GSPartners and proprietor Josip Heit are named respondents in a brief stop and desist order, issued by the Arizona Company Fee (ACC).

GSPartners and proprietor Josip Heit are named respondents in a brief stop and desist order, issued by the Arizona Company Fee (ACC).

Following an inner investigation into GSPartners and Heit, the ACC decided “public welfare requires rapid motion”.

The Securities Division, in coordination (with) different regulatory businesses from the US and Canada, is coming into this Non permanent Order to Stop and Desist to cease the events from inflicting rapid and irreparable public hurt.

As per the ACC’s November sixteenth order;

Swiss Valorem Financial institution Ltd.; GSB Gold Normal Company AG; and GSB Gold Normal Pay Ltd. appearing beneath the model GSDeFi; Josip Heit; and Tannisha Glaspie are participating in or are about to have interaction in acts and practices that represent violations of the Arizona Securities Act.

ACC cites Heit (proper) as “an individual controlling” GSB Gold Normal Company AG and GSB Gold Normal Pay Ltd., making him

ACC cites Heit (proper) as “an individual controlling” GSB Gold Normal Company AG and GSB Gold Normal Pay Ltd., making him

collectively and severally liable … for his or her violations of the antifraud provisions of the Securities Act.

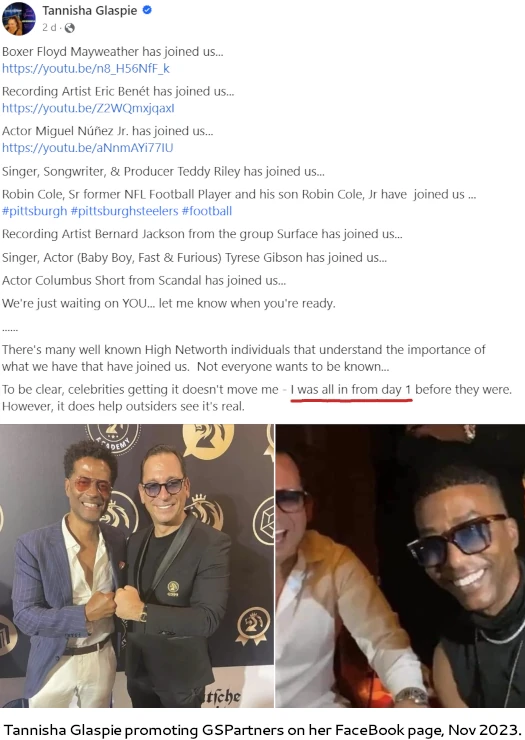

Tannisha Glaspie, an “single Arizona resident”, is a GSPartners promoter who who claims she’s been “all in from day 1”.

Glaspie, who refers to herself as “The Gold Physician”, promotes GSPartners via her YouTube channel, Instagram account and the web site “Optimistic Farm”

Citing a latest October thirty first GSPartners webinar, ACC quotes Glaspie as claiming;

I haven’t wanted a job in years due to this. My 24-year-old daughter hasn’t wanted a job both as a result of she’s listening.

We don’t must share this data with anybody. We select to. It will be egocentric to maintain it to your self.

On FaceBook Glaspie cites herself as a colon hydrotherapist and barber.

ACC describes GSPartners as an “exploitative funding scheme”, requiring its enterprise mannequin to be “continuously evolving and repackaged into a brand new providing”.

GSPartners has been participating in a global scheme to illegally supply and promote fraudulent investments tied to a metaverse, liquidity swimming pools, staking platforms, and digital property that may purportedly yield extremely profitable returns the place earnings are allegedly generated through international alternate (foreign exchange) buying and selling, real-estate, and renewable power.

It’s scheme is being pushed by a global confederation of multilevel entrepreneurs which have collectively earned round $11 million in commissions and purported promotions from athletes reminiscent of retired skilled boxer Floyd Mayweather.

The ACC’s investigation left them unable to confirm GSPartners’ exterior income claims, leaving new funding as the one supply of generated income.

Regardless of the promise of extremely profitable returns and the cost of great commissions, GSPartners is concealing key data from the general public, together with data related to its capitalization, its use of principal, and the way in which it really generates adequate income to pay earnings and canopy compensation.

It’s unclear how earnings are generated by GSPartners’ alleged buying and selling in foreign exchange, real-estate, or renewal [sic] power. Fairly, buyers make cash via a referral rewards program by turning into promoters.

Thus, buyers are incentivized by recruiting new buyers and promoting memberships as a result of their earnings are tied to the downline.

GSPartners solicits funding on the promise of as much as 5% every week. No exterior income would in fact make GSPartners a Ponzi scheme.

BehindMLM reviewed and has been reporting on GSPartners since 2021. This has resulted in retaliatory authorized motion filed within the New York Supreme Court docket.

