The EminiFX Receiver has filed a report pertaining to the “monetary situation” of the EminiFX Receivership.

The EminiFX Receiver has filed a report pertaining to the “monetary situation” of the EminiFX Receivership.

The excellent news for victims of the Ponzi scheme is “the majority of the EminiFX property” have been recovered.

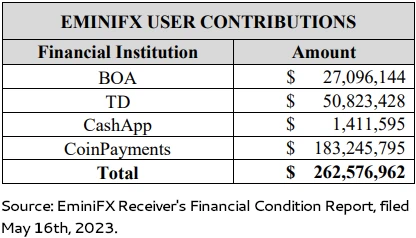

Primarily based on ongoing evaluation of data, the EminiFX Receiver believes the Ponzi scheme took “over $260 million … from no less than 25,000 customers”.

EminiFX launched in late 2021. By Might 2022 ROI liabilities had spiralled uncontrolled to $374 million. That is in fact cash that didn’t exist.

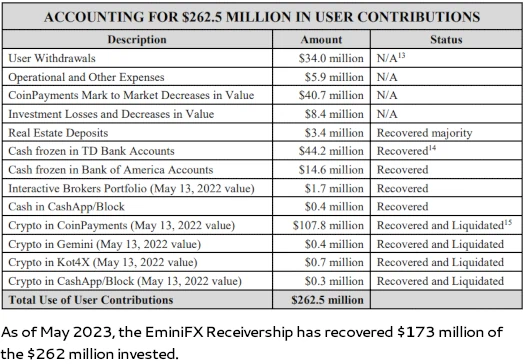

As of Might sixteenth, 2023, the EminiFX Receiver has recovered $173 million.

As famous within the chart above, $40.7 million was misplaced attributable to cryptocurrency declining worth earlier than it may very well be liquidated. One other $34 million is lacking attributable to early buyers and recruiters cashing out.

As of but the EminiFX Receiver hasn’t filed any clawback litigation. The Receiver notes nonetheless that the EminiFX Receivership

reserves all rights with respect to any quantities withdrawn by a Person in extra of his or her contributions to EminiFX.

Wanting ahead, in some unspecified time in the future the Receiver will provoke a claims course of for EminiFX victims.

Web-winners of the Ponzi scheme are suggested;

ROI and bonuses should not precise liabilities of EminiFX or the Receivership, and the Receiver doesn’t intend to incorporate the ROI and bonuses within the upcoming claims course of.

There’s as of but no timeline for the EminiFX Receiver to implement a claims course of.