Just a few days in the past the BigWhale Ponzi scheme collapsed.

Just a few days in the past the BigWhale Ponzi scheme collapsed.

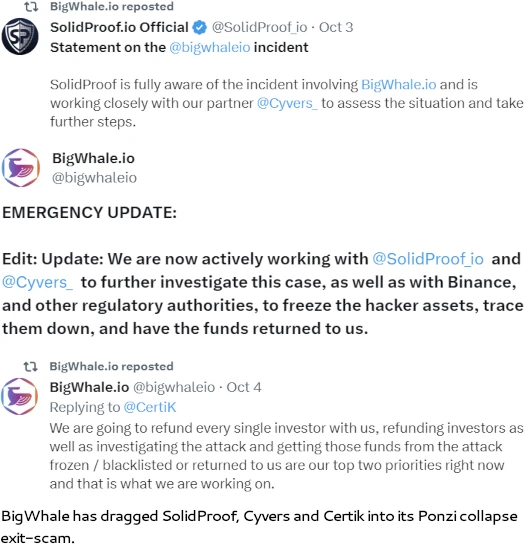

BigWhale’s admins drained what was left in its smart-contract and, in an effort to cowl up their exit-scam, concocted a “we received hacked!” ruse.

Now it has been revealed that regulators had been onto the multi-million greenback Ponzi scheme.

On October 4th the Texas State Securities Board issued an emergency stop and desist in opposition to BigWhale.

TSSB cites BigWhale as a Dubai-based firm. In reviewing BigWhale again in July, BehindMLM famous a Swiss shell firm and potential ties to Canada.

That BigWhale has ties to Dubai, the MLM crime capital of the world, doesn’t come as a shock.

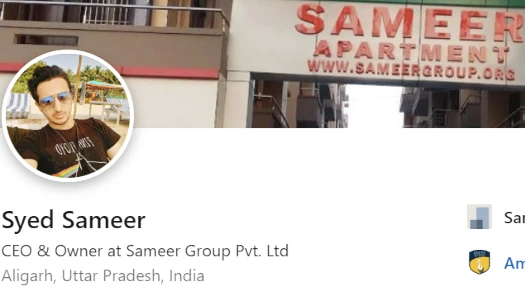

Along with BigWhale itself, TSSB identifies Syed Sameer and Christopher Web page as individuals of curiosity.

Sayeed Sameer purportedly owns BigWhale’s web site.

On LinkedIn Sayeed Sameer cites himself as a resident of Uttar Pradesh, India. He’s additionally the

proprietor of Aligarh primarily based Sameer Group Pvt. Ltd. – The third largest actual property developer in Aligarh metropolis.

Sameer Group is a privately owned holding firm concerned in Actual Property & E-Commerce by means of its subsidiaries Sameer Actual Property Pvt. Ltd and Essencia, LLC.

Essencia LLC is a Delaware, USA primarily based firm with investments in eCommerce, Digital Advertising & Social Media Advertising.

