![]() Following an SEC lawsuit alleging $108 million in fraud, OnPassive seems to be diverting funds to Dubai.

Following an SEC lawsuit alleging $108 million in fraud, OnPassive seems to be diverting funds to Dubai.

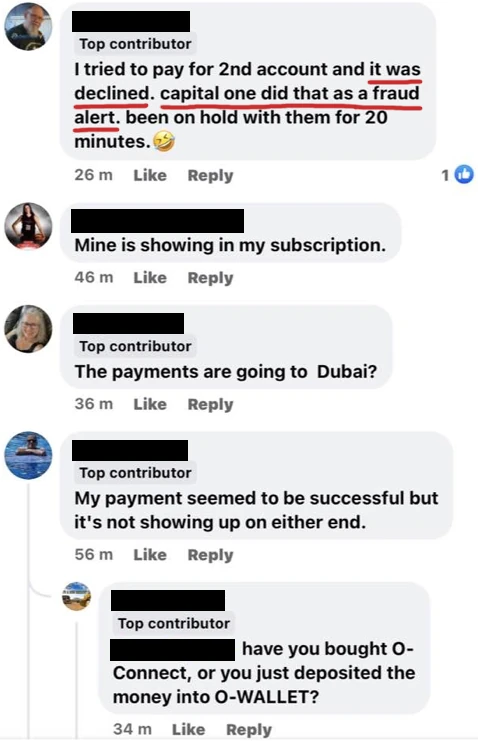

OnPassive associates report US banks are flagging the transactions as fraudulent.

Previous to the SEC’s lawsuit, OnPassive is believed to have been utilizing US banking channels. Now the corporate is laundering funds via Dubai and cryptocurrency.

This has prompted US banks to start out flagging OnPassive funds are fraudulent:

This isn’t shocking. Dubai is a worldwide hub for monetary fraud, together with MLM.

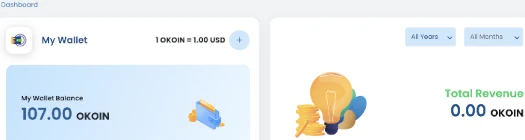

As soon as funds are transferred into OnPassive, associates are given OKOIN.

OKOIN is a nugatory inhouse token represented to equal the USD.

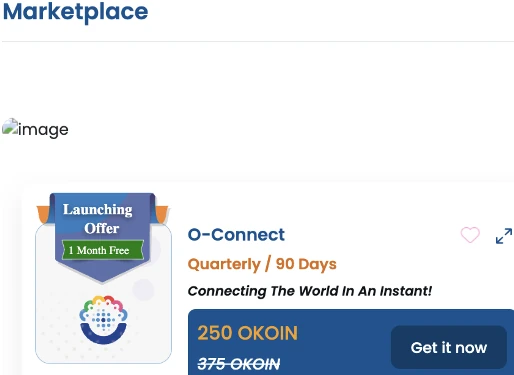

In response to the SEC’s lawsuit, which identified OnPassive had not launched a product since launch, Ash Mufareh introduced plans to launch O-Join.

Up till the SEC filed its lawsuit, O-Join was an unreleased Zoom clone OnPassive used to market its MLM alternative for years.

Whereas Zoom is free or $250 yearly at its highest retail tier, OnPassive is charging 375 OKOIN ($375) each quarter for entry to O-Join ($1500 yearly).

One other response to the SEC’s lawsuit is OnPassive providing refunds on $97 O-Founder charges.

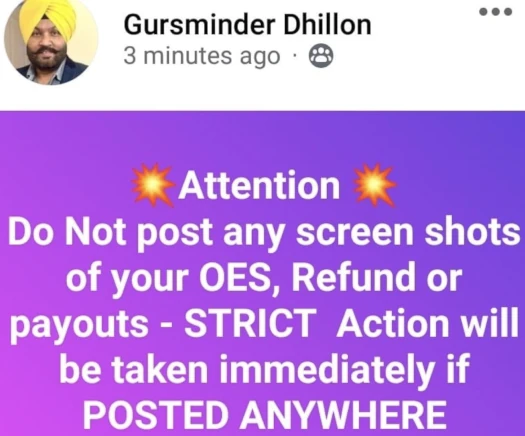

Sadly as a consequence of threats of “speedy motion”, we don’t know whether or not OnPassive refund requests are being promptly honored.

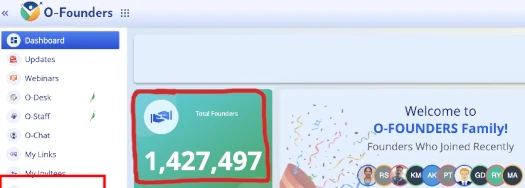

What we do know is, as of August 2023, OnPassive claims to have bought 1.4 million O-Founders positions.

At $97 a pop, this involves $138.4 million in potential refunds. Even when it’s only for tutorial functions, hopefully the SEC obtains OnPassive refund information as a part of the invention course of.

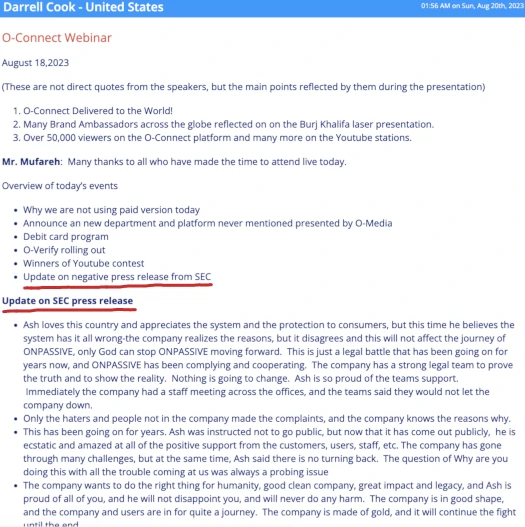

Sadly relatively than acknowledge the SEC suing OnPassive for $108 million as a serious federal enforcement motion, Mufareh and OnPassive promoters are minimizing it to a “press-release”.

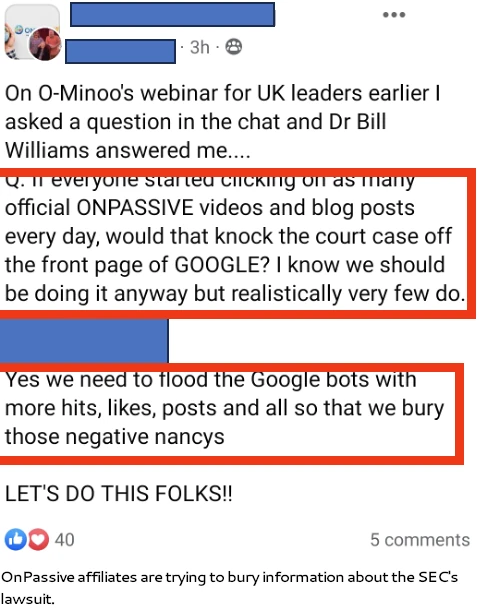

Different OnPassive associates are working to suppress consciousness of the SEC’s OnPassive lawsuit.

Whereas it’s true the SEC issued a press-release relating to its federal lawsuit, the enforcement motion itself is the lawsuit. The SEC prevailing, both by jury verdict or settlement, would imply the tip of OnPassive.

It’s anticipated as actuality sinks in, over the approaching months increasingly more OnPassive associates will notice they’ve been had.

Inquiries to the SEC will be submitted by way of their web site.