InvesableAI operates within the cryptocurrency MLM area of interest.

InvesableAI operates within the cryptocurrency MLM area of interest.

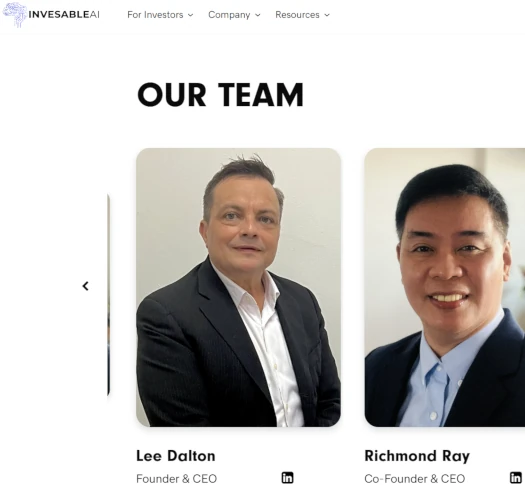

The corporate presents two co-founders on its web site; Lee Dalton and Richmond Ray Gonzales:

Each Dalton and Gonzales are cited as InvesableAI CEOs.

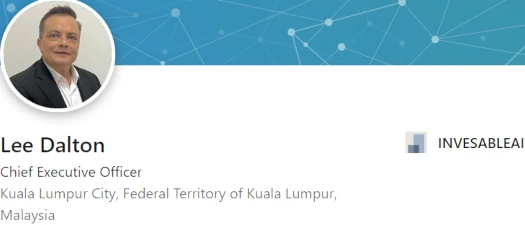

Primarily based on his accent, Dalton seems to be an Australian nationwide. On LinkedIn Dalton represents he’s primarily based out of Malaysia:

Richmond Gonzales seems to be a Singapore nationwide:

Of be aware is, primarily based on his LinkedIn profile, Gonzales has spent a number of years working in Australia.

Each Dalton and Gonzales don’t have a verifiable MLM historical past. This would possibly recommend they’ve been employed to entrance InvesableAI.

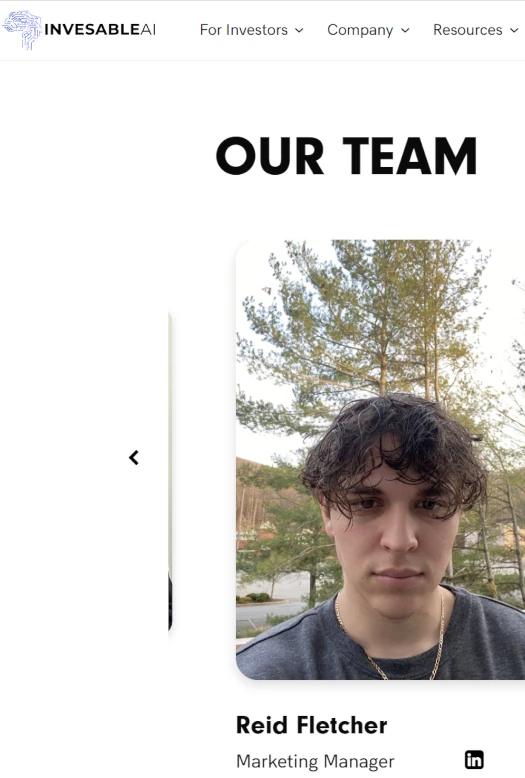

A 3rd title we are able to connect to InvesableAI is Advertising and marketing Director Reid Fletcher:

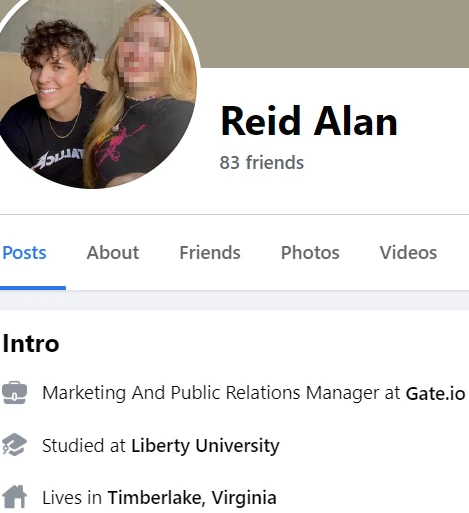

On FaceBook Fletcher goes by “Reid Alan” and represents he’s primarily based out of Virginia within the US.

