![]() TranzactCard operates within the banking and cashback MLM niches.

TranzactCard operates within the banking and cashback MLM niches.

On its web site, TranzactCard identifies its Founder and Chairman as Richard Smith.

On the company aspect of issues;

TranzactCard LLC is a completely owned subsidiary of TZT Holdings LLC. TZT Holdings owns the model “TranzactCard” and the TranzactCard Monetary Ecosystem.

On LinkedIn Smith cites himself as TZT Holdings’ Government Chairman.

Lengthy story brief, Richard Smith owns and operates TranzactCard.

TranzactCard operates from two main web site domains; “tranzactcard.com” and “mytzt.com” – each first registered in April 2021, with personal registrations final up to date on April twenty ninth, 2023.

Though we didn’t understand it on the time, BehindMLM first got here throughout Richard Smith’s MLM work with Divvee in mid 2016.

As a substitute of the fronting the corporate he was a co-founder of, Smith initially hid behind CEO Allen Davis.

Divvee’s authentic idea flopped and it was rebooted as Divvee Rank and Share in November 2016. Someday after Smith and co-founder Troy Muhlestein turned the face of the corporate.

By July 2017 it was obvious Divvee Rank and Share had additionally flopped. This prompted a pivot to foreign currency trading securities and commodities fraud.

After that we had Nui – a continuation of the aforementioned securities and commodities fraud.

Nui devolved right into a bunch of crypto schemes led by Darren Olayan. The mess culminated in Texas issuing a securities fraud stop and desist in July 2018.

The Texas State Securities Board would go on to advantageous Nui $25,000 in February 2019.

I don’t know precisely when Richard Smith left Nui however he resurfaced with The Digital Vault and RevvCard in March 2019.

The Digital Vault and RevvCard had been purported to convey fiat banking companies to Nui’s crypto fraud.

In April 2019 The Digital Vault relaunched as R Community.RevvCard nonetheless hadn’t launched and wasn’t because of launch for one more eight months.

By mid 2020 the unique idea for RevvCard had been scrapped. Smith started providing inventory possession in R Community, regardless of neither himself or the corporate being registered with the SEC.

What was left of R Community quietly died off after that. In March 2021 what was left of R Community was offered off to iX World.

We didn’t hear something farther from Smith till TranzactCard surfaced on or round April 2023.

Learn on for a full overview of TranzactCard’s MLM alternative.

TranzactCard’s Merchandise

TranzactCard markets a VISA bank card.

TranzactCard is (a) the digital and plastic transaction card that carries the authorized Visa financial institution card model and can be utilized anyplace on the earth that Visa is accepted, and (b) the general public dealing with model of the TranzactCard Monetary Ecosystem.

TranzactCard’s web site Phrases of Service reveal the cardboard is issued by means of CBW Financial institution.

This TranzactCard Visa Credit score Card Settlement (this “Settlement”) constitutes a authorized settlement between CBW Financial institution, Member FDIC (“Financial institution” and, along with Financial institution’s successors and assigns, “We”, “Us” and “Our”) and the person (“You” or “Your”) that utilized and certified for the TranzactCard Visa® Credit score Card (“Card”).

TranzactCard’s official FAQ provides two extra banks into the combo;

Evolve Financial institution and Belief, N.A. is the present financial institution throughout the mushy launch of TranzactCard.

Performance clever TranzactCard’s VISA card has every day and month-to-month caps in place:

At present the safety limits on your TranzactCard account are $5,000.00 per day with a most restrict of $15,000.00 monthly.

Each retail clients and recruited associates can join a TranzactCard card.