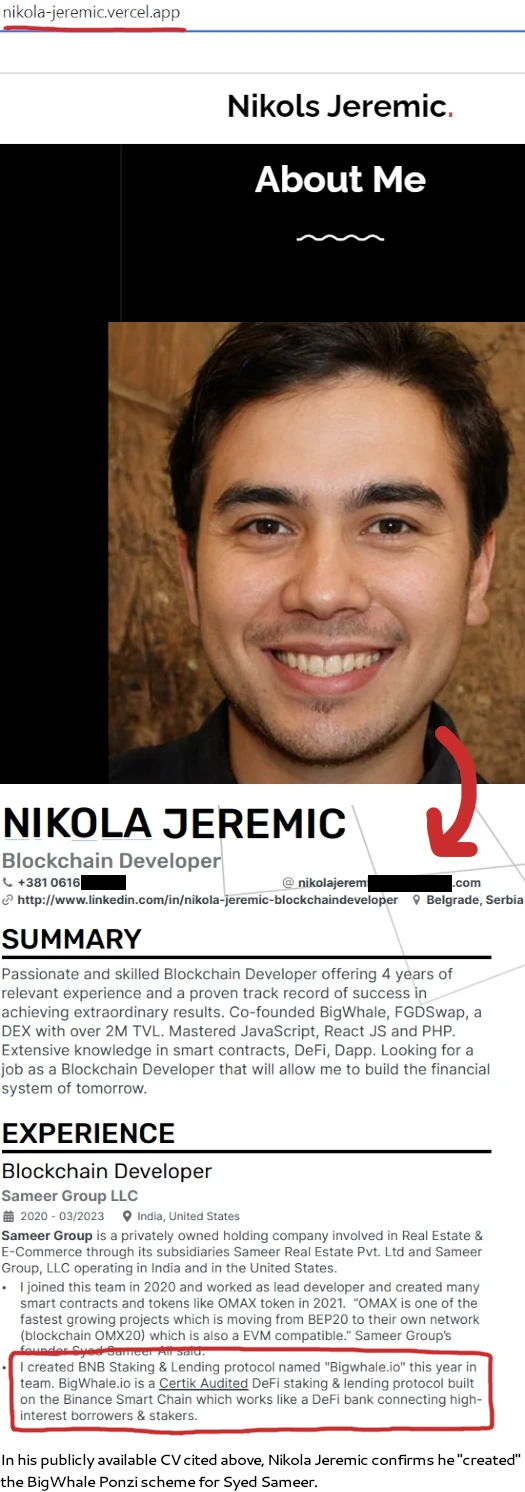

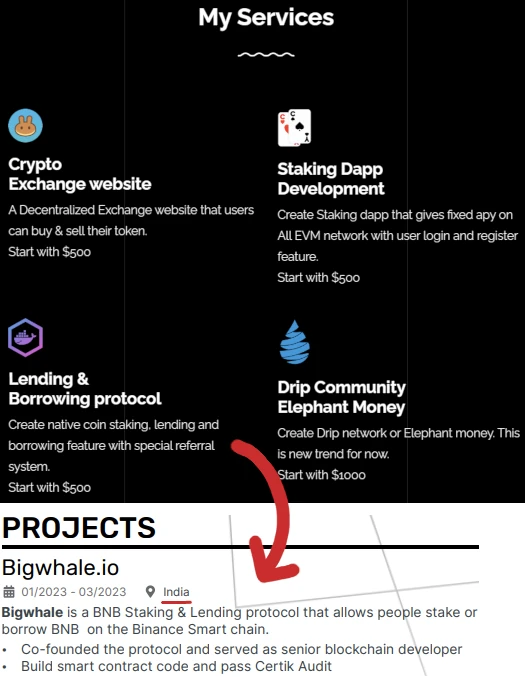

BigWhale was put collectively by Serbia primarily based developer Nikols Jeremic (aka Nikola Jeremic).

Jeremic cites Ponzi scheme enterprise fashions, together with BigWhale, as a “service” on his web site:

Sameer is one in every of Jeremic’s “joyful purchasers”:

Christopher Web page owns BigWhale’s web site area. I wasn’t capable of finding something on Web page, suggesting it is likely to be an alias.

Along with BigWhale’s admins, promoter shills on YouTube additionally get a point out;

Varied customers are selling Respondent BigWhale and the BigWhale Dapp by means of social media and movies printed in YouTube, together with customers performing as MoonShot Max (@moonshotmax3841), SCrypto101 (@Scrypto101), Razz Tafari (@razztafari), Crypto Goshen (@cryptogoshen3579), DeFi Technique (@defi_strategy), Crypto Kingz (@cryptokingz9915), Scott_The_Investor (@ScottTheInvestor), Crypto Muscle Community (@cryptomusclenetwork1), Crypto Muscle OG Channel (@cryptomusclelegacy), DEFILIFE (@mydefilife), Hippo Crypto (@hippocrypto3675), Jacob Crypto (@jacobcryptoyt) and Mo Crypto 777 (@mocrypto777).

TSSB’s goes on to verify BigWhale is an unlawful Ponzi scheme, is committing securities fraud and is masquerading as a financial institution.

Though Respondents are utilizing the time period “financial institution” and “banking” when describing Respondent BigWhale and the BigWhale Dapp, Respondent BigWhale will not be licensed with nor obtained a constitution from the Texas Division of Banking and the Nationwide Multistate Licensing System doesn’t present it has been conferred any state license tied to mortgages, cash service companies or client finance.

Respondents are representing the sensible contract was audited by Licensed Kernel Tech LLC, often known as CertiK (“CertiK”), and it’s utilizing this audit to tout the legitimacy of the BigWhale Dapp.

The audit additionally identifies a important discovering. The important discovering reveals “[t]he challenge seems to be utilizing consumer deposits as different folks’s rewards…”

The investments described herein haven’t been registered by qualification, notification or coordination and no allow has been granted for his or her sale in Texas.

Respondent BigWhale has not been registered with the Securities Commissioner as a vendor or agent at any time materials hereto.

Respondents Sameer and Web page haven’t been registered with the Securities Commissioner as brokers of Respondent BigWhale at any time materials hereto.

