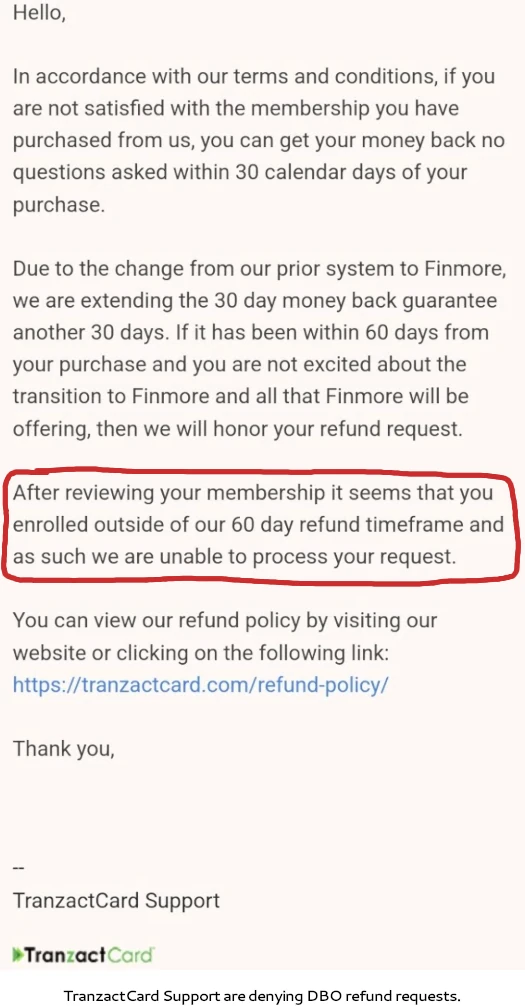

TranzactCard DBOs who had been duped into paying $495 are being denied refunds.

TranzactCard DBOs who had been duped into paying $495 are being denied refunds.

As a part of TranzactCard rebooting as FinMore, DBOs had been advised they’d be entitled to refunds. This declare has been publicly parroted by promoters of the scheme.

Whereas TranzactCard DBO refunds can be found in some situations, sadly there’s a serious catch.

By now it’s fairly clear anybody who signed up as a TranzactCard DBO primarily based on the advertising has been bait and switched.

If we glance again on TranzactCard’s unique providing, potential DBOs had been pitched on

- a TranzactCard VISA card

- Z-Bucks value $1 in Z-Membership and earned 1:1 per greenback spent with the TranzactCard VISA card

- entry to Z-Membership, populated with “on a regular basis objects, luxurious objects and even trip packages”

- entry to a Energy Save Account that gives a “fastened rate of interest larger than any financial institution you’ve ever seen”, funded by spending of Z-Bucks in Z-Membership and use of the TranzactCard VISA card

FinMore as a substitute gives entry to Flourish subscriptions, providing reductions to numerous third-party service suppliers.

In the event you’re pleased with what FinMore gives regardless of what you mgith have been pitched on with TranzactCard, extra energy to you.

Logically although (and legally), anybody who signed up for $495 primarily based on what TranzactCard was pitching ought to be entitled to a refund.

As an alternative, when one BehindMLM reader reached out for a refund, TranzactCard help advised them they weren’t legible.

Regardless of the plain bait and change, TranzactCard is sticking to its said refund coverage.

Stated refund coverage locks a TranzactCard DBO out of a refund if 30 days have handed. FinMore has prolonged that interval by one other 30 days, however this explicit DBO nonetheless falls outdoors that vary.

Is that this cheap?

FinMore was revealed on February third, 2024. If we dial the clock again 60 days, we arrive at December fifth, 2023.

To recap, at the moment TranzactCard was nonetheless signing up DBOs primarily based on their unique advertising representations.

TranzactCard did lose their US banking providers in September, however figured they’d be capable of dupe banks by pretending Richard Smith didn’t personal the corporate by having him “resign” in November (observe Smith nonetheless owns TranzactCard and is believed to additionally personal FinMore).

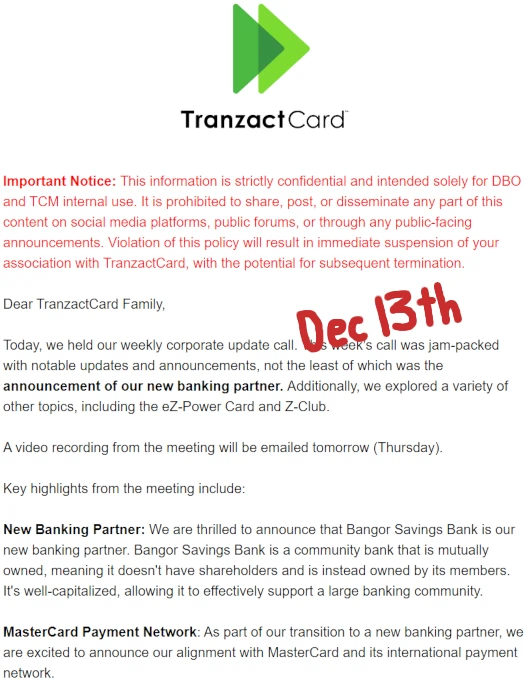

On December thirteenth, TranzactCard introduced Bangor Financial institution as its new banking companion.

That is actually per week into the sixty-day FinMore bait and change refund deadline.

However Bangor Financial institution happening to disclaim partnership with TranzactCard, throughout this time DBOs had been very a lot being recruited on TranzactCard’s unique and ongoing advertising representations.

These DBOs paid $495 and are actually being advised, even when none of TranzactCard’s unique advertising representations apply to FinMore, they aren’t entitled to refunds.

Overlook about potential legalities and FTC Act violations, how do you justify that as moral?

In the event you prelaunch an MLM firm, cost individuals $495 for months after which bait and change, the naked minimal you have to be doing is providing a full refund to anybody you duped.

Regardless of the underlying causes are for you fully failing to ship what individuals purchased into, you don’t simply to maintain the cash. That’s fraud.

If I needed to guess, TranzactCard DBO recruitment in all probability peaked across the time they misplaced their US banking providers.

Within the wake of shedding US banking providers, TranzactCard company had been adamant they’d be fast to interchange the misplaced companions. Little question these deceptive representations inspired new DBOs to proceed signing up, regardless of the plain obtrusive crimson flags.

With every passing day TranzactCard’s prolonged 60-day refund window cuts increasingly DBOs off from a refund.

The entire variety of bait and switched TranzactCard DBOs ineligible for a refund is unknown.