What’s left of the Richard Smith’s Tranzact Card to FinMore grift has collapsed.

What’s left of the Richard Smith’s Tranzact Card to FinMore grift has collapsed.

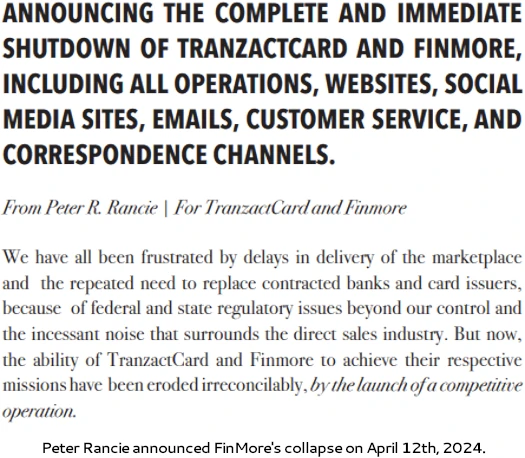

In an e mail despatched out a couple of hours in the past, frontman Peter Rancie “announc[ed] the whole and instant shutdown of TranzactCard and FinMore”.

Whereas Rancie (proper) “doesn’t blame” newly launched NeloLife for TranzactCard’s and FinMore’s “errors”, he does state the its launch is the rationale TranzactCard and FinMore had been unable “to attain their respective missions”.

Whereas Rancie (proper) “doesn’t blame” newly launched NeloLife for TranzactCard’s and FinMore’s “errors”, he does state the its launch is the rationale TranzactCard and FinMore had been unable “to attain their respective missions”.

Rancie attributes earlier TranzactCard and FinMore blunders, which given Richard Smith’s historical past ought to have and had been apparent, to “federal and state regulatory points past our management”.

Rancie additionally cites “the incessant noise that surrounds the direct gross sales business”, which because it pertains to TranzactCard and FinMore largely revolved round mentioned “federal and state regulatory points”.

BehindMLM coated TranzactCard and FinMore exhaustively, starting with our June 2023 TranzactCard evaluation.

Backside line? I’m not 100% on TranzactCard committing securities fraud however I’m smelling smoke. And that smoke is thick given Smith’s previous brushes with securities fraud.

Smith, who has a felony securities fraud conviction, solicited $495 funds from hundreds of “Digital Department Workplace” associates.

The solicitation was primarily based on quite a few misrepresentations, together with at one level the involvement of Donald Trump, Barack Obama, the RNC, DNC and LeBron James.

Following due-diligence into Smith, TranzactCard’s deliberate US banking providers had been terminated in September 2023. This marked the top of the enterprise, nonetheless solicitation of $495 DBO’s continued on guarantees of recent banking channels.

TranzactCard and FinMore named Bangor Financial institution as a substitute in the direction of the top of 2023, nonetheless this was promptly denied by the financial institution.

The deception continued by means of the announcement of FinMore, a reboot in identify solely. Richard Smith nonetheless owned father or mother firm TZT Holdings LLC.

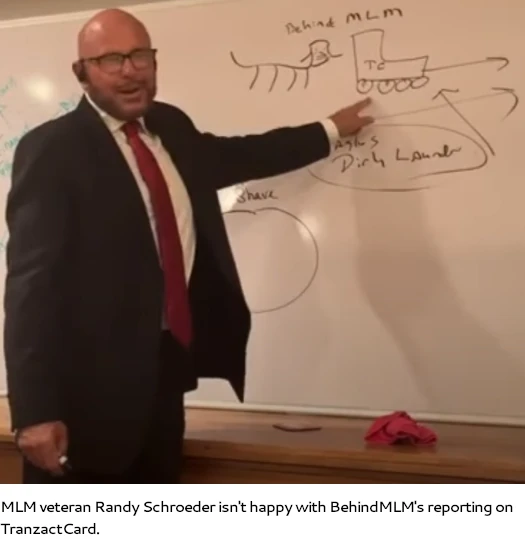

As occurs usually, BehindMLM obtained criticism for masking TranzactCard and FinMore. Notably, MLM veteran Randy Schroeder had a meltdown over our reporting in September 2023.

Characterizing BehindMLM as a “canine chasing a prepare”, Schroeder falsely claimed BehindMLM had been paid to report on TranzactCard and FinMore.

Schroeder was very public in spreading misinformation with respect to BehindMLM’s reporting. To one of the best of my data Schroeder has by no means publicly acknowledged this or taken accountability.

As a substitute, as TranzactCard and FinMore collapsed round him, Schroeder went on a “delete the proof” spree and commenced selling Nelo Life.

From the angle of FinMore and TranzactCard company, Right here’s Peter Rancie on Nelo Life;

The power of TranzactCard and Finmore to attain their respective missions have been eroded irreconcilably, by the launch of a aggressive operation.

On account of this final issue, most digital communications channels have been polluted with a social media civil struggle that’s nonetheless escalating.

Fairly than examine or accuse any particular person or group of people who could have based or migrated to this new competitor with crossrecruiting, or breaches of non-disclosure agreements, or different potential contract violations, each TranzactCard and Finmore will stop all operations instantly.

As a substitute of getting on with the work of TranzactCard, for many of 2024, the changeover to Finmore has taken priority. This migration was requested by the Area Management Council, not initiated by company.

The brand new, aggressive entity was swiftly created by, and promoted by, a lot of the identical leaders who had advocated shifting to Finmore. It was launched even earlier than Finmore had the prospect to launch its retailer and commissionable merchandise.

In hindsight, the final months of exercise have been a whole distraction on all fronts. It’s time to finish the social media civil unrest and the following mayhem. The social affect and industrial goals of TranzactCard and Finmore can’t be fulfilled on this setting.

Observe: The brand new, aggressive entity has by no means been a part of TranzactCard/Finmore. After all, there are a number of potential or precise conflicts of curiosity embedded in these happenings; the crossover actions of sure subject leaders, the crossover of authorized counsel, and the crossover of the expertise crew, to call a couple of.

Whereas all of this stuff are topic to additional consideration by outisde [sic] authorized counsel, no accusation is made herein.

Nelo Life emerged as an try to “money seize” what was left of TranzactCard and FinMore’s promoters final month.

The FinMore “leaders” Rancie cited as creating FinMore are Nick Sorensen, Eric Allen and Larry Lane.

Orkan Arat is the fourth Nelo Life co-founder, nonetheless this info was initially hidden from customers.

Rancie mentioning “the crossover of the expertise crew” suggests Arat could have additionally been concerned in TranzactCard and FinMore.

Evaluation of Nelo Life’s compensation plan noticed BehindMLM elevate issues it was a pyramid scheme. As extra about Nelo Life’s enterprise mannequin got here to gentle, we later expressed securities fraud issues.

This prompted a response from Eric Allen on March thirty first. Whereas Allen acknowledged he “truly agree[s] with the overwhelming majority of” BehindMLM’s analysis, what we’d printed about Nelo Life was “utterly unfaithful”.

This echoed criticism BehindMLM had beforehand obtained over our TranzactCard and FinMore reporting.

Following TranzactCard and FinMore’s collapse, Peter Rancie states there “shall be no additional correspondence from both entity”.

Richard Smith cashed out and rode off into the sundown final 12 months. Because it stands we don’t understand how a lot Smith misappropriated from customers by way of misleading advertising and misrepresentations.

What we do know is at the very least 48,000 bank cards had been filed with TranzactCard and FinMore. At $25 and $495 a pop, this probably resulted in a windfall working effectively into the thousands and thousands.

Pending any additional updates, we’ll hold you posted.