![]() Bitfinex is a widely known crypto change tied to tether (USDT). Seems it’s additionally an MLM firm.

Bitfinex is a widely known crypto change tied to tether (USDT). Seems it’s additionally an MLM firm.

Bitfinex was launched in 2012 by Raphael Nicolle. Nicolle parted methods with Bitfinex in the course of the in early 2017.

At this time Bitfinex is owned by iFinex Inc., a BVI shell firm.

Names we are able to connect to Bitfinex embrace:

- Jean-Louis van der Velde (CEO) from the Netherlands

- Giancarlo Devasini (CFO) from Italy and

- Paolo Ardoino (CTO), additionally from Italy

To the most effective of my information, none of Bitfinex’s executives have any prior MLM government expertise.

Being one of many oldest cryptocurrency exchanges, Bitfinex has a well-documented historical past:

There’s a good bit extra, with Bitfinex’s Wikipedia entry making for good studying.

Learn on for a full assessment of Bitfinex’s MLM alternative.

Bitfinex’s Merchandise

Bitfinex operates as a cryptocurrency change.

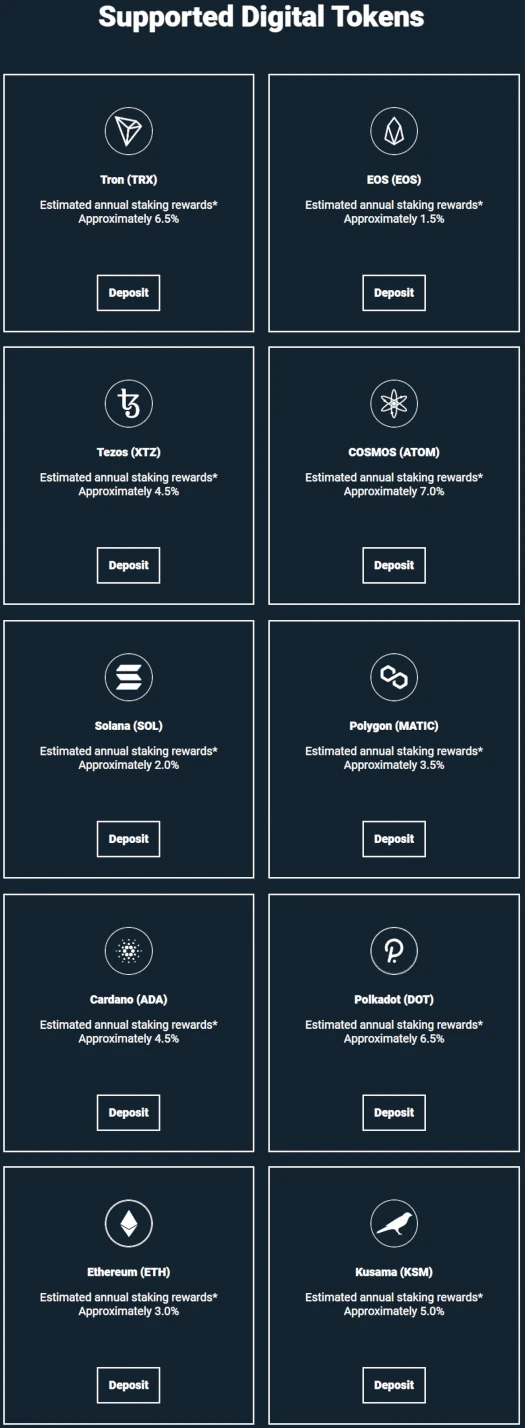

The corporate additionally presents passive returns on varied cryptocurrencies through a staking mannequin:

Staking returns are paid out weekly primarily based on the above marketed annual ROI charges.

Bitfinex’s Compensation Plan

Bitfinex associates earn commissions on buying and selling and margin funding charges paid by retail clients and recruited associates.

Bitfinex pays commissions down three ranges of recruitment (unilevel):

- stage 1 (personally recruited associates) – 18%

- stage 2 – 6%

- stage 3 – 2%

Be aware that the above fee quantities seem to cut back by 0.5% each 30 days.

The share of the charges you obtain for every member of your community will begin at 18% (6% or 2% primarily based on its connection stage) and can scale back each second in a straight-line trend in order that by the tip of every thirty days, it’s decreased by 0.5%.

This means that ultimately Bitfinex associates might be screwed out of commissions earned on private clients and referred associates.

- stage 1 commissions will attain 0% after 36 months

- stage 2 commissions will attain 0% after 12 months

- stage 3 commissions will attain 0% after 4 months

Multipliers

Bitfinex presents multipliers on referral commissions, topic to the next qualification standards:

- affiliate’s account is KYC verified (Fundamental Plus tier or greater) – 1.2x multiplier

- downline buyer/affiliate is KYC verified (Fundamental Plus tier or greater) – 1.2x multiplier on their commissionable quantity

- downline buyer/affiliate has greater than 500 USDT in LEO token of their account = 1.1x multiplier on their commissionable quantity

- downline buyer/affiliate has greater than 5000 USDT in LEO token of their account = 1.2x multiplier on their commissionable quantity

- downline buyer/affiliate has greater than 50,000 USDT in LEO token of their account = 1.5x multiplier on their commissionable quantity

Be aware that Unus Sed Leo (LEO) is owned by Bitfinex’s father or mother firm iFinex.

