Incomation fails to supply possession or government data on its web site.

Incomation fails to supply possession or government data on its web site.

Incomation operates from a subdomain hosted on Kartra (“incomation.katra.com”).

Kartra markets itself as “the best all-in-one platform ever”. Kartra is a part of Genesis Digital LLC, a US firm run by CEO Sarah Jenkins.

So far as I can inform, whoever is operating Incomation is a shopper of Kartra’s – there’s in any other case no direct connection between the 2 corporations.

On the backside of Incomation’s web site are a collection of hyperlinks below the heading “Join with our Founder”.

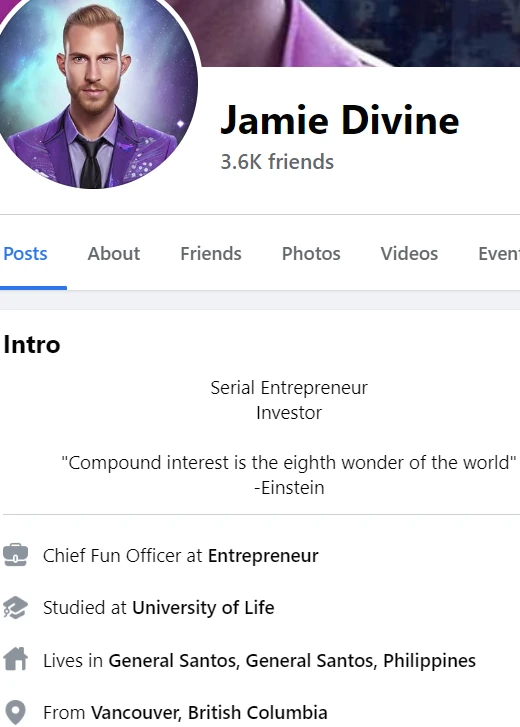

These hyperlinks result in numerous social media profiles of Jamie Divine.

In response to his FaceBook profile, Divine is a Canadian nationwide residing within the Philippines.

Earlier than he launched Incomation, Divine was an Eaconomy promoter.

Eaconomy launched in 2019. The corporate happened after Hassan Mahmoud and spouse Candace cut up from convicted fraudster David Mayer.

Earlier than Eaconomy the Mahmouds and Mayer ran Silver Star Stay. Each Silver Star Stay and Eaconomy had been MLM corporations constructed round an AI foreign currency trading bot.

The Mahmouds settled Silver Star Stay commodities fraud fees with the CFTC in 2019. In 2021 the CFTC secured a $15.6 million judgment in opposition to David Mayer, once more for Silver Star Stay commodities fraud.

Eaconomy collapsed in 2020. In 2021 there was a short Eaconomy reboot by Jeremy Reynolds’ Past.

That lasted a couple of months earlier than Past itself collapsed and was offered off to My Each day Selection.

In early 2021 Eaconomy was rebooted for a a third-time, with the identical AI foreign currency trading bot ruse.

Eaconomy’s web site continues to be up as of April 2023 however there’s not a lot occurring.

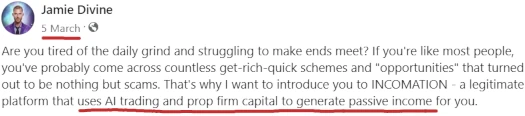

Right here’s a quote from Jamie Divine as he was launching Incomation;

Are you completed with increase tasks simply to have them crash and burn?

Are you bored with corporations that don’t have your finest pursuits at coronary heart?

Sick of getting used to your networks after which left within the mud?

Are you fed up with over-promising and under-delivering?

Nicely, I’ve some thrilling information for you!

We’re introducing a revolutionary new AI buying and selling system that leverages prop agency funds, however with a coronary heart for the shoppers AND associates.

I do know that was lots of backstory to get again to Incomation. I’ll go over why I took the time to cowl Eaconomy’s origins in-depth within the conclusion of this overview.

Learn on for a full overview of Incomation’s MLM alternative.

Incomation’s Merchandise

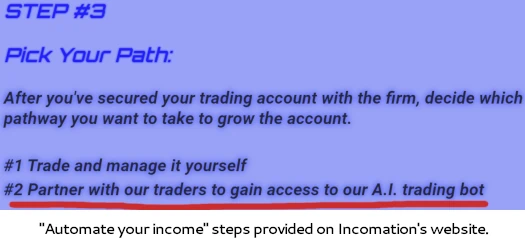

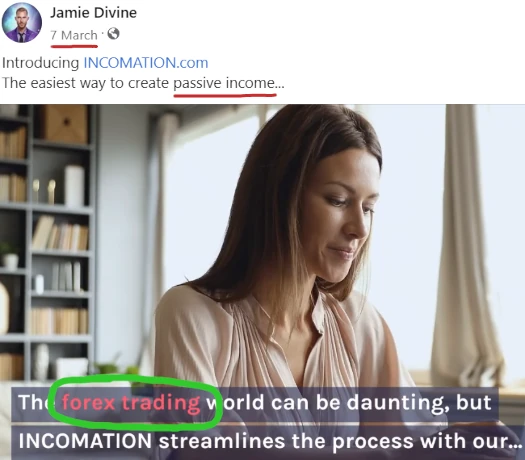

Incomation markets passive returns by an “A.I. buying and selling bot”.

Entry to the bot prices $1500 for a $100,000 funded account, or $2000 for a $200,000 funded account.