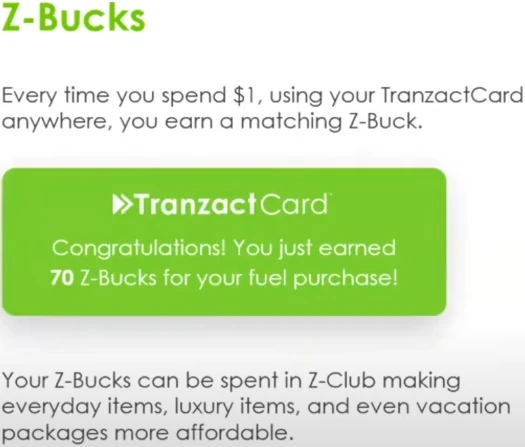

One of many promoting factors of TranzactCard’s VISA card is Z-Bucks.

Z-Bucks are awarded at a charge of $1 spent on the cardboard = 1 Z-Buck.

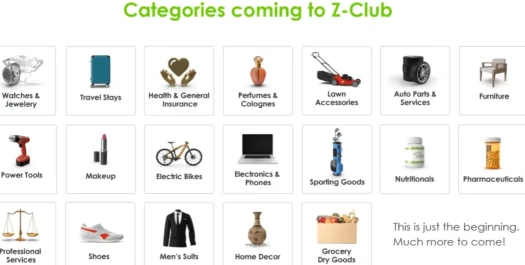

TranzactCard represents that Z-Bucks can be utilized to buy services and products from an inside market.

Observe that precise cash could be mixed with Z-Bucks on inside TranzactCard market purchases.

TranzactCard card membership is $25 for 12 months after which both $4.95 a month or $47.50 yearly.

TranzactCard’s Compensation Plan

TranzactCard’s compensation plan pays on utilization of the corporate’s VISA card by retail clients and recruited associates.

TranzactCard calculates commissions utilizing “Foundation Factors”.

Foundation Factors (BPs) are particularly calculated on

transaction interchange charges, earnings from financial institution charges, financial institution incentives, product margins, advert vendor quantity incentives.

These transactions are counted from referred retail clients and a TranzactCard’s recruited downline.

TranzactCard assigns Foundation Factors a 0.0001% % worth of every transaction within the classes above made.

With respect to commissions paid out, TranzactCard caps commissions earnable from TranzactCard utilization by recruited downline associates at 30%.

If the precise quantity is lower than 30%, the payable ratio is lowered till a 30%/70% ratio between downline affiliate card utilization and downline retail clients is reached.

TranzactCard Affiliate Ranks

There are six affiliate ranks inside TranzactCard’s compensation plan.

Together with their respective qualification standards, they’re as follows:

- Digital Department Workplace (DBO) – join as a TranzactCard affiliate, pay month-to-month charges and personally refer at the very least three retail TranzactCard members

- Supervisor – proceed to pay month-to-month charges, generate and keep twelve retail TranzactCard members throughout your downline and recruit and keep three Digital Department Workplaces or larger

- Senior Supervisor – proceed to pay month-to-month charges, generate and keep thirty-nine retail TranzactCard members throughout your downline, personally recruit and keep three Managers or larger and generate and keep a complete downline of twelve DBO or larger ranked associates

- Vice President – proceed to pay month-to-month charges, generate and keep 100 and twenty retail TranzactCard members throughout your downline, personally recruit and keep three Senior Managers or larger and generate and keep a complete downline of thirty-nine DBO or larger ranked associates (at the very least 9 should be Supervisor or larger)

- Senior Vice President – proceed to pay month-to-month charges, personally refer and keep six retail TranzactCard members, generate and keep seven hundred and twenty-six retail TranzactCard members throughout your downline, personally recruit and keep six Vice Presidents or larger and generate and keep a complete downline of 200 and forty DBO or larger ranked associates (at the very least fifty-four should be Supervisor or larger)

- President – proceed to pay month-to-month charges, personally refer and keep 9 retail TranzactCard members, generate and keep one thousand and eighty-nine retail TranzactCard members throughout your downline, personally recruit and keep 9 Vice Presidents or larger and generate and keep a complete downline of 300 and sixty DBO or larger ranked associates (at the very least eighty-one should be Supervisor or larger)

Required referred retail clients can both be personally referred clients or referred by recruited downline associates.

