UK authorities investigating the collapsed CashFX Group Ponzi scheme have accomplished their investigation.

UK authorities investigating the collapsed CashFX Group Ponzi scheme have accomplished their investigation.

Essex Police have opted to drop the case, owing to there being “no proof anybody within the UK has dedicated legal offenses”.

Information of Essex Police investigating CashFX Group broke again in August. On the time Essex Police had been soliciting data from CashFX Group victims, as a part of “Operation Hent”.

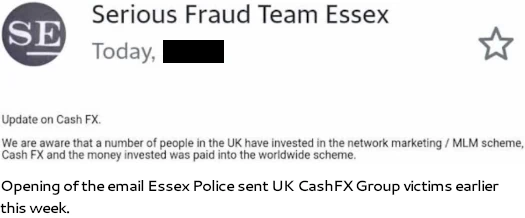

As per an e-mail despatched out to those self same victims earlier this week;

We’re conscious that quite a lot of individuals within the UK have invested within the community advertising and marketing / MLM scheme, Money FX and the cash invested was paid into the worldwide scheme.

We have now accomplished quite a few enquiries and presently we aren’t conscious, neither is there any prima facie proof to assist allegations that anybody within the UK has dedicated legal offenses, nonetheless we might counsel that sure ethics inside the scheme are questionable, together with the enterprise mannequin.

Essex Police’s investigation seems to have been restricted to operation of CashFX Group.

The community advertising and marketing / MLM scheme is situated outdoors of the UK and the method is cyber enabled, this presents cross bounder [sic] jurisdiction points.

Whereas it’s true CashFX Group had no bodily operations within the UK, when it launched again in 2019, CashFX Group falsely claimed it was “regulated by (the) Monetary Conduct Authority of London” (FCA).

The FCA would go on to challenge a CashFX Group securities fraud warning in December 2019. Past that, the FCA categorically refused to research CashFX Group in 2021.

CashFX Group was additionally overtly promoted throughout the UK by native promoters; James Curtis, Richard Maude Martin Orena, Donal McCrossan, Emmanuel Kuye, Roy J. Maurice, Lee Oshea, Brian Chittick, Neil Slinn and Jojar Dhinsa come to thoughts.

Within the US promoters of Ponzi schemes face civil and legal wire fraud, securities fraud and cash laundering costs.

Talking of the US, Essex Police counsel they’re deferring to US authorities.

We have now liaised with worldwide Legislation Enforcement companions within the US, they’ve an curiosity within the working mechanics of the scheme and sure enablers with vital management of the corporate.

Nothing additional with respect to a US investigation into CashFX Group is disclosed. Regardless it seems to be a repeat of OneCoin.

Following their very own legal investigation, UK authorities shamelessly introduced they had been leaving it as much as the US to wash up OneCoin in 2019.

Even then issues haven’t gone easily. Not too long ago the UK refused to extradite two OneCoin cash launderers to the US.

This adopted the seizure and return of £30 million in stolen cash to one of many needed suspects in 2017.

Opting likewise to show a blind eye to CashFX Group associated fraud within the UK, Essex Police shut their e-mail by stating;

Our place within the UK will stay the identical except we obtain additional data or proof of legal offences being dedicated within the UK.

To the continued detriment of their victims, what it takes to get MLM Ponzi scammers arrested within the UK stays a thriller.