Developer Rebate

If a Bitfinex affiliate can be a developer, they obtain a 5% rebate on any buying and selling charges generated by their platform/app.

Becoming a member of Bitfinex

Bitfinex affiliate membership is free.

Bitfinex Conclusion

Bitfinex as an MLM alternative is totally shadowed by its connection to tether and ongoing US felony investigations.

Earlier than we get into that (plenty of which is subjective evaluation on my half), let’s consider Bitfinex’s MLM alternative independently.

With Bitfinex as an MLM firm now we have a straight-forward change that prices charges. Stated charges fund its compensation plan and there’s nothing improper with that.

Factor begin to disintegrate nonetheless with diminishing fee charges, that are decreased by 0.5% each month.

This beautiful a lot kills the “residual” nature of Bitfinex’s commissions, which in MLM is (imagined to be) one of many main drawcards.

One other pink flag is Bitfinex’s staking funding scheme. By mentioned scheme, Bitfinex clients make investments cryptocurrency on the promise of marketed passive returns.

As per the Howey Check, this constitutes a securities providing. Within the US, securities are required to be registered with the SEC.

A search of the SEC’s public Edgar database reveals neither Bitfinex or father or mother firm iFinex are registered.

Which means that at a minimal, Bitfinex is committing securities fraud within the US.

Following two CFTC fines, Bitfinex seems to have spun off its commodities division into “Bitfinex Securities”.

Out of curiosity I ran seek for Bitfinex and iFinex on the CFTC’s BasicNet database. There’s nothing for Bitfinex however iFinex comes up as an NFA non-member to notice the 2021 CFTC fraud high quality.

Bitfinex Securities falls outdoors the scope of this assessment so I can’t actually touch upon whether or not Bitfinex has rememied its Commodities Act violations.

Regardless, registering with the CFTC doesn’t treatment Bitfinex’s failure to register its staking funding alternative with the SEC.

In conclusion; as a stand-alone MLM alternative, Bitfinex presents buying and selling, securities fraud and unattractive diminishing fee charges.

Now the elephant within the room: Tether.

Tether is a stablecoin additionally owned by iFinex. Not surprisingly, Bitfinex executives maintain the identical government roles between the 2 corporations.

Tether’s unique schtick was it was backed 1:1 by USD. This turned out to be a lie and Tether’s precise USD reserves stay a thriller.

Tether does put out unaudited statements periodically however, for apparent causes, these are meaningless.

As of August 2022, iFinex, Bitfinex and Tether are believed to be the topic of an ongoing US felony investigation.

Now we get to the subjective pink flags.

Tether is extensively thought to be the first software used to prop up the cryptocurrency market.

The straightforward model of that is iFinex prints unbacked tether on demand, makes use of it to purchase bitcoin, bitcoin pumps, iFinex sells (actual cash extracted out of the market), rinse and repeat.

That is clearly fraud and, together with cash laundering and evading banking legal guidelines, is probably going on the middle of investigations into iFinex.

Taking into account world sanctions which might be presently in place, SimilarWeb presently tracks Russia as the highest supply of visitors to Bitfinex’s web site.

Over the previous few years US authorities have been working their means as much as the larger crypto fish. This 12 months the fish are getting larger, and we’ve already seen FTX and Celsius go down.

The SEC filed go well with towards Binance and proprietor Changpeng Zhao in June, for

working unregistered exchanges, broker-dealers, and clearing businesses; misrepresenting buying and selling controls and oversight on the Binance.US platform; and the unregistered supply and sale of securities.

It’s possible that Zhao has additionally been indicted however, pending his arrest, we received’t know for certain (Zhao fled to Dubai after the SEC Criticism dropped).

What’s larger than Binance? iFinex.

I believe the instances towards iFinex (DOJ, SEC and presumably one other one from the CFTC), will ramp up following Zhao’s arrest.

Zhao’s arrest may have a serious impression on the cryptocurrency market, presumably even sending Tether into an implosion.

The identical additionally holds true if prices towards iFinex and its executives are introduced. Both was on the playing cards however given the SEC’s lawsuit, I imagine Binance might be first.

Binance and iFinex concurrently could be epic however, as a result of magnitude of fraud and subsequent quick fallout, in all probability unlikely (I’d like to be confirmed improper on this).

The underside line? Bitfinex has sufficient baggage and potential regulatory danger via iFinex and Tether, that no person ought to be taking it critically as an MLM firm.