Observe that to qualify in the direction of rank qualification, referred retail clients and recruited associates should be paying month-to-month charges.

Retail Commissions

TranzactCard associates obtain Foundation Factors off transactions generated by personally referred retail clients primarily based on rank:

- DBOs obtain 10 BPs per personally referred retail transaction or 5 BPs per transaction from an organization assigned retail buyer

- Managers obtain 12 BPs per personally referred retail transaction or 6 BPs per transaction from an organization assigned retail buyer

- Senior Managers obtain 14 BPs per personally referred retail transaction or 7 BPs per transaction from an organization assigned retail buyer

- Vice Presidents obtain 16 BPs per personally referred retail transaction or 8 BPs per transaction from an organization assigned retail buyer

- Senior Vice Presidents obtain 18 BPs per personally referred retail transaction or 9 BPs per transaction from an organization assigned retail buyer

- Presidents obtain 20 BPs per personally referred retail transaction or 10 BPs per transaction from an organization assigned retail buyer

Residual Commissions

TranzactCard pays residual commissions through a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the prime of a unilevel staff, with each personally recruited affiliate positioned instantly beneath them (degree 1):

If any degree 1 associates recruit new associates, they’re positioned on degree 2 of the unique affiliate’s unilevel staff.

If any degree 2 associates recruit new associates, they’re positioned on degree 3 and so forth and so forth down a theoretical infinite variety of ranges.

Residual commissions are paid because the sum whole of Foundation Factors generated on as much as ten unilevel staff ranges.

What number of unilevel staff ranges a TranzactCard affiliate receives Foundation Factors on is set by rank:

- DBOs are paid on as much as 5 unilevel staff ranges, they get 5 BPs on downline referred retail clients, 10 BPs on personally recruited associates (degree 1) and 5 BPs on downline recruited associates throughout ranges 2 to five

- Managers are paid on as much as six unilevel staff ranges, 6 BPs on downline referred retail clients, 12 BPs on personally recruited associates (degree 1) and 6 BPs on downline recruited associates throughout ranges 2 to six

- Senior Managers are paid on as much as seven unilevel staff ranges, 7 BPs on downline referred retail clients, 14 BPs on personally recruited associates (degree 1) and seven BPs on downline recruited associates throughout ranges 2 to 7

- Vice Presidents are paid on as much as eight unilevel staff ranges, 8 BPs on downline referred retail clients, 16 BPs on personally recruited associates (degree 1) and eight BPs on downline recruited associates throughout ranges 2 to eight

- Senior Vice Presidents are paid on as much as 9 unilevel staff ranges, 9 BPs on downline referred retail clients, 18 BPs on personally recruited associates (degree 1) and 9 BPs on downline recruited associates throughout ranges 2 to 9

- President – are paid on as much as 9 unilevel staff ranges, 10 BPs on downline referred retail clients, 20 BPs on personally recruited associates (degree 1) and 10 BPs on downline recruited associates throughout ranges 2 to 10

Rebate Test Bonus

When a TranzactCard affiliate qualifies at Supervisor they obtain a $500 rebate examine.

What a rebate examine is isn’t clarified however it feels like a credit score towards their Visa card spend.

Supervisor Growth Grants

The Supervisor Growth Grant is a bonus paid when downline when downline TranzactCard associates qualify at Supervisor.

- Managers obtain a $50 Supervisor Growth Grant throughout six unilevel staff ranges

- Senior Managers obtain a $50 Supervisor Growth Grant throughout seven unilevel staff ranges

- Vice Presidents obtain a $50 Supervisor Growth Grant throughout eight unilevel staff ranges

- Senior Vice Presidents obtain a $50 Supervisor Growth Grant throughout 9 unilevel staff ranges

- Presidents obtain a $50 Supervisor Growth Grant throughout ten unilevel staff ranges

Management Bonus

The Management Bonus is a month-to-month bonus, paid on the quantity of Supervisor and better ranked associates in a TranzactCard affiliate’s downline.