GSPartners’ retaliatory authorized motion in opposition to BehindMLM is cited in ACC’s order;

On the authorized web page of the GSPartners International Web site, there’s additionally a bit titled “Defamation and Disinformation,” the place GSPartners claims “Attributable to present ongoing authorized motion in opposition to a gaggle of criminals … our authorized staff, together with the Model and Relationship Administration staff, have issued directions to suspends [sic] the accounts of the small variety of offending members who’re working with the criminals to additional their trigger”.

The “criminals” referred to by GSPartners are the homeowners of a web site known as BehindMLM.

BehindMLM has been posting details about GSPartners which incorporates allegations that GSPartners via Swiss Valorem Financial institution, GSB Gold Normal Company, and different associated GSPartners firms are operating a Ponzi scheme.

On or about December 20, 2022, GSPartners filed a lawsuit within the State of New York in an try to silence the cliams made by BehindMLM.

ACC additionally cites GSPartners’ Code of Ethics” as a way to “preemptively management detrimental feedback in regards to the firm”, in addition to a Virginia lawsuit filed in opposition to Chris Saunders in late 2021.

The measure described above demonstrated GSPartners’ impudent makes an attempt to silence tales and accounts about its enterprise operations as a fraud or Ponzi scheme.

One other level of word in ACC’s order is GSPartners’ purportedly mendacity about Swiss Valorem Financial institution being “absolutely regulated”.

On each the Swiss Valorem Financial institution and GSB International Web sites, they declare Swiss Valorem Financial institution is a sort of financial institution that’s “absolutely regulated”, with a category personal banking license of L11863, and a registration variety of 11863.

Nevertheless, there isn’t a clarification (of) which regulatory physique that license quantity is registered to.

Each web sites additionally declare they’re registered with the Republic of Kazakhstan for digital cost processing beneath the identify IBBP Pay Companies LTD with a BIN variety of 210440025439.

Nevertheless, a search carried out of the digital licensing web site maintained by the Republic of Kazakhstan produces no outcomes.

A search of the personal banking license of L11863 and registration variety of 11863 on Kazakhstan’s e-License Web site produces outcomes that don’t seem like associated to Swiss Valorem or any GSPartners associates.

GSPartners claimed “A-Class banking license” can be known as into query.

On the Gold Normal Web site, GSPartners additionally claims they’ve an “A-Class banking license” beneath one other affiliate firm known as GSB Gold Normal Financial institution LTD, registered and licensed with Mwali, an island off the coast of Africa.

The Mwali Worldwide Service Authority (MISA) is a regulatory physique that supervises the monetary sector in Mwali.

MISA has a web site the place the general public can analysis firms, and on the MISA web site, GSB Gold Normal Financial institution LTD is listed on their web page title “Corporations in liquidation”.

Moreover, GSB Gold Normal Financial institution LTD just isn’t a presently lively firm in Mwali.

BehindMLM documented GSPartners’ Mwali shenanigans in July 2021.

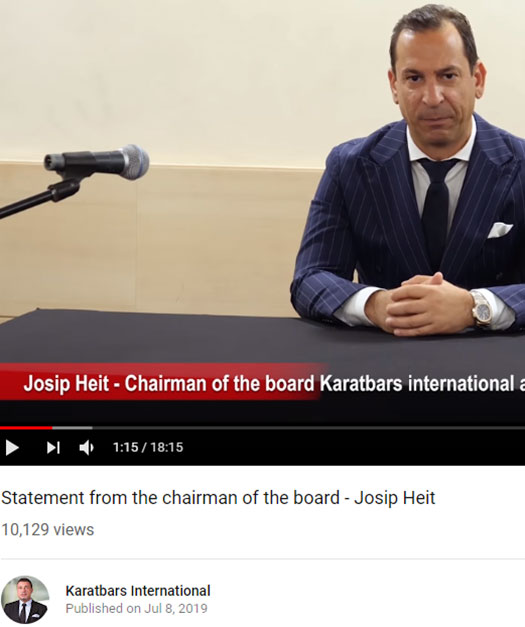

Previous to GSPartners, Josip Heit was Chairman of the Board at Karatbars Worldwide.

Heit and his staff oversaw Karatbars’ transition to cryptocurrency fraud, which resulted in catastrophe mid 2019. This was the precursor to GSPartners.

Heit was beforehand concerned with an organization known as Karatbars Worldwide.

Heit appeared in movies for Karatbars and held himself out as Karatbars’ Chairman of the Board.

On Could 3, 2019, the Financial institution of Namibia declared Karatabars as a pyramid scheme following an investigation.

On October 21, 2019, the German Federal Monetary Supervisory Authority, also called BaFin, issued a stop and desist order to Karatbit, which upon data and perception is one other identify that Karatabars operated as, to cease issuing the Karat Gold Coin with out the right license.

Upon data and perception, GSPartners doesn’t open up to potential buyers that its Chairman, Josip Heit, was beforehand concerned in with the Karatbars alleged pyramid scheme.

