Following two securities fraud warnings and an interim cease order, Validus filed an enchantment towards New Zealand’s Monetary Markets Authority.

Following two securities fraud warnings and an interim cease order, Validus filed an enchantment towards New Zealand’s Monetary Markets Authority.

The Excessive Court docket dismissed Validus’ enchantment, that means the Ponzi scheme is now completely banned in New Zealand.

The FMA started investigating Validus following a November 2022 webinar held in New Zealand. Sooner or later this led to the FMA contacting Validus.

In an try to stave off additional investigation, on March third Validus wrote to the regulator to advise

the Validus Pool promoted on the Seminar had been eliminated and not exists.

Validus would go on to disable withdrawals however on the time, this was a lie.

Consequently, the FMA contacted Validus on March twenty fourth to advise them of their intent to challenge a Cease Order.

The FMA issued an Interim Cease Order on or round April sixteenth. Validus collapsed on April twentieth.

Technically, if Validus despatched their correspondence to the FMA after April twentieth, they wouldn’t have been mendacity.

Additional, (Validus’) letter stated “Validus isn’t, and doesn’t intend to be, a monetary product and no individual ought to ever enter right into a industrial relationship with Validus intending or anticipating to make returns of any type, as no such returns are promised or assured in any means”.

Now that is very a lot a lie, as famous by the FMA;

Dr Parwiz Daud, Chief Community Officer of Validus, attended and spoke on the Seminar, throughout which a key speaker, Souai Tito, suggested attendees that:

“… as soon as you buy a [education] pack you get rewarded … so with the cash that you simply bought your schooling packs, we’ve a staff of consultants that commerce your cash within the foreign exchange market. And with that you simply receives a commission 2 to three% weekly loyalty factors over 60 weeks.”

“We commerce in shares, and gaming, crypto, NFTs, staking… after 60 weeks you get 350% [of your money] again”.

Paradoxically, Validus’ denial of the returns it marketed by means of its funding scheme have been deemed additional proof of “false and deceptive representations”.

Paul Gregory, Govt Director of Response and Enforcement, stated:

“Seminar attendees have been induced to buy, bought or intend to buy, instructional packages in reliance on false or deceptive representations.

They won’t obtain the promoted 2-3% return on their cash, or have the ability to withdraw that cash. They’re more likely to undergo materials monetary hurt.

Validus has made false or deceptive representations to the general public that had each look of an unregulated supply of monetary merchandise.”

In dismissing Validus’ enchantment, the Excessive Court docket discovered Validus sought to

exclude outright scams, baldly inviting participation in non-existent monetary merchandise, from the FMA’s enforcement operate.

Following dismissal of Validus’ enchantment, the FMA’s beforehand issued Everlasting Cease Order is now in impact.

The Order prohibits Validus and Validus-FZCO and related individuals from taking steps that may end in repeat illegal behaviour that will trigger materials monetary hurt, particularly:

- making provides of Validus Monetary Merchandise; and

- distributing any restricted communication that pertains to the supply of Validus Monetary Merchandise; and

- accepting additional purposes, contributions, investments, or deposits in respect of Validus Monetary Merchandise.

The FMA notes that related individuals means anybody selling Validus Monetary Merchandise in New Zealand.

Following its collapse, Validus has solely been paying commissions on recruitment of recent victims.

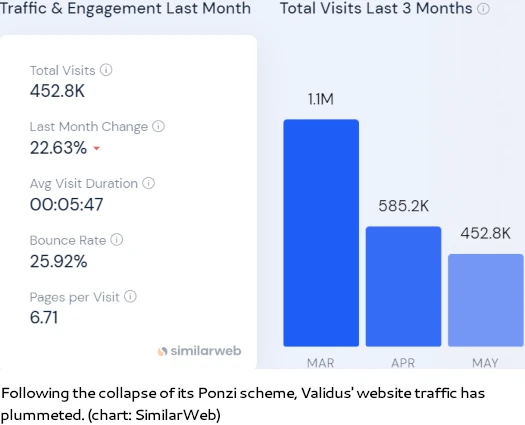

Because of the Ponzi aspect of the scheme not paying out, Validus’ web site site visitors has tanked:

Primarily based on site visitors evaluation by SimilarWeb, nearly all of Validus victims are believed to be in France, the Netherlands, Colombia, Belgium and the UK.

Validus is run from Dubai by Parwiz Daud and Mansour Tawafi.

Each Daud and Tawafi are former promoters of the infamous OneCoin Ponzi scheme.