The SEC has been ordered to elucidate why it shouldn’t be sanctioned within the ongoing Debt Field & iX World case.

The SEC has been ordered to elucidate why it shouldn’t be sanctioned within the ongoing Debt Field & iX World case.

As famous by the courtroom, on the listening to to dissolve the TRO (the TRO was dissolved in October),

the courtroom highlighted a number of of the Fee’s representations supporting the TRO Utility the courtroom believed had been false or deceptive.

The misrepresentations pertain to this point ranges Debt Field started transferring investor funds exterior of the US.

In help of their ex-parte movement requesting a TRO, the SEC alleged;

Proof obtained by the Fee, and set forth within the Fee’s [TRO Application] signifies that Defendants are presently within the technique of making an attempt to relocate property and investor funds abroad, the place no less than Defendant Jacob Anderson has contended that these property will likely be exterior the attain of U.S. regulators.

Financial institution data obtained by the Fee . . . present that on June 26, 2023, Defendant iX World, LLC—the multi-level-marketing entity by way of which the Defendants’ ‘node licenses’ are primarily promoted—started closing its financial institution accounts in america, and eliminated over $720,000 in putative investor funds from these accounts.

To additional help their movement, the SEC additionally alleged iX World had closed financial institution accounts.

In June, Defendants started to liquidate investor funds and transfer operations abroad.

On June 26, 2023, Defendant iX World . . . closed its fundamental accounts with Financial institution of America and cashed out over $720,000 in putative investor funds.

In the meantime, DEBT Field’s principals declare DEBT Field is within the technique of shifting its operations to the United Arab Emirates for the specific function of evading the federal securities legal guidelines.

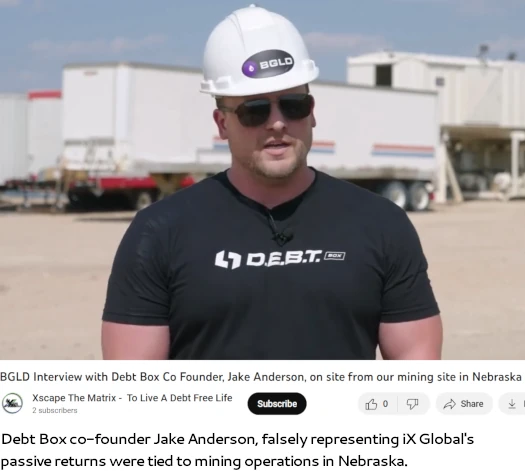

For example, in a June 14, 2023, promotional video posted on YouTube, Defendant Jacob Anderson claimed Defendants “have moved all of [DEBT Box’s] operations to Abu Dhabi,” in order to “be underneath the jurisdictional management of Abu Dhabi, not the SEC.

Defendants have additionally taken motion to dam SEC investigative employees from viewing their social media websites, and seem to have

not too long ago deleted an internet site containing coaching supplies for the scheme’s promotors [sic].

Throughout the ex-parte proceedings main as much as the unique order granting the TRO, the SEC famous “round 33 financial institution accounts” had been closed inside a 48 hour interval.

The courtroom understood this to imply Defendants had closed 33 financial institution accounts within the final 48 hours.

Of their movement to dissolve the TRO, Debt Field claimed it “didn’t have any account closures in July 2023.”

They offered paperwork exhibiting the closed accounts belonging to them or DEBT Field—13 accounts whole—closed by January 2023

9 of these accounts had been closed by banks (not Defendants), together with the accounts closed in January 2023.

As to the opposite 4 accounts, it’s unclear who initiated the closures, however they occurred in August 2021 and January 2022.

Debt Field additionally argued that Anderson’s statements about “keep away from[ing] SEC jurisdiction” had been taken out of context.

Debt Field asserted it had already begun avoiding US regulation by transitioning to the UAE in Might 2022, properly earlier than the SEC’s requested TRO.

Versus Debt Field committing securities fraud after which transferring the proceeds of stated fraud offshore, it’s the checking account closure dates offered by the SEC in help of their TRO that the courtroom is hung up on.

First, the Fee tacitly acknowledged there was no proof DEBT Field or the DEBT Council Defendants closed accounts in July 2023.

At no level in its Opposition did the Fee acknowledge (the SEC lawyer’s) assertion that “within the final 48 hours Defendants have closed extra financial institution accounts.” Nor did it present proof to help that assertion.

The dates for the UAE transfer can be a difficulty.

Second, the Fee argued DEBT Field’s transfer to Abu Dhabi was ongoing and had not completed in Might 2022.

With respect to the iX World checking account closed in June 2023;

The iX World Defendants defined the financial institution closed these accounts with out enter from iX World.

In addition they cited an Exhibit from the Fee’s TRO Utility exhibiting the $720,000 from the closed accounts was deposited right into a Mountain America Credit score Union account (i.e., not despatched abroad).

In response, the Fee acknowledged the iX World Defendants didn’t shut the accounts however faulted them for not offering “any proof” the funds “had been preserved.”

The Fee didn’t present proof iX World moved the $720,000 abroad after depositing it into the Mountain America Credit score Union account.

Nor did it acknowledge that when it requested the TRO, it had cause to know iX World deposited the $720,000 right into a home account.

This brings us to the order to point out trigger.

Given the extraordinary energy conferred by the TRO, the courtroom is conscious of the way it was obtained.

From November thirtieth, the SEC has fourteen days to elucidate why sanctions shouldn’t be ordered in opposition to it for the above “misrepresentations”.

It needs to be famous that the courtroom connected the next assertion to its November thirtieth order;

The courtroom cautions that though it denied the Commissions request for extraordinary aid, it isn’t presently ruling on the deserves of the Fee’s claims.

I’m sort of curious what sanctions the SEC could be dealing with if the courtroom ordered them. Hopefully they don’t jeopardize the case (I don’t see that being seemingly).

If the sanctions are a monetary penalty, that’s one thing whoever is in command of these items internally to look at and take care of.

In the meantime as soon as we transfer previous this, the case will proceed. “Yeah we did the stuff, we simply did it sooner than the SEC claims” isn’t a authorized protection to the broader alleged fraudulent conduct.

Clearly there was makes an attempt to violate and proceed to violate US securities legislation by shifting enterprise operations and investor funds offshore. And that’s one thing hopefully Debt Field and iX World will reply for.

Past potential SEC sanctions, a Joint Standing Report is due by January third, 2024. A Standing Convention has been scheduled for January seventeenth.