- Managers obtain $6 a month per recruited Supervisor or or larger throughout six unilevel staff ranges

- Senior Managers obtain $7 a month per recruited Supervisor or larger throughout seven unilevel staff ranges

- Vice Presidents obtain $8 a month per recruited Supervisor or larger throughout eight unilevel staff ranges

- Senior Vice Presidents obtain $9 a month per recruited Supervisor or larger throughout 9 unilevel staff ranges

- Presidents obtain $10 a month per recruited Supervisor or larger throughout ten unilevel staff ranges

Matching Bonus

Senior Supervisor and better ranked TranzactCard associates earn a Matching Bonus on Management Bonuses paid to personally recruited decrease ranked Managers and better.

E.g. should you’re a Vice President you’ll earn the Matching Bonus on personally recruited Managers and Senior Managers.

Energy Save Account

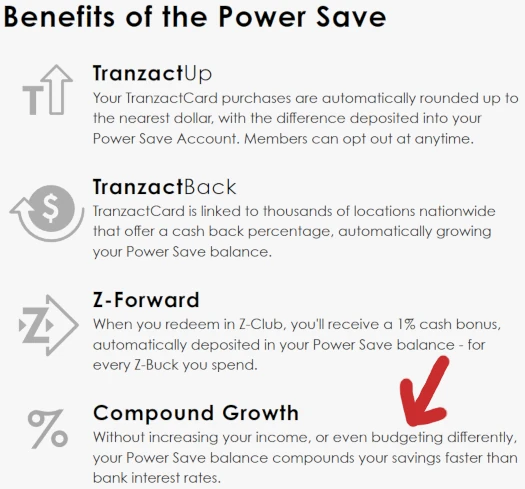

TranzactCard presents a Energy Save Account.

In a advertising video on the official TranzactCard YouTube channel, Eric H. Allen claims the Energy Save Account offers a

mounted rate of interest, larger than any financial institution you’ve ever seen. And the opposite half goes to be variable curiosity tied to our real-estate funding belief.

TranzactCard associates construct their Energy Save Account steadiness by means of three strategies:

- 1% of Z-Bucks spent is contributed the Energy Save Account

- a 2-4% cashback supplied at retailers is shipped to the Energy Save Account

- each buy made with a TranzactCard could be rounded as much as the closest greenback, with the rounded up quantity despatched to the Energy Save Account; and

Becoming a member of TranzactCard

TranzactCard affiliate membership is $495 after which $150 a month.

TranzactCard Conclusion

In case you take out the Energy Save Account, TranzactCard is mainly a cashback alternative with an MLM compensation plan.

Your compensation, together with bonuses, is solely depending on the transactions of Members and annual card membership charges inside your Digital Department Neighborhood.

Compliance clever TranzactCard has a retailable product (the cardboard), and there’s an honest effort to encourage retail buyer referrals through laborious private and downline retail buyer necessities.

To get into the Energy Save Account we first want to take a look at Z-Bucks.

Z-Bucks are primarily cashback which may solely be spent inside TranzactCard. This isn’t uncommon with card choices though cashback is normally simply returned as money.

I needed to make clear that as a result of spending Z-Bucks appears to be a main approach to construct a Energy Save Account.

An official TranzactCard “Glossary of Phrases” doc defines the Energy Save Account as

a long-term financial savings account that grows steadily and routinely, constructing monetary momentum.

Compounding is talked about in TranzactCard’s advertising, so that is very a lot an financial savings/funding account paying a passive return.

That aspect of the Energy Save Account is positively a safety. The place I pause although is on how the funds get into the Energy Save Account.

First, should you’re like me, you may be questioning whether or not it’s precise cash or Z-Bucks that go into the Energy Save Account.

As revealed by Eric H. Allen within the beforehand cited official TranzactCard advertising video, it’s precise cash.

[5:32] 1% of all of the Z-Bucks you burn goes to go on this Energy Save Account.

