Catly fails to supply possession or government data on its web site.

Catly fails to supply possession or government data on its web site.

Actually as I write this, Catly’s homepage is nothing greater than a enroll/check in type. An MLM firm hiding every part about itself is an immediate red-flag.

Catly’s web site area (“catly.io”), was privately registered on March 2nd, 2023.

With an enormous of rigging round I used to be in a position to entry Catly’s whitepaper. Whereas there’s a “Crew and Advisors” part of the whitepaper, no precise details about who’s behind Catly is offered.

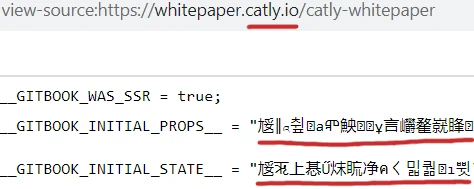

Within the source-code of Catly’s whitepaper we discover Chinese language:

Whereas not definitive, this means whoever is working Catly has ties to China, Singapore and/or Malaysia.

Of observe is there appears to be some manipulation occurring with Catly’s recorded web site site visitors.

SimilarWeb tracked simply 89,200 visits to Catly’s web site in April 2023. This jumped to a whopping 6.8 million in Might and even larger to 9.8 million in June.

That is extremely uncommon for a brand new internet property and suggests synthetic site visitors was used.

Nonetheless, as of June 2023 SimilarWeb tracked high sources of site visitors to Catly’s web site as Russia (24%), Ukraine (15percent0 and Indonesia (11%).

The Central Financial institution of Russia is fairly fast to challenge securities fraud warnings for scams concentrating on Russia. If ~2.5 million visits to Catly’s web site originated from Russia final month, it’d in all probability have appeared on their radar.

This reaffirms Catly is probably going manipulating its web site site visitors information.

It additionally introduces the opportunity of Russian scammers working Catly, having engaged Chinese language builders to place collectively its web site.

As at all times, if an MLM firm will not be overtly upfront about who’s working or owns it, suppose lengthy and laborious about becoming a member of and/or handing over any cash.

Catly’s Merchandise

Catly has no retailable services or products.

Associates are solely in a position to market Catly affiliate membership itself.

Catly’s Compensation Plan

Catly associates make investments tether for for CATLY tokens. Pricing isn’t offered however one advertising and marketing instance I noticed equated 1 USDT to 250 CATLY.

As soon as invested in, CATLY is parked with the corporate on the promise of a day by day 3% ROI (staking).

Catly’s “staking” funding plan runs for 15 days, throughout which staked CATLY is locked.

Over the 15 days the day by day ROI will be cashed out. After 15 days the unique CATLY funding quantity is unlocked.

Catly pays referral commissions through a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the high of a unilevel crew, with each personally recruited affiliate positioned straight underneath them (degree 1):

If any degree 1 associates recruit new associates, they’re positioned on degree 2 of the unique affiliate’s unilevel crew.

If any degree 2 associates recruit new associates, they’re positioned on degree 3 and so forth and so forth down a theoretical infinite variety of ranges.

Catly caps referral commissions down ten unilevel crew ranges.

Referral commissions are paid as a share of tether deposited in throughout these ten ranges as follows:

- degree 1 (personally recruited associates) – 3.5%

- degree 2 – 1.8%

- degree 3 – 1.6%

- degree 4 – 1.4%

- degree 5 – 1.2%

- degree 6 – 1%

- degree 7 – 0.8%

- degree 8 – 0.4%

- degree 9 – 0.2%

- degree 10 – 0.1%

Becoming a member of Catly

Catly affiliate membership is free.

Full participation within the connected earnings alternative requires funding in CATLY tokens.

Catly solicits funding in tether.

Catly Conclusion

Catly is an easy “staking” mannequin Ponzi scheme, constructed round its CATLY token.

CATLY is a BEP-20 token, created on the Binance Good Chain. BEP-20 tokens will be created in a couple of minutes at little to no value.

New buyers deposit tether for CATLY. CATLY is then fed into Catly’s staking funding scheme, which generates extra CATLY.

The purpose is to money out different folks’s tether, making CATLY a Ponzi scheme.

At a minimal Catly offers no proof it has registered its funding scheme with monetary regulators.

As a substitute Catly provides up this nonsense;

Compliance Necessities

CATLY will adhere to native legal guidelines and laws and preserve shut cooperation with regulatory authorities. We’ve got obtained the US MSB (Cash Providers Enterprise) license and US Basis license to make sure platform compliance and mitigate potential fraud and cash laundering actions.

“US MSB” seems to check with FINCEN. No thought what a “US Basis license is”.

Regardless, these aren’t monetary regulatory registrations. For the aim of MLM due-diligence, FINCEN registration is meaningless.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding.

This can starve CATLY of ROI income, ultimately prompting a collapse.

At present, CATLY is nugatory outdoors of Catly itself. When the time comes, Catly plans to exit-scam by dumping CATLY on dodgy exchanges.

As soon as 70% of the $CATLY tokens are minted, our focus will shift in direction of looking for listings on respected cryptocurrency exchanges.

Realistically at 3% a day, it’s extra seemingly Catly will simply exit-scam by disappearing.

Both means the mathematics behind Ponzi schemes ensures that after they inevitably collapse, nearly all of contributors lose cash.