![]() 7Eleven-INS fails to offer possession or government info on its web site.

7Eleven-INS fails to offer possession or government info on its web site.

7Eleven-INS’ web site area (“7eleven-ins.com”), was privately registered on Might thirtieth, 2024.

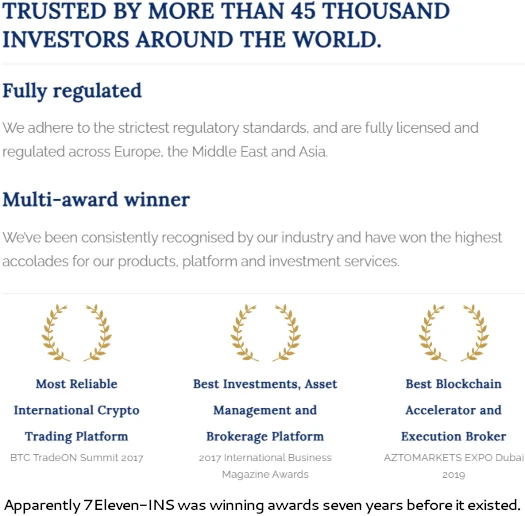

On its web site 7Eleven-INS claims to have “greater than 45 thousand traders”. The corporate additionally claims to have gained a number of awards courting again to 2017.

Primarily based on 7Eleven-INS solely present for a couple of month and a half, the advertising and marketing claims on its web site are clearly false.

The Chicago handle 7Eleven-INS gives on its web site seems to be a random workplace constructing that has nothing to do with the corporate.

Of notice although is the UK’s FCA citing a agency for securities fraud in 2022, purportedly claiming to function from the identical handle.

Whether or not the identical scammers behind Horizon Crypto are additionally additionally behind 7Eleven-INS is unclear. What we are able to affirm although is no less than one group of scammers have used the seemingly random Chicago handle 7Eleven-INS pretends to function from.

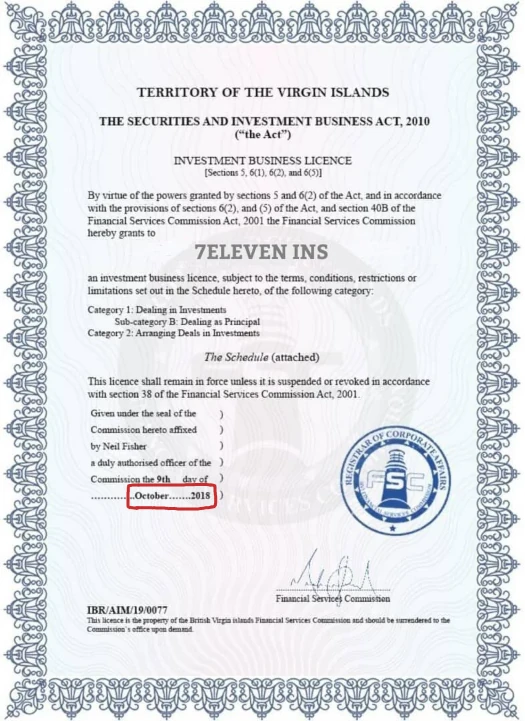

In an try to seem respectable, 7Eleven-INS gives a BVI Funding Enterprise License on its web site:

Given the certificates is dated October 2018, it’s both doctored or has nothing to with 7Eleven-INS.

However BVI being a scam-friendly jurisdiction with little to no regulation of MLM associated fraud. 7Eleven-INS representing any ties to BVI is a right away pink flag.

With respect to precise regulation, the Central Financial institution of Russia issued a 7Eleven-INS pyramid fraud warning on June twenty fifth, 2024.

As at all times, if an MLM firm just isn’t overtly upfront about who’s working or owns it, suppose lengthy and onerous about becoming a member of and/or handing over any cash.

7Eleven-INS’s Merchandise

7Eleven-INS has no retailable services or products.

Associates are solely capable of market 7Eleven-INS affiliate membership itself.

7Eleven-INS’s Compensation Plan

7Eleven-INS associates make investments USD equivalents in cryptocurrency.

That is accomplished on the promise of marketed returns:

- Plan 1 – make investments $50 to $499 and obtain 6% a day

- Plan 2 – make investments $500 to $1000 and obtain 10% a day

- Plan 3 – make investments $1000 to $5000 and obtain 15% a day

- Plan 4 – make investments $5000 or extra and obtain 30% a day

7Eleven-INS pays referral commissions on invested cryptocurrency down three ranges of recruitment (unilevel):

- degree 1 (personally recruited associates) – 5%

- degree 2 – 2%

- degree 3 – 1%

Becoming a member of 7Eleven-INS

7Eleven-INS affiliate membership is free.

Full participation within the hooked up revenue alternative requires a minimal $50 funding.

7Eleven-INS solicits funding in numerous cryptocurrencies.

7Eleven-INS Conclusion

7Eleven-INS is your typical generic finance template Ponzi scheme.

Along with mendacity concerning the basis of the corporate, 7Eleven-INS’ web site presents itself as a generic finance themed template.

The positioning is populated with copious quantities of generic finance jargon, accompanied by a plethora of inventory photos.

As a passive returns funding scheme, 7Eleven-INS is required to register itself with monetary regulators. 7Eleven-INS fails to offer proof it has registered with any monetary regulators.

A doctored BVI certificates that predates 7Eleven-INS by six years just isn’t credible for apparent causes. Moreover, even when the certificates was respectable it might solely apply to BVI. 7Eleven-INS would nonetheless offer unregistered securities outdoors of the BVI.

Thus, at a minimal, 7Eleven-INS is committing securities fraud.

7Eleven-INS’ enterprise mannequin additionally fails the Ponzi logic take a look at.

7Eleven-INS’ enterprise mannequin additionally fails the Ponzi logic take a look at.

If 7Eleven-INS is already managing $6562 billion and producing 20% a day, what do they want your cash for? And why are they losing time soliciting $50 investments in cryptocurrency from randoms over the web?

Because it stands the one verifiable income coming into 7Eleven-INS is new funding.

Utilizing new funding to pay ROI withdrawals would make 7Eleven-INS a Ponzi scheme. Moreover with nothing marketed or bought to retail prospects, the MLM aspect of 7Eleven-INS operates as a pyramid scheme.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding.

It will starve 7Eleven-INS of ROI income, ultimately prompting a collapse.

The mathematics behind Ponzi schemes ensures that once they collapse, nearly all of individuals lose cash.