Maxpread Applied sciences and suspected co-owner Jan Gregory Cerato have acquired a securities fraud warning from California’s DFPI.

Maxpread Applied sciences and suspected co-owner Jan Gregory Cerato have acquired a securities fraud warning from California’s DFPI.

As per an April nineteenth order, Maxpread Applied sciences and Cerato have been accused of securities fraud.

Efficient instantly, Maxpread Applied sciences and Cerato have been ordered to stop doing enterprise in California.

BehindMLM reviewed Maxpread Applied sciences again in January 2023.

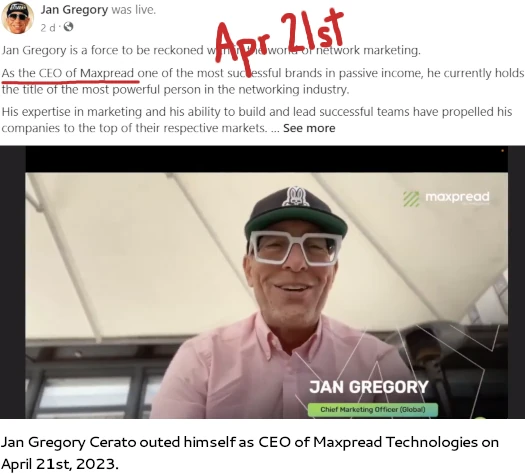

We recognized the rip-off as a Boris CEO Ponzi scheme, fronted by Canadian nationwide Jan Cerato (aka Jan Strzepka, proper).

We recognized the rip-off as a Boris CEO Ponzi scheme, fronted by Canadian nationwide Jan Cerato (aka Jan Strzepka, proper).

Following an inside investigation, DFPI claims

Cerato managed and induced or offered substantial help to Maxpread.

MLM Ponzi schemes and securities fraud go hand in hand.

In keeping with BehindMLM’s Maxpread Applied sciences evaluate, DFPI accuses Maxpread Applied sciences and Cerato of committing securities fraud.

Starting no less than as early as 2022, Maxpread provided and bought securities within the type of funding contracts in California by way of normal solicitations on its web site.

On the time of BehindMLM’s Maxpread Applied sciences evaluate, Albert Ignatev was introduced as proprietor of the corporate.

Ignatev, believed to initially be from Sarkha Republic, is a Russian nationwide primarily based out of Dubai.

Since publication of our evaluate, Maxpread Applied sciences changed Ignatev with an AI bot CEO:

As famous by DFPI;

Maxpread claimed that its CEO was a person named Michael Vanes.

Maxpread revealed a video on YouTube during which “Michael Vanes” launched himself to potential buyers, defined Maxpread’s enterprise, and touted the profitability of Maxpread’s “AI-powered arbitrage platform.”

In actuality, this was a hoax: the person within the video was not the corporate’s CEO, however relatively a fictitious, computer-generated avatar programmed to recite a script.

Maxpread Applied sciences’ AI bot CEO video was uploaded to their YouTube channel on or round April twelfth. The video has since been deleted, leaving Cerato as the only face of the corporate.

Summing up DFPI’s enterprise mannequin, DFPI writes;

Maxpread was luring buyers into what is named a Excessive-Yield Funding Program (HYIP).

HYIPs are unregistered investments usually run by unlicensed people – and are sometimes frauds.

The hallmark of an HYIP rip-off is the promise of excessive returns on an annual (and even month-to-month, weekly, or every day) foundation at little or no threat to the investor.

One other key aspect of most HYIPs is a referral program, during which the HYIP presents referral commissions or bonuses to buyers to recruit new buyers.

This often results in buyers sharing details about the HYIP with their family and friends and selling HYIPs on social media. HYIPs hardly ever disclose the true identities of the people working the HYIP.

With respect to Californian securities legislation;

The Arbitrage Plans provided by Maxpread had been securities that had been neither certified nor exempt from the qualification requirement beneath the CSL.

The Division has not issued a allow or different type of qualification authorizing Maxpread to promote these securities in California.

Based mostly on the foregoing findings, the Commissioner is of the opinion that the securities provided or bought by Maxpread Applied sciences Restricted and Jan Gregory Cerato had been topic to qualification beneath the CSL and have been or are being provided or bought with out first being certified in violation of Firms Code part 25110.

On account of their fraudulent conduct, the DFPI has ordered Maxpread Applied sciences

to desist and chorus from the additional supply or sale of securities in California, together with however not restricted to funding contracts generally known as Arbitrage Plans, until and till the qualification necessities of the CSL have been met.

“Qualification necessities” require Maxpread Applied sciences and Cerato to register their securities providing with the DFPI. That is customary process for monetary regulators in any jurisdiction securities are provided in.

Neither Maxpread Applied sciences or Cerato are registered to supply securities in any jurisdiction.

Registration with monetary regulators requires periodic submitting of audited monetary studies. MLM Ponzi schemes like Maxpread Know-how commit securities fraud, as a result of submitting audited monetary studies would out the rip-off.

As of March 2023, SimilarWeb ranks high sources of site visitors to Maxpread Applied sciences’ web site as France (14%), Vietnam (13%) and the US (9%).

Maxpread Applied sciences recruitment in these jurisdictions seems to have stalled, with new victims coming from Moldova (9% of whole March 2023 site visitors, up 1889% month on month).

Final September the Alberta Securities Fee fined Jan Gregory Cerato $40,000 plus $125,000 in prices for securities fraud.

Cerato defrauded buyers out of $200,000 in his fraudulent WhaleClub funding scheme.

In handing down their fantastic, ASC famous;

The panel thought-about that Cerato poses a big threat to buyers and the capital market, and said in its choice that he “accepted little or no duty or remorse and as an alternative blamed others and exhibited contempt in the direction of those that had been harmed by his actions.”

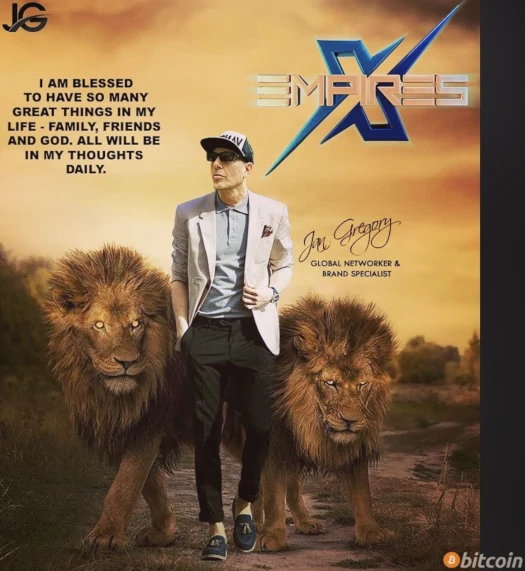

Cerato has been defrauding shoppers by way of varied crypto Ponzi schemes for years.

EmpiresX was a 1% a day MLM crypto Ponzi. The SEC and CFTC filed swimsuit towards EmpiresX in mid 2022. EmpiresX’s Brazilian homeowners have additionally been indicted.

After the ASC’s WhaleClub fantastic Cerato fled Canada for Dubai, the MLM crime capital of the world.

After launching quite a lot of MLM crypto Ponzi schemes, Cerato now splits his time between Dubai and Turkey.

Along with Maxpread Applied sciences, Cerato additionally fronts the CoinMarketBull and Vortic United Ponzi schemes.

Whether or not the SEC and/or CFTC take federal motion towards Maxpread Applied sciences, Cerato and promoters of the rip-off stays to be seen.