There isn’t a point out of Karatbars on the GSPartners International or Swiss Valorem Financial institution web sites.

Upon data and perception, GSPartners doesn’t open up to potential G999 buyers that its Chairman, Josip Heit, was beforehand concerned with a cryptocurrency coin providing, Karat Gold Coin, the place a German regulator issued a stop and desist order to cease the issuance of that cryptocurrency.

There isn’t a point out of Karatbars, Karatbit, or the Karat Gold Coin on the G999 web site.

Oh and if you happen to’re questioning how far again Tannisha Glaspie’s “all in from day 1” goes;

Even after the Financial institution of Namibia’s declaration and Bafin’s stop and desist order, Glaspie promoter Karatbars on February 5, 2020, with a video posted on her YouTube channel titled, “Company Headquarters – Karatbars”.

With respect to GSPartners’ securities fraud, this takes place via GSPartners’ “metacertificates”.

GSPartners’ MetaCertificates primarily capabilities as funding plans or funding choices, the place buyers can make cash via this certificates program.

GSPartners offers primarily with cryptocurrency transactions and investments are paid with a cryptocurrency known as Tether (USDT).

The investments issued embrace staking swimming pools, digital property, non-fungible tokens, and merchandise tied to a metaverse that may be accessed with an web browser (the “Lydian World Metaverse”).

As a part of its “staking swimming pools” scheme, GSPartners’ failed G999 cryptocurrency additionally will get a point out.

By means of the G999 Web site, GSPartners represents to potential buyers that they’ll earn “passive rewards in G999” by investing within the masternodes and by staking.

For the G999 masternodes, GSPartners characterize that buyers could make worthwhile, passive revenue fromthe G999 blockchain with returns of seven.5% yearly.

The G999 Web site additionally encourages staking of the G999 Coin by claiming that homeowners can alternate cash generated from staking for gold cash, after which to bodily gold.

As of November twenty fifth, G999 is buying and selling at $0.0002433 with a 24 hour quantity of $765.

ACC’s order lobs three alleged violations of Arizona regulation at GSPartners, Josip Heit and Tannisha Glaspie (proper);

ACC’s order lobs three alleged violations of Arizona regulation at GSPartners, Josip Heit and Tannisha Glaspie (proper);

- supply and sale of unregistered securities (violation of A.R.S. §44-1841)

- transactions by unregistered sellers or salesmen (violation of A.R.S. §44-1842)

- fraud in reference to the supply or sale of securities (violation of A.R.S. §44-1991)

The Non permanent Order, which is in place for 180 days, requires GSPartners, Heit and Glaspie to “stop and desist from any violations of the Securities Act”.

The momentary nature of the order provides GSPartners, Heit and Glaspie a chance to reply. This have to be executed inside 20 days of service of the order.

Failing which, the ACC has requested aid within the type of a everlasting stop and desist order, restitution and an administrative penalty of as much as $5000 per Securities Act violation ($15,000).

Along with Arizona, New Hampshire, Arkansas, Wisconsin, Kentucky, California, Washington, Alabama and Texas have all taken regulatory motion in opposition to GSPartners and Josip Heit.

BehindMLM additionally not too long ago confirmed ongoing CFTC and SEC investigations into GSPartners.

Exterior of the US, GSPartners has obtained seven securities fraud warnings from Canadian authorities; British Columbia, Ontario, Alberta (G999, GSTrade and GSPartners), Quebec and Saskatchewan.

As a part of a joint operation with their US counterparts, earlier this week the British Columbia Securities Fee took additional motion in opposition to three GSPartners promoters.

The Australian Securities and Investments Fee added GSPartners to its Investor Alert Checklist on November fifteenth. South Africa’s FSCA additionally issued a GSPartners securities fraud warning on November twenty second.

Given the scope of GSPartners’ fraud throughout the US and involvement of federal regulators, it’s extremely seemingly the DOJ are additionally constructing a prison case.

Thus far neither Josip Heit or any GSB executives have addressed the GSPartners regulatory enforcement actions.

As a substitute, someday over the previous couple of days GSPartners introduced a “booster” scheme.

Beneath the brand new booster scheme, GSPartners buyers are inspired to make an extra 20% funding of their unique deposit.

That is executed on the promise of

- a 50% elevated end-of-contract bonus;

- resetting of present 52 week contracts; and

- a brand new equal worth funding place in GSPartners’ new “Success Collection” certificates scheme (equal to the unique quantity invested into a previous certificates scheme)

Notably, the booster scheme successfully pushes again the lump sum bonus GSPartners has to pay out on the finish of present contracts by as much as 30 months.

In gentle of regulatory enforcement motion from the US, Canada, South Africa and Australia, why GSPartners is determined to dodge upcoming end-of-contract payouts ought to be apparent.