![]() BehindMLM reviewed Aluva the identical month it launched in June 2021.

BehindMLM reviewed Aluva the identical month it launched in June 2021.

In reviewing Aluva, I used to be sort of impartial on the MLM alternative.

There’s nothing overtly offensive about Aluva’s MLM alternative.

Sadly there’s additionally nothing to essentially hook you in.

Founder Gavin Dickson’s story about his father is a pleasant contact however the underlying message is mainly “take care of your self earlier than it’s too late”.

And also you don’t essentially want an vitality drink, multivitamin drink or weight reduction complement to attain that.

Virtually two years into Aluva’s launch, SimilarWeb tracks negligible visitors to its web site.

This isn’t definitive, but it surely’s a very good indication Aluva isn’t doing effectively.

Since launch, Aluva has marketed a variety of dietary dietary supplements.

Then, on or round January tenth, the corporate introduced it was pivoting to AUX.

Take part within the largest monetary shift of the century and get your time again, extra freedom, and funds on observe utilizing AUX.

This unimaginable platform launches 1/15!

AUX stands for Aluva College & Trade; and you’ll in all probability guess the place that is going…

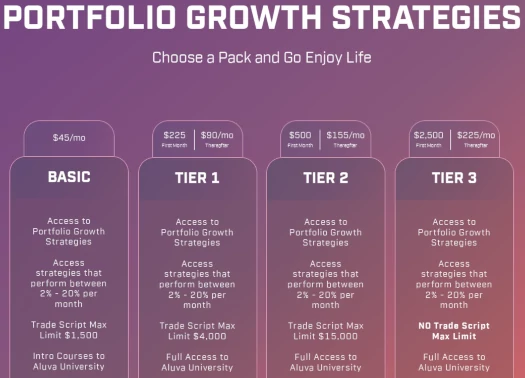

By way of AUX, Aluva pitches a 2% to twenty% passive month-to-month ROI:

It’s your typical buying and selling bot providing, with costs beginning at $45 a month.

- Primary – $45 a month and in a position to make investments as much as $1500

- Tier 1 – $225 after which $90 a month, in a position to make investments as much as $4000

- Tier 2 – $500 after which $155 a month, in a position to make investments as much as $15,000

- Tier 3 – $2500 after which $225 a month, no funding restrict

Funds invested are purportedly traded on investor’s behalf via Aluva’s “commerce script”.

Take part in state-of-the-art buying and selling methods with Aluva’s hands-free API integration.

We’ll deal with the technicalities – your simply make investments, commerce and earn.

Aluva advertising and marketing suggests charges and funding are solicited in bitcoin and ether.

Connected to Aluva’s “buying and selling script” funding scheme is AUX College.

You understand the drill, crypto buzzwords and an training platform no one cares about.

AUX is $240 a month standalone or bundled with Tier 1 and better funding plans.

The Primary tier supplies entry to “intro programs to Aluva College”.

To be clear, there’s nothing inherently unlawful about Aluva’s passive funding buying and selling alternative.

Being a US-based firm nevertheless, the legitimacy Aluva’s “buying and selling script” scheme hinges on registration with the SEC.

A search of the SEC’s Edgar database reveals neither Aluva or founder and CEO Gavin Dickson are registered.

Which means at a minimal Aluva is committing securities fraud.

On prime of that, Aluva fails to reveal particulars of its “buying and selling script” to customers. It is a potential violation of the FTC Act (disclosures).

Failing regulatory intervention, MLM buying and selling bot schemes sometimes finish in one among two methods;

- the bot blows up; or

- a rigged trades exit-scam.

No matter how Aluva’s “buying and selling script” funding scheme ends, the one individuals who will generate income with it are Gavin Dickson, early buyers and/or prime recruiters.