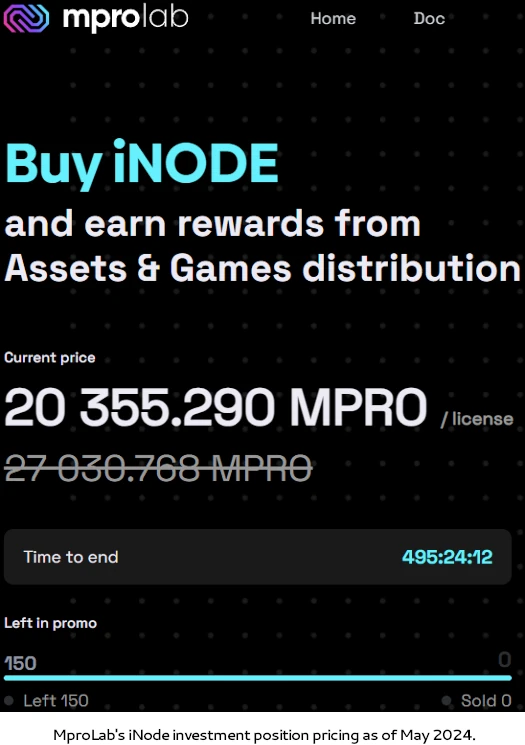

MproLab associates put money into iNode positions. That is accomplished on the promise of a every day passive return.

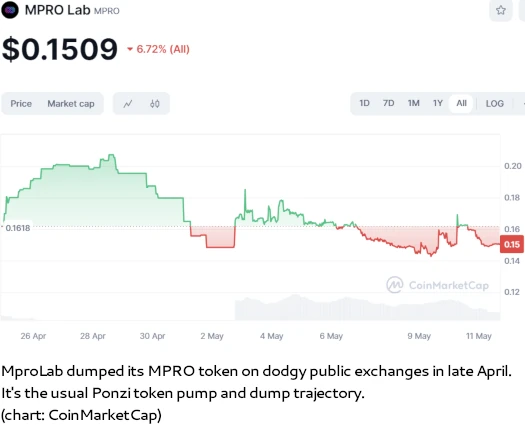

iNode positions and every day returns are paid in MPRO, a token MproLab created.

As of Might 2024 an iNode funding place prices ~27,015.869 MPRO, nevertheless reductions seem continuously accessible on MproLab’s web site.

The complete iNode funding quantity additionally appears to fluctuate, consistent with MPRO tokens declining public worth.

MproLab pays referral commissions on iNode positions invested in down three ranges of recruitment (unilevel):

- stage 1 (personally recruited associates) – 8%

- stage 2 – 4%

- stage 3 – 3%

Becoming a member of MproLab

MproLab affiliate membership is free.

Full participation within the connected earnings alternative requires buy of MPRO and funding into an iNode place.

MproLab Conclusion

MproLab is an easy MLM crypto Ponzi scheme.

New associates join, purchase MPRO (which MproLab sells them), after which invests MPRO into iNode funding positions.

MproLab pays a every day return to every investor in MPRO, which it generates on demand.

MPRO itself is an ERC-20 shit token.

These tokens will be created in a couple of minutes at little to no value.

Cashing out MPRO returns is feasible for so long as MproLab permits withdrawals.

As to the place that cash comes from;

As an iNODE supplier, you contribute to the soundness and effectivity of the Metapro protocol. In return on your companies, you obtain MPRO as compensation

MproLab has no verifiable supply of exterior income, which is after all an issue.

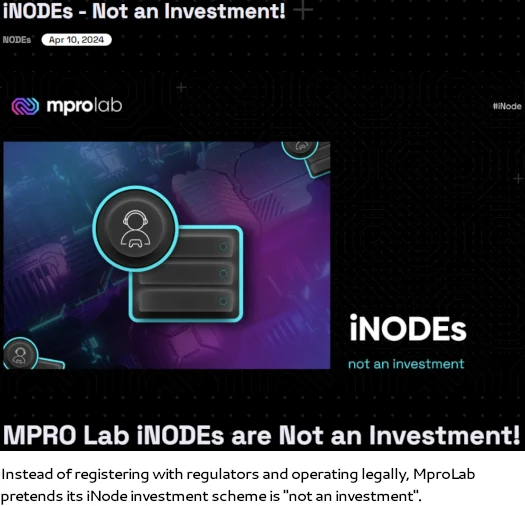

On the regulatory entrance MproLab’s iNodes funding scheme satisfies all prongs of the Howey Take a look at.

MproLab associates make investments with the corporate (a typical enterprise), “with the cheap expectation of earnings” (see quoted MproLab advertising spiel above), “derived from the efforts of others” (returns are purportedly generated and paid out by MproLab).

MproLab fails to offer proof it has registered its securities providing with regulators in any jurisdiction.

As of April 2024, SimilarWeb tracked prime sources of visitors to MproLab’s web site as Sweden (44%), Hungary (12%), India (7%), Finland (7%) and the Netherlands (5%).

Every of those nations has a regulated monetary market and by failing to register to supply securities, MproLab illegally solicits funding in every nation.

As an alternative of registering its securities providing with monetary regulators and working legally, MproLab pretends its iNode funding scheme isn’t an funding scheme.

Right here’s a related YouTube video from the SEC addressing corporations pretending their funding schemes aren’t funding schemes.

Whereas the SEC regulates securities fraud within the US, securities regulation is materially the identical in every nation with a regulated monetary market; both you’re registered otherwise you’re working illegally.

Because it stands, the one verified income getting into MproLab is new funding. Utilizing new funding to fund MPRO withdrawals would make MproLab a Ponzi scheme.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding.

It will starve MproLab of MPRO withdrawal income, finally prompting a collapse.

The mathematics behind Ponzi schemes ensures that after they collapse, nearly all of contributors lose cash.