Tori Belle has filed for Chapter 11 chapter.

Tori Belle has filed for Chapter 11 chapter.

BehindMLM beforehand reported Tori Belle submitting for Chapter 11 chapter in August 2022.

That submitting pertaining to mother or father firm LashLiner, which technically is a separate entity. Virtually talking although, each LashLiner and Tori Belle are the identical entity run by the identical folks.

The courts acknowledged this and so we simply categorized LashLiner and Tori Belle as one and the identical.

It took a 12 months, however nonetheless we now have Tori Belle itself having filed for Chapter 11.

A Revenue and Loss Assertion filed with Tori Belle’s chapter reveals an $456,867 operational loss as April 2023.

Tori Belle claims to have $4.6 million in belongings, $4.5 million of which is unsold stock.

On June twenty sixth Tori Belle filed a movement in search of permission to unload its belongings.

Tori Belle filed this continuing as a result of continued operations haven’t been worthwhile and a sale in bulk of most of its belongings whereas working will generate a higher return than a wholesale liquidation.

Tori Belle’s belongings include :

• Tori Belle internet sites and content material

• Gross sales and advertising and marketing collateral

• Product information

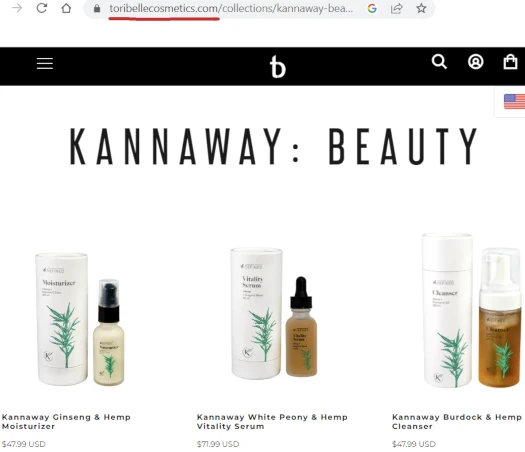

The customer of the belongings was Kannaway.

Tori Belle, topic to Court docket approval, has entered right into a multi-party Belongings and Stock Buy and Licensing Settlement, between LashLiner, Tori Belle; Laura Hunter and Bob Kitzberger, on one hand, with LashLiner and Tori Belle collectively known as “Sellers,” and Kannaway USA, LLC, on one other hand as a “Purchaser.”

Kannaway was ready to buy sure Tori-Belle non-inventory belongings for $1.5 million.

In change, Tori Belle would obtain

10% of month-to-month product sales by Purchaser of Tori Belle merchandise throughout all Purchaser’s markets worldwide, payable month-to-month (the “Gross sales Override”) and can obtain proceeds from the month-to-month consigned gross sales of its Stock at Price.

I don’t know what settlement Tori Belle and Kannaway have already entered into, however I do word that Kannaway’s merchandise are at present obtainable via Tori Belle:

Following a listening to on July seventh, the courtroom denied Tori Belle permission to promote its belongings to Kannaway.

I’m not likely certain what this implies for Tori Belle going ahead. I figured CEO Laura Hunter would have addressed the brand new chapter, as she did the unique chapter final 12 months.

Tori Belle did host a reside on its FaceBook web page on June sixteenth, the identical day Tori Belle filed for Chapter 11.

Within the video although Hunter didn’t tackle Tori Belle’s chapter. The chapter wasn’t addressed the next week both (Hunter appears to host a reside Tori Belle broadcast as soon as every week).

It’s unclear whether or not Tori Belle distributors have been knowledgeable of current developments concerning the enterprise.

To distinguish between Tori Belle’s two bankruptcies, I’ll be referring to the unique one because the LashLiner chapter going ahead.

On LashLiner’s chapter, the court-appointed Trustee filed a movement requesting LashLiner’s Chapter 11 be transformed to a Chapter 5 on July nineteenth.

A Chapter 11 chapter permits for a enterprise to restructure its debt. A Chapter 7 is an easy liquidation.

In submitting her movement, the Trustee cited a breach of the permitted reorganization plan.

Tori Belle has did not make its Could, June and July 2023 funds to Creditor PIRS Capital and Lashliner did not docket this default as required by the Plan.

It’s my enterprise judgment that the conversion to Chapter 7 at this level is extra prone to lead to a distribution to Collectors, somewhat than dismissal of the case. I hereby respectfully request conversion of this case from Chapter 11 to Chapter 7.

A listening to on the Trustee’s movement has been scheduled for August eleventh.

Chapter proceedings do are inclined to get complicated however we’ll do our greatest to maintain you posted.