Warren Finance fails to offer possession or government data on its web site.

Warren Finance fails to offer possession or government data on its web site.

In a corresponding GitBook, Warren Finance claims the “masterminds” behind the scheme are people who go by “Moonshot Max”, “Math” and “Nomad”.

Solely Telegram person accounts are supplied as factors of contacts for these people. That is a right away crimson flag.

Moonshot Max has a YouTube channel and, a minimum of based mostly on his accent, seems to be a US nationwide.

MoonShot Max makes use of his YouTube channel to advertise varied fraudulent crypto funding schemes. Notable is Drip Community, which has collapsed and been rebooted quite a few occasions.

Warren Finance’s web site area (“warren.finance”), was privately registered on November tenth, 2023.

As all the time, if an MLM firm is just not brazenly upfront about who’s operating or owns it, suppose lengthy and laborious about becoming a member of and/or handing over any cash.

Warren Finance’s Merchandise

Warren Finance has no retailable services or products.

Associates are solely in a position to market Warren Finance affiliate membership itself.

Warren Finance’s Compensation Plan

Warren Finance associates make investments DAI on the promise of an marketed 2% day by day ROI, capped at 175%.

A 0.05% conditional bonus applies to the next incentives:

- don’t withdraw

- make investments 153,129 DAI

A further 0.1% bonus is applies for each 4,287,612 DAI invested into Warren Finance.

Warren Finance differs from a typical MLM compensation plan in that, whereas commissions are solely paid down one degree of recruitment, qualification makes use of a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the prime of a unilevel crew, with each personally recruited affiliate positioned straight below them (degree 1):

If any degree 1 associates recruit new associates, they’re positioned on degree 2 of the unique affiliate’s unilevel crew.

If any degree 2 associates recruit new associates, they’re positioned on degree 3 and so forth and so forth down a theoretical infinite variety of ranges.

Warren Finance makes use of 5 ranges of the unilevel crew to calculate referral commissions.

Referral commissions are tiered between 2.5% and 10% of DAI invested by personally recruited associates.

Observe that Warren Finance don’t disclose required downline funding quantity to progress from 2.5% to 10%.

Becoming a member of Warren Finance

Warren Finance affiliate membership is free.

Full participation within the connected earnings alternative requires funding in DAI.

Warren Finance

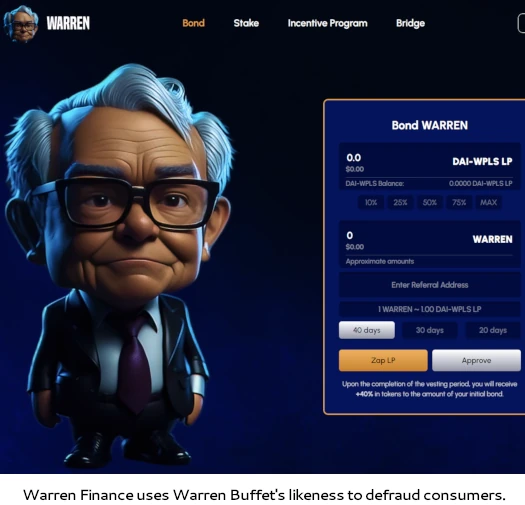

Warren Finance markets itself by way of the unauthorized use of Warren Buffet’s likeness.

That is no completely different to crypto scams that misappropriate well-known people to advertise themselves (Elon Musk being an apparent instance).

On the regulatory entrance Warren Finance is a mixture of securities fraud, wire fraud and cash laundering.

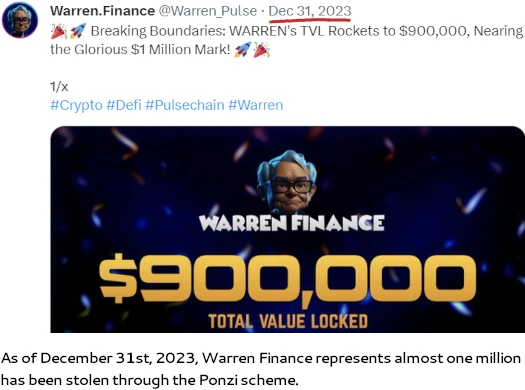

(cash stolen)

With “Moonshot Max” showing to be a US nationwide Warren Finance falls below the jurisdiction of the SEC. A search of the SEC’s Edgar database reveals Warren Finance isn’t registered.

The explanation Warren Finance isn’t registered and operates illegally is as a result of it’s a Ponzi scheme.

Funding from new Warren Finance victims is stolen by Moonshot Max, his co-conspirators and early buyers.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding.

This can starve Warren Finance of ROI income, finally prompting a collapse.

The maths behind Ponzi schemes ensures that once they collapse, the vast majority of individuals lose cash.

As with Drip Community and its DRIP token, Warren Finance runs its Ponzi scheme by way of WARREN token.

WARREN a PRC-20 shit token. Like different blockchain equivalents (ERC-20, TRC-20 and many others.), these will be arrange in a couple of minutes at little to no value.

When Warren Finance inevitably collapses, buyers might be left bagholding nugatory WARREN tokens they will’t money out.

It ought to additional be famous that PRC-20 tokens are created on PulseChain. PulseChain is owned by Richard James Schueler (aka Richard Coronary heart).

In July 2023 Schueler was sued by the SEC for misappropriating “a minimum of $12 million” from customers.

PulseChain is a part of a broader crypto asset scheme that has already defrauded customers out of over $1 billion.