Regardless of denials by distributors, proof suggests FinMore is actually a duplicate and paste reboot of TranzactCard.

Regardless of denials by distributors, proof suggests FinMore is actually a duplicate and paste reboot of TranzactCard.

To this point I’ve heard two cover-ups with respect to FinMore simply being TranzactCard “we wanted a brand new identify to dupe banks” 2.0.

Shortly after BehindMLM lined TranzactCard’s collapse, we had a distributor declare FinMore was a “merger”.

I’m not seeing something that means TranzactCard collapsed. This can be a merger with a wholly totally different firm.

FinMore’s web site area registration was final up to date on January thirty first 2024. We will see by way of the WayBack machine that the area has been on the market for a number of years prior.

Lengthy story quick, FinMore didn’t exist till a couple of week in the past so pretending it was some current third-party entity that merged with TranzactCard is foolish.

The second cover-up got here from Randy Schroeder, who claims FinMore is “licensing expertise” from TranzactCard.

Following the FinMore reveal, Schroeder held a livestream to clarify the reboot as he understood it.

After confirming Richard Smith lied about TranzactCard, and “proudly owning” that he parroted these lies…

[1:48] It’s completely the truth that [Richard Smith] mentioned some issues which I then repeated [which] wound up not being correct, I personal that. I don’t blame Richard for that.

[3:01] “However Randy you advised me that I might go on the market and get thirty-nine accounts. And on account of getting thirty-nine accounts I might make $150,000 a 12 months within the bonus pool.”

“Randy, you advised me I solely needed to change into a Supervisor and that solely meant I needed to be a DBO and enroll three individuals who did the identical, and that might make me $6000 a 12 months.”

I can not let you know how a lot I want that this image had been an correct and true and proper image.

We now know, as a complete group, this isn’t an correct and proper and true image.

We additionally know that the gentleman who delivered this image … the one who crafted this message that wound up not being a legitimate message, the individual that crafted the message “we could have 100 million playing cards in individuals’s fingers by the top of the primary quarter within the influencer program”, all, actually the entire issues that have been mentioned wound up not being 100% correct, have been mentioned by an individual who’s not a part of our firm.

In actual fact was by no means part of FinMore.

…Schroeder trotted out his licensing clarification.

[4:55] What precisely and particularly has occurred, so that you all know, is there was a licensing of expertise.

So over right here we have now an organization that is named TranzactCard. TranzactCard continues to exist, it must live on. Why?

As a result of if TranzactCard doesn’t live on, then it will be far too straightforward and in reality logical to say, “Effectively FinMore is simply TranzactCard with a special identify”.

And if FinMore is simply TranzactCard with a special identify, and the first one who is chargeable for the misinformation that led us to a degree of … a substantial amount of concern and misunderstanding, there needed to be an entire complete and absolute break between these two firms.

And so no, FinMore will not be merely a rebranding of TranzactCard.

The instant drawback with Schroeder’s “licensing” clarification is that who then owns FinMore hasn’t been publicly disclosed.

TranzactCard downlines being preserved and carried over seamlessly into FinMore additionally raises questions.

For Richard Smith to not be concerned in FinMore presumably the TranzactCard DBO database was offered to individuals unknown. Firstly why are they unknown, and secondly why did this occur with out consent of TranzactCard’s DBOs?

Alternatively if FinMore is in actual fact “simply TranzactCard with a special identify”, stating in any other case is a continuation of the admitted deception Smith began when TranzactCard launched.

Because it stands there may be completely nothing to counsel a licensing settlement between TranzactCard and FinMore. This begins with who owns FinMore and public acknowledgement of a licensing contract between Richard Smith and a third-party.

If this consists of DBO private particulars, acknowledging and disclosing this info is essential.

With respect to FinMore being “simply TranzactCard with a special identify”, compelling proof exists to make that case.

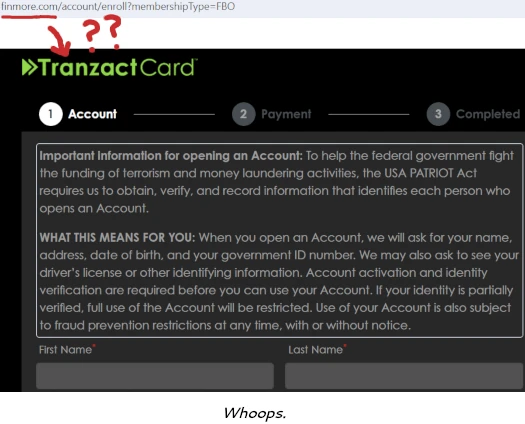

Presently, signing up as a FinMore FBO presents a really acquainted TranzactCard branded type:

If FinMore is a totally seperate (albeit new) firm that has nothing to do with TranzactCard, why is that this the case?

“As a result of FinMore is licensing TranzactCard’s tech you jackass!”

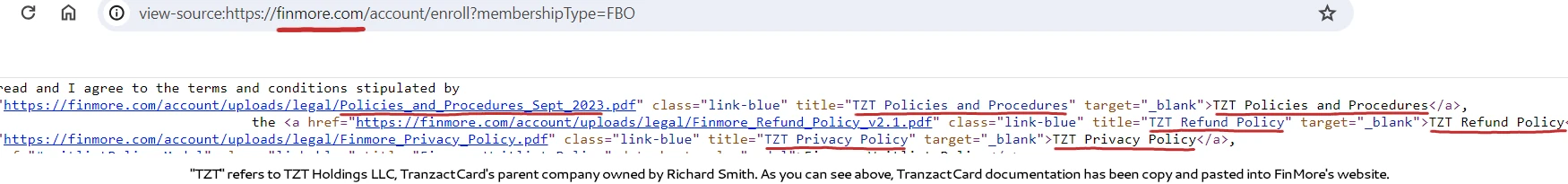

Oh, proper. Effectively then how come there’s references to TranzactCard’s Insurance policies and Procedures in FinMore’s web site source-code, backdated to September 2023?

(click on to enlarge):

I feel it’s fairly apparent, even right down to the web site code, that FinMore is “simply TranzactCard with a special identify”. That is literal copy and paste with totally different branding.

Why does that matter? The entire cause FinMore was created was to faux Richard Smith doesn’t personal the corporate in order that US banks could be duped into offering TranzactCard/FinMore monetary companies.

With out mentioned companies, TranzactCard DBOs who signed up for $495 have been completely bait and switched.

Pending FinMore disclosing who owns it or a licensing settlement with named events turning up, we’ll hold you posted.