Fletcher/Alan cites himself as a Advertising and marketing and Public Relations Supervisor for the Gate cryptocurrency change.

Gate is a crypto change that primarily providers Russia. Gate deliberately avoids the US as a result of it doesn’t need to register its varied funding alternatives with the SEC and file audited monetary experiences.

Whether or not any InvesableAI funds movement by means of Gate is unclear.

Learn on for a full overview of InvesableAI’s MLM alternative.

InvesableAI’s Merchandise

InvesableAI has no retailable services or products.

Associates are solely capable of market InvesableAI affiliate membership itself.

InvesableAI’s Compensation Plan

InvesableAI associates make investments USD equivalents in cryptocurrency.

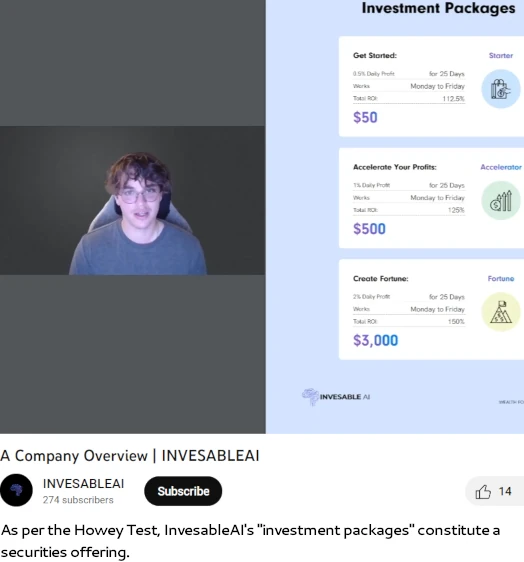

That is completed on the promise of marketed returns:

- Starter – make investments $50 and obtain 112.5% over 25 days

- Accelerator – make investments $500 and obtain 125% over 25 days

- Fortune – make investments $3000 and obtain 150% over 25 days

The MLM facet of InvesableAI pays on recruitment of affiliate buyers.

Referral Commissions

InvesableAI pays referral commissions by way of a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the high of a unilevel staff, with each personally recruited affiliate positioned immediately beneath them (degree 1):

If any degree 1 associates recruit new associates, they’re positioned on degree 2 of the unique affiliate’s unilevel staff.

If any degree 2 associates recruit new associates, they’re positioned on degree 3 and so forth and so forth down a theoretical infinite variety of ranges.

InvesableAI caps referral commissions at six unilevel staff ranges.

Referral commissions are paid as a proportion of cryptocurrency invested throughout these six ranges as follows:

- Newbie – 6% on degree 1 (personally recruited associates), 2% on degree 2 and 1% on degree 3

- Superior (make investments at the very least $3000) – 7% on degree 1, 3% on degree 2, 2% on degree 3 and 1% on ranges 4 to six

- Gold (make investments at the very least $10,000) – 8% on degree 1, 3% on degree 2, 2% on ranges 3 and 4 and 1% on ranges 5 and 6

- Diamond (make investments at the very least $15,000) – 8% on degree 1, 4% on degree 2, 3% on degree 3, 2% on ranges 4 and 5 and 1% on degree 6

Matching Bonus

InvesableAI rewards associates when their personally recruited associates make investments as a lot as they do.

- Metallic – make investments $5000 and generate $5000 in personally recruited affiliate funding quantity = 2% of $5000 ($100)

- Silver – make investments $10,000 and generate $10,000 in personally recruited affiliate funding quantity = 3% of $10,000 ($300)

- Gold – make investments $15,000 and generate $15,000 in personally recruited affiliate funding quantity = 4% of $15,000 ($600)

- Diamond – make investments $20,000 and generate $20,000 in personally recruited affiliate funding quantity = 5% of $20,000 ($1000)

- Sapphire – make investments $25,000 and generate $25,000 in personally recruited affiliate funding quantity = 6% of $25,000 ($1500)

- Ruby – make investments $50,000 and generate $50,000 in personally recruited affiliate funding quantity = 7% of $50,000 ($3500)

- Jasper – make investments $75,000 and generate $75,000 in personally recruited affiliate funding quantity = 9% of $75,000 ($6750)

- Garnet – make investments $100,000 and generate $100,000 in personally recruited affiliate funding quantity = 20% of $100,000 ($20,000)

