HyperFund co-founder Sam Lee and promoter Brenda Indah Chunga have been charged by the SEC.

HyperFund co-founder Sam Lee and promoter Brenda Indah Chunga have been charged by the SEC.

The SEC cites HyperFund as a ~$1.7 billion greenback Ponzi scheme. This tracks with BehindMLM’s HyperFund overview, printed again in 2021.

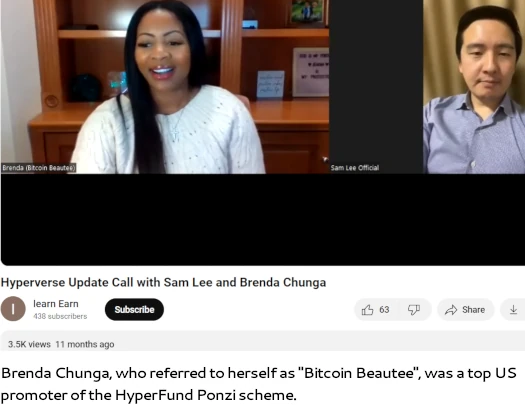

Lee, an Australian nationwide who fled to Dubai in 2021, and Chunga, aka Bitcoin Beautee, have been charged with a number of violations of the Securities Act.

HyperFund operated underneath the banner of HyperTech, an organization Lee co-founded with Ryan Xu (aka Zijing Xu).

Chunga, a US nationwide residing in Maryland, was a high HyperFund promoter. The SEC cited Chunga as “arguably the face of [HyperFund’s] United States presence”.

Chunga ultimately turned certainly one of solely six “company” presenters for HyperFund, and certainly one of solely two within the U.S.

The ruse behind HyperFund’s Ponzi scheme was cryptocurrency mining.

As revealed within the SEC’s January twenty ninth filed Criticism;

Lee was a co-founder of HyperTech Group, which claimed to be concerned in “Massive Scale Crypto Mining,” together with bitcoin, that promoters asserted was a key income supply for HyperFund.

Nevertheless, Lee later admitted that HyperTech Group was not engaged in large-scale bitcoin mining.

HyperFund had no actual income aside from funds obtained from traders. HyperFund … was a pyramid and Ponzi scheme.

In the end, the scheme collapsed in 2022 when traders had been not capable of make withdrawals

As per US legislation, HyperFund’s passive returns funding scheme constituted a securities providing.

HyperFund’s membership packages had been provided and offered as funding contracts, and subsequently, securities underneath the federal securities legal guidelines, as a result of traders made an funding of cash in a typical enterprise with an affordable expectation of earnings from the efforts of Defendants or third events.

The membership packages had been provided and offered with out registration, and with out qualifying for any exemption from registration.

The SEC doesn’t disclose how a lot Lee personally stole by HyperFund.

Chunga is accused of encouraging others to lose “no less than $5 million” in HyperFund. She can also be personally accused of stealing “over $3.7 million”.

[Chunga] used her earnings to fund extravagant private bills and assist recruit others into the scheme by displaying off the potential wealth to be earned by HyperFund.

Amongst different issues, Chunga spent that cash on a lavish party that doubled as a HyperFund recruitment occasion, in addition to costly custom-made jewellery and clothes, a BMW, designer purses, a $1.2 million residence in Severna Park, Maryland, and a $1.1 million condominium in Dubai.

To encourage new recruits to enroll and lose cash, Chunga falsely boasted she was stealing “over $5 million a 12 months” by HyperFund.

A lot of the cash Chunga stole was by HyperFund’s Ponzi scheme. A few of it although was straight stolen from HyperFund victims Chunga recruited.

Chunga typically accepted U.S. foreign money straight from traders who transferred funds to her private checking account through examine or wire.

Chunga charged these victims a 1% to three% payment for accepting their cash. These charges totalled $1.1 million alone.

Whereas Ryan Xu is cited within the SEC’s Criticism as “Founder B”, fees in opposition to him are conspicuously absent.

Xu additionally seems to have dodged legal fees, following Lee’s and Chunga’s respective HyperFund indictments.

One chance is that Xu was only a frontman.

Lee was not solely a co-founder of HyperFund, however he maintained management over HyperFund all through its existence.

Both manner, Xu hasn’t been seen in public since fleeing to Dubai. His present whereabouts and standing stay unknown.

With respect to its civil fraud fees filed in opposition to Lee and Chunga, the SEC is looking for a everlasting injunction, disgorgement of ill-gotten features and a civil financial penalty.

As per a January twenty ninth press-release from the SEC, Chunga has already settled filed civil fraud fees in opposition to her.

Chunga agreed to settle the fees, to be completely enjoined from future violations of the charged provisions and sure different exercise, and to pay disgorgement and civil penalties in quantities to be decided by the court docket at a future date.

In her parallel legal proceedings, Chunga additionally pled responsible to conspiracy to commit securities and wire fraud.

BehindMLM is monitoring each legal and civil HyperFund proceedings. Keep tuned for updates.