The TSSB’s cites BigWhale’s advertising and marketing, during which BigWhale claims to have reinvented itself as an offshore crypto Ponzi scheme following a $258,000 advantageous issued by the Swiss Federal Tax Administration.

The advantageous and related authorized bills purportedly drove Respondent BigWhale to incur $120,000 in prices related to transitioning its operations offshore.

It additionally purportedly started partnering with offshore banks to reduce tax and threat publicity from the Swiss FTA and European Union.

TSSB labels the advertising and marketing “misleading and deceptive” as a result of a scarcity of proof.

As described herein, the Swiss FTA purportedly assessed a $258,000 in opposition to Respondents.

Their description of the advantageous is materially deceptive or in any other case more likely to deceive the general public as a result of they aren’t offering an outline of the information giving rise to the advantageous or the violations of legislation that gave rise to the advantageous, and they aren’t offering ample info for traders to independently entry the order, judgment or different motion that levied the advantageous.

Lastly, BigWhale’s exit-scam, together with purported hyperlinks to the Russian authorities, additionally get a point out.

On October 3, 2023, Respondents introduced Respondent BigWhale “suffered what appears to be a spoofing kind or another kind of hack.”

Respondent BigWhale is providing a “bounty” of 20% to the hacker in trade for the return of belongings.

Respondents are additionally threatening to pursue extrajudicial reduction and leverage contacts within the Russian authorities.

Along with banking and securities fraud, additional allegations of fraud the TSSB ranges at BigWhale embrace failing to reveal

- “the id and site of the debtors, in addition to their capitalization, income, and credit score threat” (BigWhale’s Ponzi ruse revolves round fictional lenders and debtors);

- “the factors used for vetting debtors and minimizing defaults on loans issued to debtors”;

- “the methodology used to recruit debtors and the results of failing to recruit new debtors”;

- “the id of the get together or events that developed, keep, and replace the BigWhale Dapp”;

- “the prices related to growing, sustaining, and updating the BigWhale Dapp”;

- “any details about the protection of investor belongings in mild of the important discovering from the CertiK audit that reveals “[t]he challenge seems to be utilizing consumer deposits as different folks’s rewards…,””;

- “any details about how a hacking incident or malicious act could negatively impression the power to make use of the BigWhale Dapp or withdraw belongings”;

- “the id of the belongings throughout the Russian authorities that Respondents purportedly work with”;

- “the character of the connection between Respondents and the belongings throughout the Russian authorities that Respondents purportedly work with”; and

- “a proof of how Respondents will work with belongings throughout the Russian authorities to handle the purported hack”.

As per TSSB’s October 4th C&D, BigWhale, Syed Sameer and Christopher Web page have been ordered to right away stop and desist committing additional acts of securities fraud in Texas.

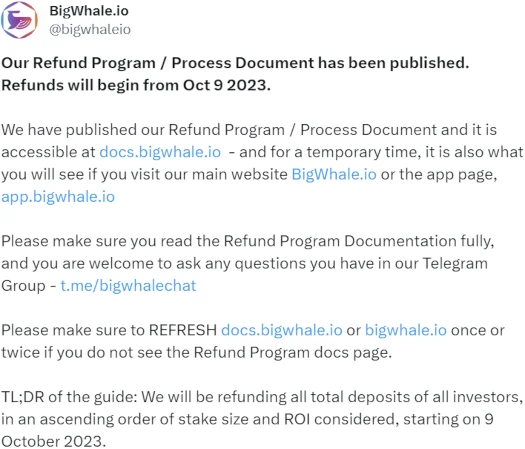

Following BigWhale’s collapse and “we received hacked!” exit-scam, the Ponzi scheme is now touting refunds for traders:

As per BigWhale’s printed refund course of, the Ponzi scheme

shall be refunding all whole deposits of all traders, in an ascending order of stake dimension and ROI thought-about, beginning on 9 October 2023.

Left unsaid is the truth that BigWhale’s greatest traders are its personal admins.

Left unsaid is the truth that BigWhale’s greatest traders are its personal admins.

Thus by “refunding” himself the cash he’s already stolen, BigWhale’s exit-scam is full and Syed Sameer (proper) rides off into the sundown.

Pending any additional developments, we’ll hold you posted.

Replace seventh October 2024 – BigWhale has confirmed its refunds scheme was a sham.

Moreover, inside a number of hours of this text being printed, Syed Sameer marked his social media profiles as non-public.

Nikola Jeremic has additionally gone underground and deleted his web site.