Staff Turnover Bonus

InvesableAI rewards associates for producing downline funding quantity as follows:

- Starter – generate $10,000 in downline funding quantity and obtain 2% of $10,000 ($200)

- Hustler – generate $20,000 in downline funding quantity and obtain 3% of $20,000 ($600)

- Mover – generate $30,000 in downline funding quantity and obtain 5% of $30,000 ($1500)

- VIP – generate $40,000 in downline funding quantity and obtain 7% of $40,000 ($2800)

- Chief – generate $50,000 in downline funding quantity and obtain 9% of $50,000 ($4500)

- Builder – generate $60,000 in downline funding quantity and obtain 11% of $60,000 ($6600)

- Government – generate $70,000 in downline funding quantity and obtain 13% of $70,000 ($9100)

- Elite – generate $80,000 in downline funding quantity and obtain 15% of $80,000 ($12,000)

- Rich – generate $100,000 in downline funding quantity and obtain 20% of $100,000 ($20,000)

Becoming a member of InvesableAI

InvesableAI affiliate membership is free.

Full participation within the connected earnings alternative requires a minimal $50 funding.

InvesableAI solicits funding in varied cryptocurrencies.

InvesableAI Conclusion

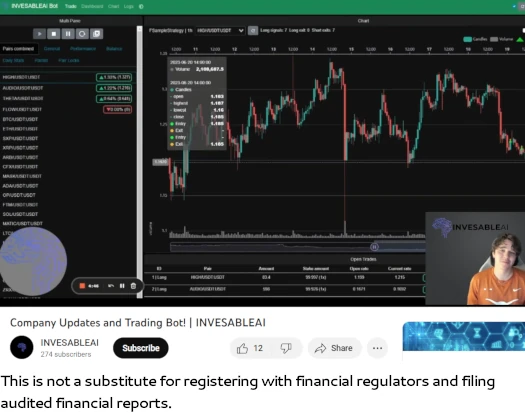

InvesableAI represents it generates exterior income by way of an AI buying and selling bot;

By becoming a member of INVESABLEAI, people acquire entry to superior funding methods powered by synthetic intelligence.

Lee Dalton and Richmond Ray Gonzales each seem to have tech backgrounds. Neither has any expertise in cryptocurrency or AI although.

It’s unlikely these middle-aged frontmen wakened someday and located an AI crypto buying and selling bot beneath their beds. This reaffirms an unnamed third-party that’s probably pulling the strings.

This might tie into Reid Fletcher/Alan and Gate. Dalton and Gonzales may have met in the course of the course of earlier employment. I’m undecided in any other case positive how Fletcher/Alan suits in.

Regardless InvesableAI is providing a passive funding alternative and is due to this fact topic to securities regulation.

If we take its government construction at face worth, we have now Dalton in Malaysia, Gonzales in Singapore and Fletcher/Alan within the US.

Securities in Malaysia are regulated by the Central Financial institution of Malaysia and Malaysian Securities Fee. In Singapore is the Financial Authority of Singapore, and within the US it’s the SEC.

InvesableAI fails to supply proof it has registered with a monetary regulator in any jurisdiction. Which means that, at a minimal, InvesableAI is committing securities fraud.

Apparently InvesableAI appears conscious of its regulatory necessities. The issue is it blatantly lies about them on its web site;

How do I be sure I cannot get scammed by InvesableAI?

We perceive that some folks could also be skeptical of AI buying and selling funding corporations, and we respect their opinions.

Nevertheless, we need to guarantee you that INVESABLEAI is a official firm with a confirmed observe report of success.

We’re a licensed and controlled funding firm, and our algorithms and funding methods are totally examined and verified by impartial third-party auditors.

InvesableAI launched in Could 2023 and has no “confirmed observe report of success”. As mentioned above, it is usually not “licensed and controlled” by a monetary regulator in any jurisdiction.

Why would InvesableAI lie about its regulatory obligations and choose to commit securities fraud?

As a result of there isn’t a AI buying and selling bot. InvesableAI is one more easy Ponzi scheme leaping on the AI advertising bandwagon.

As with all MLM Ponzi schemes, as soon as affiliate recruitment runs dry so too will new funding.

This can starve InvesableAI of ROI income, ultimately prompting a collapse.

The mathematics behind Ponzi schemes ensures that once they collapse, nearly all of contributors lose cash.