Funded accounts are primarily offered by Subsequent Step Funded, with Incomation representing Subsequent Step Funded will eat any losses.

Am I answerable for any losses on the account?

No, the losses are fully lined by the prop agency which is why they’ve such strict necessities to cross their challenges and keep the accounts.

We’ll go over Subsequent Step Funded a bit extra within the conclusion of this overview.

Incomation’s Compensation Plan

Incomation associates are paid on the recruitment of retail prospects and associates who make investments $1500 or $2000.

Referral Commissions

Incomation pays a referral fee on funds invested down two ranges of recruitment (unilevel):

- degree 1 (personally recruited associates) – 20%

- degree 2 – 10%

This can be a one-time fee tied to preliminary funding.

ROI Commissions

Incomation pays a fee on passive returns earned down two ranges of recruitment:

- degree 1 – 20%

- degree 2 – 10%

This can be a month-to-month recurring fee, tied to passive returns paid out every month.

Becoming a member of Incomation

Incomation affiliate membership is tied to a $1500 or $2000 funding.

The extra an Incomation affiliate invests the upper their revenue potential.

Incomation Conclusion

Incomation sells entry to $100,000 and $200,000 foreign currency trading accounts for $1500 and $2000 respectively.

Topic to some “challenges”, apparently there’s a agency keen to let individuals blow up a whole lot of hundreds of {dollars} for a tiny outlay.

Do I have to level out that is an totally silly enterprise mannequin that is not sensible in the actual world?

Subsequent Step Funded offers no possession, government or regulatory data on its web site.

Subsequent Step Funded’s web site area (“nextstepfunded.com”), was solely just lately privately registered on October ninth, 2022.

And there’s this, from Subsequent Step Funded’s web site phrases and situations:

These Phrases are ruled by the legal guidelines of Saint Vincent and the Grenadines and every get together irrevocably and unconditionally submits to the non-exclusive jurisdiction of the courts of Saint Vincent and the Grenadines.

St. Vincent and the Grenadines is a tax haven with no lively regulation of MLM associated fraud.

I additionally famous referenced to MDP Funding, which seems to be one other funded buying and selling account choice.

MDP Funding is one other firm that doesn’t disclose something about itself, apart from it purportedly operates by Australian shell firm Prop Commerce Tech.

Like Subsequent Step Funded, MDP Funding’s web site area (“mdpfunding.com”), was solely just lately privately registered on December eleventh, 2022.

These are your first purple flags with regards to Incomation.

Having been an Eaconomy promoter, Incomation is simply Jamie Divine copy and pasting the identical A.I. buying and selling bot mannequin.

The issue with each buying and selling bot MLM scheme is that if the bot really labored long-term, there’d be no want for an connected MLM scheme.

Simply run the bot, rake in infinity cash and develop into one of many richest individuals on the planet.

On the regulatory entrance Incomation fails to reveal any details about its purported A.I. buying and selling bot. With respect to regulatory licenses, the 2 at play listed below are securities and commodities.

Securities regulation covers any MLM firm providing a passive funding alternative. That is no matter how the funding alternative is run or the medium (USD, cryptocurrency and so forth.).

Commodities legal guidelines kick in as a consequence of Incomation representing passive returns are derived through foreign currency trading.

Within the US, Incomation must be registered with the CFTC and SEC. Neither Incomation or Jamie Devine are registered with both regulator.

Subsequent Step Funded doesn’t seem like registered with any monetary regulators both.

I did observe this from Subsequent Step Funded’s web site FAQ;

Which Platforms Can I Use for My Buying and selling?

You’re permitted to commerce your account with the MT4 platform which is offered by ASIC-regulated dealer EightCap.

That is irrelevant. Incomation and Subsequent Step Funded are each required to be registered with securities and commodities regulators in each jurisdiction they solicit funding in.

Sadly Incomation’s web site doesn’t obtain sufficient site visitors for SimilarWeb to supply a geographical breakdown.

What I can present you although is relevant regulators for admins of Incomation’s official FaceBook group:

- Jamie Divine – resident of Philippines, securities and commodities regulated by Philippine SEC

- Anfa Pleasure Samboa – seems to be resident of Philippines, securities and commodities regulated by Philippine SEC

- Will J. Galindez – resident of Illinois within the US, securities regulated by SEC and commodities regulated by CFTC

- Nicholas V. LoScalzo – resident of Kansas within the US, securities regulated by SEC and commodities regulated by CFTC

- Ollie Grey, resident of Worcestershire within the UK, securities and commodities regulated by FCA

None of those people seem like registered with the relevant monetary regulators.

What tends to occur in these dodgy buying and selling bot schemes is the accounts inevitably blow up. Subsequent Step Funded being round since late 2022 with nameless possession is testomony to that.

With respect to losses, any cash paid to Incomation is gone the second it’s handed over.

That is from Subsequent Step Funded’s web site FAQ;

Do you provide refunds?

In case you are buying an analysis by Subsequent Step Funded you might be doing so in acknowledgement that you’ll not be refunded.

You’re mainly hoping to get better your charges by the A.I. buying and selling bot earlier than the account blows up or Subsequent Step Funded disappears.

Incomation’s regulatory shortcomings are purpose sufficient to remain well-clear.

Look no additional than Eaconomy for the inspiration behind Incomation, together with proof that, even after 4 years, no person has made long-term constant cash by buying and selling.