So that you burn 100 Z-Bucks, a greenback money goes in your Energy Save Account.

So we’ve established the Energy Save Account is actual cash and never Z-Bucks.

So far as I can inform, there’s no direct approach for a TranzactCard affiliate to deposit/make investments into the Energy Save Account. And, if I’m not mistaken, that is what Richard Smith is hinging TranzactCard’s securities compliance on.

What it mainly comes all the way down to, with respect to the Howey Check, is whether or not TranzactCard’s oblique funding of Energy Save Account rely as a deposit/funding?

I can’t instantly reply that as a result of that is the primary time I’ve seen this particular sort of arrange. Actually, I’m not 100% certain on making a securities fraud name both approach.

Props to Richard Smith for throwing me a curveball.

After eager about it for a bit, what I can present is comparability to a reasonably related mannequin – Zeek Rewards’ “VIP bids”.

Zeek Rewards was arrange such that direct funding was additionally not attainable. Associates needed to spend money on “VIP bids”, VIP bids had been dumped on non-affiliate accounts, which generated “VIP Reward Factors”.

VIP Reward Factors had been internally price $1 every. Crucially to Zeek Rewards’ funding scheme, they had been held in an account on which a every day ROI was paid.

The every day ROI may very well be compounded, in a lot the identical method TranzactCard’s Energy Save Account does.

To raised illustrate the similarities, right here’s a breakdown:

Zeek Rewards:

- actual cash invested in VIP Bids (actual cash in)

- bids dumped on accounts (motion)

- VIP Factors generated primarily based on 1:1 with VIP Bids dumped (motion 2)

- passive ROI paid on VIP Level steadiness that may optionally be auto-compounded (ROI).

TranzactCard:

- actual cash spent on no matter and Z-Bucks generated (not fairly the identical as actual cash in however actual cash spent)

- Z-Bucks spent once more on no matter internally (motion)

- 1% of V-Bucks spent internally = $1 generated in Energy Save Account, or cashback or rounding up (motion 2)

- passive ROI paid on greenback quantity in Energy Save Account that may optionally be auto-compounded (ROI)

Like I stated it’s not a 1:1 comparability however the basic theme is there. I suppose a key distinction is that Zeek Rewards took in actual cash paid for VIP Bids, whereas TranzactCard’s VISA card could be spent anyplace.

This does increase the query of how TranzactCard’s passive returns are going to be generated. TranzactCard declare it’s a “mounted rate of interest” plus a “variable charge” from a “real-estate funding belief”.

No particular particulars about this have been made public. This may be violation of the FTC Act (disclosures), in addition to a securities compliance subject in and of itself.

Bear in mind, TranzactCard’s official advertising movies promise a “mounted rate of interest, larger than any financial institution you’ve ever seen”. Not disclosing how is an issue.

I additionally may be affected by a little bit of “Ponzi mind” right here. If TranzactCard’s returns are calculated yearly and aren’t too outrageous, they may very well be legitimately generated.

I really feel there must be regulatory filings although, particularly with TranzactCard advertising Energy Save Account as a comparable checking account.

Paid charges are an elephant within the room. Particularly the $495 TranzactCard affiliate payment. What on Earth is that going in the direction of?

May there be recycling of TranzactCard’s membership charges on the backend? Possibly. Shoppers can’t make an informed due-diligence name as a result of TranzactCard doesn’t present audited monetary reviews.

Backside line? I’m not 100% on TranzactCard committing securities fraud however I’m smelling smoke. And that smoke is thick given Smith’s previous brushes with securities fraud.

The very last thing I’ll end on is TranzactCard’s personal earnings examples.

As above, in TranzactCard’s personal earnings examples, associates are dropping cash. The above instance offers a $12,000 spend coming to $12 a month in commissions.

This similar affiliate would want to generate $150,000 a month in spend simply to interrupt even.

I’m not saying it’s inconceivable however is it real looking on your common TranzactCard affiliate?

Method with warning.